Chinese PMI, Australian CPI, euro-zone GDP, the new UK chancellor’s statement to Parliament, the Bank of Japan, the Bank of England, the Fed…it’s a packed week of releases and central bank meetings and Group Chief Economist Neil Shearing talks through what will be some of the more closely watched market events.

In the process, he puts recent US data in context, talks about what the Fed and Bank of England are likely to do and explains why the UK’s fiscal rules make little sense.

Plus, our Japan team thinks there’s potential for the Bank of Japan to raise rates at its meeting on Wednesday. Marcel Thieliant, our Asia-Pacific head and Tom Mathews, our Asia Markets lead, discuss the inflation dynamics that could prompt the second hike of the year and where the yen is likely headed next following its recent bounce.

Analysis, data and events referenced in this podcast:

Analysis, data and events referenced in this podcast:

- Data: GDP Nowcasts

- It’s close, but BoE to keep rates on hold for a little longer

- Fed warming up to a September rate cut

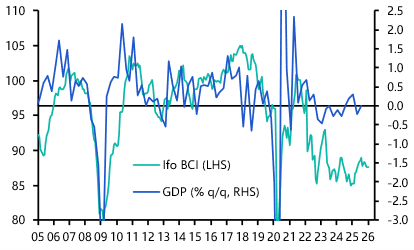

- German debt brake to cause more self-inflicted pain

- We doubt this is the start of a far bigger rotation in US equities

- Japan Drop-In: Will the BOJ hike rates again before the policy window closes?

- ANZ Drop-In: Could Q2 inflation push the RBA to hike again?

- Global Drop-In: Fed, ECB, BoE – The latest decisions and the policy outlook