On top of tariff threats and geopolitical ruptures, investors are having to grapple with notable signs of weakness in the recent economic data. With that said, while the outlook has clearly soured, we think fears that the global economy is on the cusp of a major slowdown are overdone.

The death of US exceptionalism?

Let’s start with the US, where there has been something of a collapse in the latest data. Both retail sales and industrial production for January were weaker than expected, consumer confidence is down and the flash services PMI for February fell sharply. The Citi Surprise Index, which tracks major data releases against market expectations, has turned negative in recent weeks. This is one of several factors that has contributed to the relative underperformance of the S&P 500 since the start of this year. All of this has led some analysts to call time on a period of US macro and market exceptionalism.

This feels like an overreaction. It is clear from the data that the US economy has had a difficult start to the year. The data that triggered the largest downward revisions to Q1 GDP forecasts (including our own) was the 0.5% m/m slump in real consumption and the 10.4% m/m surge in imports in January that was reported at the end of last week. Severe winter weather may have weighed on household spending at the start of the year but in both cases it is likely that concerns about tariffs are also playing a role. On the consumer front, it seems that worries about tariff-related price increases later this year are causing households to raise precautionary savings. Even so, assuming some weather-related bounceback in spending in February, consumer spending is still on track to expand by 1.7% q/q annualised, which is hardly a sign of an impending recession.

Meanwhile, the surge in imports appears to reflect the front-running of tariffs by US firms, which should unwind over the coming months as higher tariffs come into force. In any case, while higher imports arithmetically detract from GDP they rarely reflect a fundamentally weak economy.

Reported GDP is likely to be volatile in the quarters ahead – contracting in the first quarter and rebounding in the second before softening once again in the middle of the year as the effects of tariffs and immigration curbs combine to weigh on output. But over the course of 2025 we still expect the US economy to expand by 1.5-2.0%. While this would be weak by US standards, it would still be well above the rates of growth experienced in Europe. So, although the outlook has undoubtedly become more challenging, the broad picture of US macro outperformance against its DM peers is likely to remain intact. And despite the recent soft patch, we continue to expect a renewed tech-led rally in the S&P 500 over the course of this year.

Europe still stuck in the slow lane…

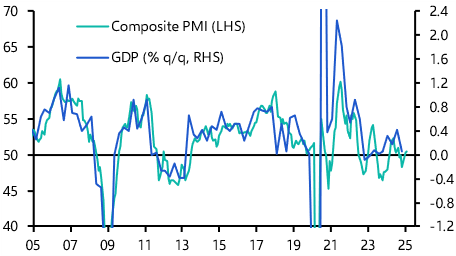

The likely volatility in US GDP over the coming quarters stands in contrast to Europe, where output is flatlining. While the Flash Composite PMI for the euro-zone picked up in February, it remains consistent with GDP remaining broadly unchanged over the coming months. (See Chart 1.) The PMIs also point to further stagnation in the UK economy.

|

Chart 1: Euro-zone Composite PMI & GDP |

|

|

|

Sources: LSEG Analytics, Capital Economics |

What’s more, despite the weakness of growth, concerns about inflation continue to linger. This is particularly true in the UK, where headline CPI inflation picked up to 3.0% in January and is likely to top 3.5% later this year as the effects of recently announced increases in regulated energy prices feed through to household utility bills.

…but better news coming on inflation

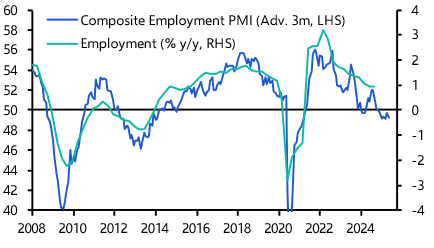

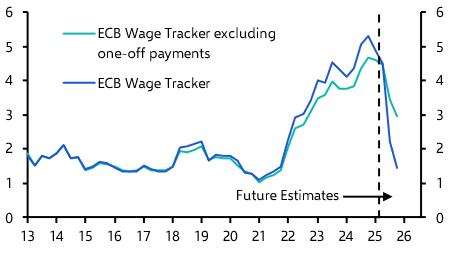

Developments in the labour market continue to hold the key for inflation beyond the next few months. The PMIs suggest that employment growth in the euro-zone will soon grind to a halt (see Chart 2) and the hope is that this will continue to bear down on wage growth. The ECB will take some encouragement from the fact that its wage tracker is pointing to a sharp slowdown in earnings growth over the coming months. (See Chart 3.)

