China’s leadership finally took action this week to staunch the economy’s bleeding with a flurry of stimulus announcements and pledges to do more. But will it be enough? Group Chief Economist Neil Shearing talks to David Wilder about whether the outlook for the Chinese economy has fundamentally shifted as a result of a news-packed few days.

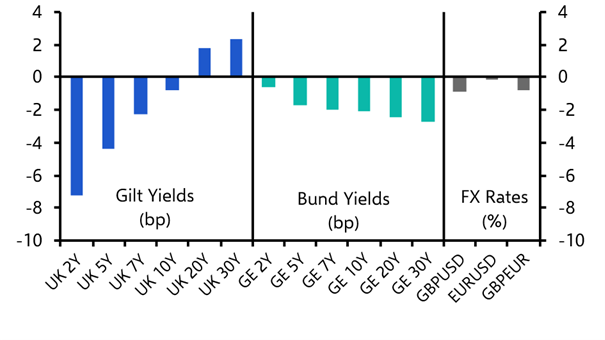

He also talks about what the latest European inflation data suggests about how the ECB will play its October meeting and marks the second anniversary of the Liz Truss “mini budget” debacle.

Also in this episode, Thomas Ryan, our US housing lead, talks to US Economist Olivia Cross about how the market is finally shifting away from sellers and discusses what Kamala Harris’ plans to improve affordability would mean for the outlook.

Analysis and events referenced in this episode:

China: New fiscal package being lined up

China property construction correction has barely begun

Germany will be stuck in the slow lane

Global Drop-In: Are the US and Europe at risk of recession?

Key Issue: What to expect on Budget day

US Housing: Sellers lose grip on the market