In the latest episode of The Weekly Briefing from Capital Economics, Group Chief Economist Neil Shearing outlines the three big policy quandaries facing three big DM central banks. He unpacks the ECB’s December decision, previews the upcoming Fed and Bank of England meetings and talks about which of these institutions faces the greatest risks in 2025.

Neil also talks about whether China’s policy pivot will translate into meaningful efforts to support and rebalance the economy, discusses what events in Syria say about geopolitics and the macro narrative and highlights a key risk for the coming year.

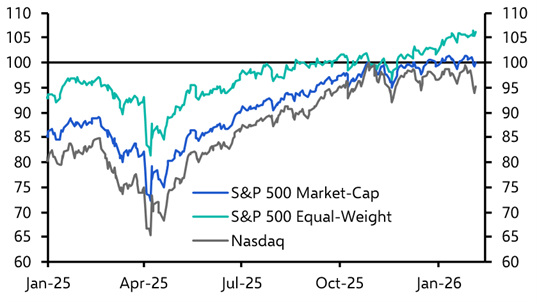

Plus, following our dive into the big macro themes for 2025, Chief Markets Economist John Higgins is on the show to talk about the financial markets outlook – including why we think a bubble in US equities will keep inflating over the year.

Analysis and events referenced in this episode:

Drop-In: The Fed, ECB and BoE December meetings and the 2025 policy outlook

/events/drop-fed-ecb-and-boe-december-meetings-and-2025-policy-outlook

Latest quarterly Outlooks

/outlooks

Week-ahead Forecasts

/data-and-charts/week-ahead-forecasts

Analysis and events referenced in this episode:

Drop-In: The Fed, ECB and BoE December meetings and the 2025 policy outlook

/events/drop-fed-ecb-and-boe-december-meetings-and-2025-policy-outlook

Latest quarterly Outlooks

/outlooks

Week-ahead Forecasts

/data-and-charts/week-ahead-forecasts