|

Chart 2: Euro-zone Composite Employment PMI & Employment |

Chart 3: ECB Wage Tracker (% y/y) |

|

|

|

|

Sources: ECB, Eurostat, LSEG Analytics, Capital Economics |

Sources: ECB, Eurostat, LSEG Analytics, Capital Economics |

What does this mean for interest rates? We expect the ECB to cut rates by 25bps to 2.5% when policymakers meet this Thursday. Beyond this, however, the outlook will become more uncertain and some of the more hawkish voices on the Governing Council are likely to push back against further policy easing. Nonetheless, we are sticking to our non-consensus view for interest rates to be cut all the way to 1.5% in this cycle as inflation pressures fade and growth remains extremely weak. Rate-setters in the UK are likely to proceed more gradually. We continue to forecast one 25bp cut each quarter this year, although our view that rates may ultimately fall to 3.5% in early 2026 is below what is currently priced into markets.

Watch China’s spending goals, not its growth target

Finally, of the major economies, China continues to face some of the greatest structural challenges. These will be in focus this week when the National People’s Congress kicks off its annual meeting on Wednesday. Much attention will be devoted to the announcement of the annual GDP growth target but, other than setting a floor for the official growth figures, this is of little importance. Our China Activity Proxy suggests that the true pace of growth has routinely undershot the official target. (Last year it was set at around 5%, but the CAP pegged annual growth at 4.5%.)

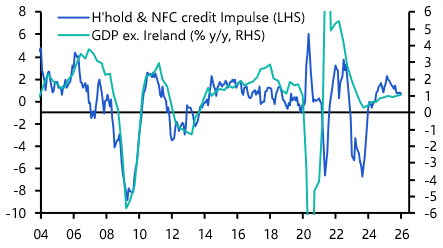

Instead, investors should pay greater attention to the degree of policy support that is laid out by the government in work reports from the premier and the Ministry of Finance. There are myriad different on- and off-budget funds to navigate, but our working assumption is that total fiscal support will be equivalent to 1.5% of GDP. That’s high by the standards of most advanced economies but low by the standards of China – we estimate that the fiscal packages of 2015 and 2020 were equivalent to 2.1% and 3.7% of GDP respectively.

What’s more, China is now facing additional headwinds in the form of US tariffs. On this front, its approach to exchange rate policy will be critical. Our sense is that the People’s Bank of China (PBOC) will allow the exchange rate to adjust in response to higher tariffs, just as it did during the first trade war. This will help to cushion the depressive effect of tariffs on export demand. But if we’re wrong and the PBOC tries to stick to its recent policy of keeping the renminbi stable against the US dollar, then it risks amplifying rather than dampening the damage from tariffs.

Put all of this together, and we expect economic growth in China to accelerate in the first half of the year, but then fade towards the back end as the effects of policy support fade and tariffs start to take their toll. While the official data are likely to show the economy will meet whatever growth target is announced this week, we think it will expand this year by just over 4% on our own CAP measure.

In case you missed it:

This new geoeconomics page is dedicated to our coverage of the intersection of global politics and macroeconomics and includes key analysis, video and data tools covering everything from the implications of a Russia-Ukraine peace deal to the fracturing of the global economy.

Upheaval in the geopolitical environment is forcing European governments to reassess their security needs. Separate reports address the key questions around higher spending in the UK and euro-zone.

Our China team will be answering your questions during their online briefing on the first day of the NPC. Click here to register for the 20-minute Drop-In at 0800 GMT/1600 SGT on Wednesday.