Equities

What's the outlook for equities?

Explore and download our forecasts for major DM and EM equities indices and projected equities returns via this interactive dashboard.

Our Economists Recommend

The latest key insight, in-depth analysis and thematic research collections

Try for free

Experience the value that Capital Economics can deliver. With complimentary 2-week access to our subscription services, you can explore comprehensive economic insight, data and charting tools, and attend live virtual events hosted by our economists.

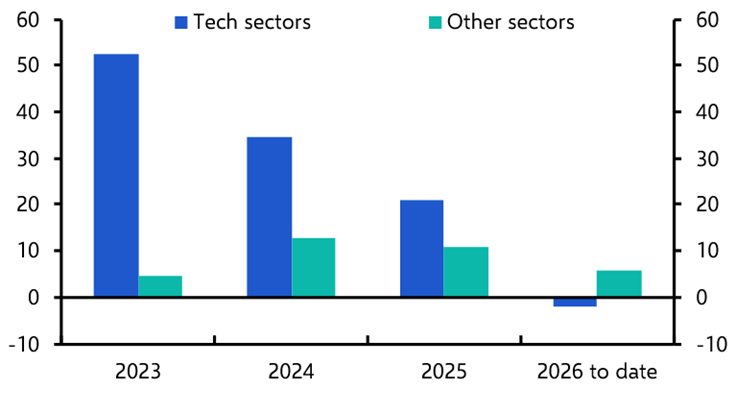

US tech to keep leading the way

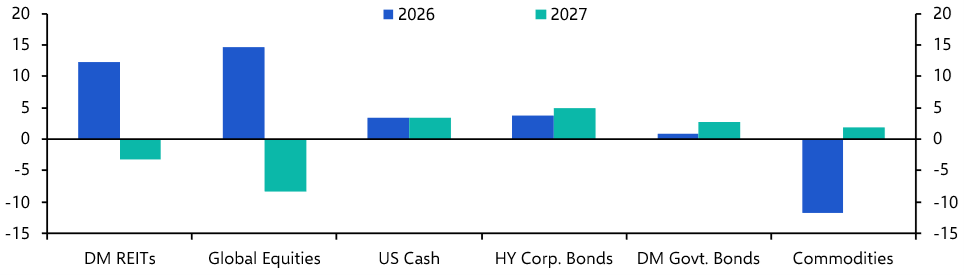

We think the AI-driven surge in equity markets will continue over the next year or so, with tech-heavy stock indices such as those in the US, Japan, and China outperforming while indices more tilted towards “old economy” sectors, especially commodities, lag.

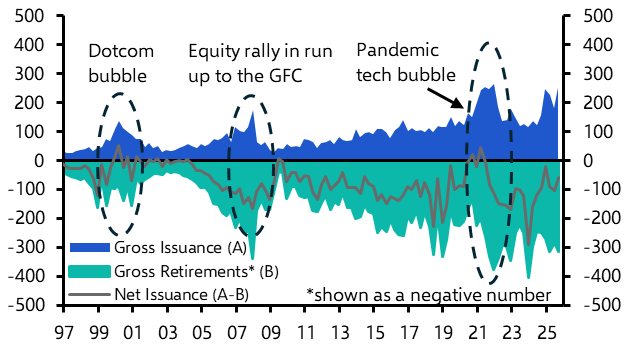

With the S&P 500 and many other leading indices at all-time high after rapid gains over the past few months, concerns of a bubble about to burst are on the rise. There is no question that equity valuations are high, especially in the US. But they not yet as stretched as during the late 1990s, and the investment boom in AI-technology shows few signs of an imminent slowdown. As such, we think equities can keep rallying for a while yet: we forecast the S&P 500 to rise to 8,000 by the end of 2026.