The drone attacks by Iran on Israel overnight mark a new and potentially significantly more dangerous phase in troubles in the region. The key risks for the global economy are whether this now escalates into a broader regional conflict, and what the response is in energy markets. A rise in oil prices would complicate efforts to bring inflation back to target in advanced economies, but will only have a material impact on central bank decisions if higher energy prices bleed into core inflation.

According to a statement released by President Biden, “nearly all of the drones and incoming missiles” were shot down. The critical question now is how Israel responds. The US – which has taken a more assertive role in attempting to quell tensions in recent weeks – will play a key role. Likewise, China will bring its influence to bear on Iran. We don’t pretend to have any particular insight into how this plays out, but over the coming days will revisit the lessons from previous regional conflicts for the global economy.

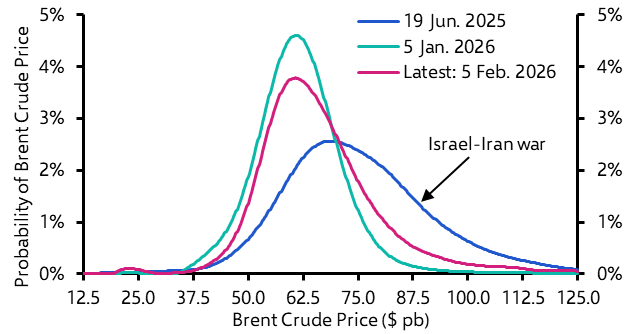

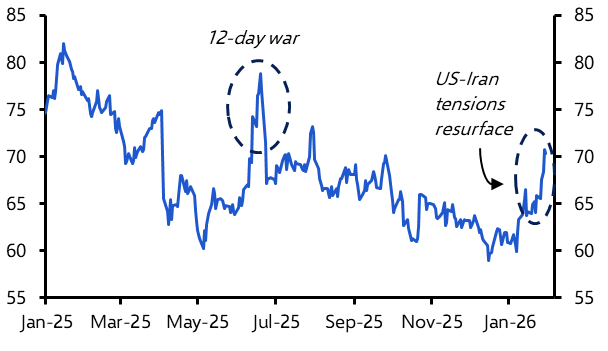

Energy markets remain the key transmission mechanism from regional tension/conflict to the rest of the world economy. Brent crude prices have already risen from $83pb one month ago to over $90pb in the past week, spurred in part by concerns about supplies and geo-political risks from conflict in the Middle East and Ukraine. (European gas prices have also risen by about 10% over the past week following Russian drone attacks on storage facilities in Ukraine.) As a broad rule of thumb, a 10% increase in oil prices adds 0.1-0.2%-pts to headline inflation in advanced economies. Accordingly, the rise in oil over the past month will add about 0.1% to headline inflation in these economies. This is unlikely to have a significant bearing on central bank policy decisions.

It would require a larger and more sustained increase in oil prices to have a significant influence on monetary policy. Specifically, it would probably require higher energy prices to feed back into core inflation – for example because producers passed on the higher cost of energy to consumers. This is perhaps a greater risk in the US than it is in Europe given the relative strength of consumer demand. But set against this, disinflationary pressures from other sources are starting to build in goods markets, notably China where a large expansion of capacity over the past three years is now starting to weight on export prices.

A final point to note is that cracks are already starting to appear in the OPEC+ group, with several nations – notably the UAE – pushing to increase production quotas. Pressure to do so, including from Washington, will intensify if tensions in the region continue to push up oil prices. A rise in oil supply will obviously help to limit any rise in its price.

We’ll continue to monitor the situation closely over the coming weeks. As things stand our sense is that events in the Middle East will add to the reasons for the Fed to adopt a more cautious approach to rate cuts, but they won’t prevent it from cutting altogether. We expect the first move in September. And, assuming that the energy prices don’t spiral over the next month or so, we think that both the ECB and BoE will cut in June.