Bonds

What's the outlook for bonds?

Explore and download our forecasts for government and corporate bonds and projected bond returns via this interactive dashboard.

Our Economists Recommend

The latest key insight, in-depth analysis and thematic research collections

Try for free

Experience the value that Capital Economics can deliver. With complimentary 2-week access to our subscription services, you can explore comprehensive economic insight, data and charting tools, and attend live virtual events hosted by our economists.

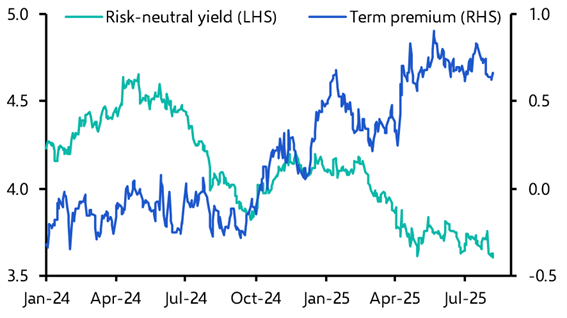

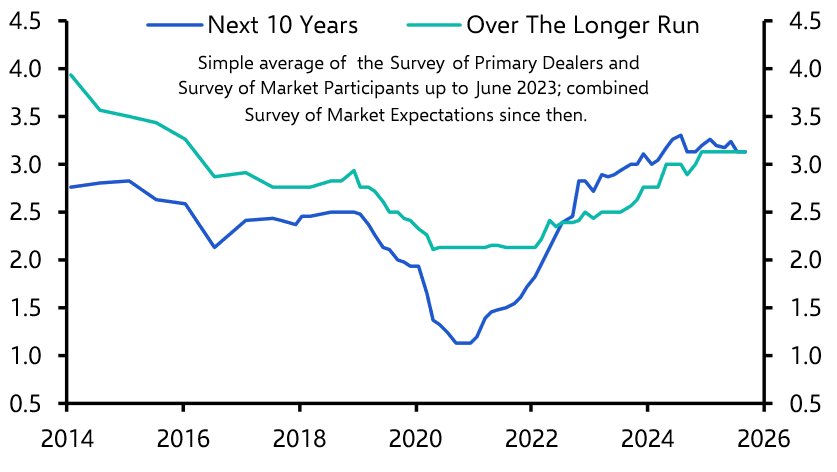

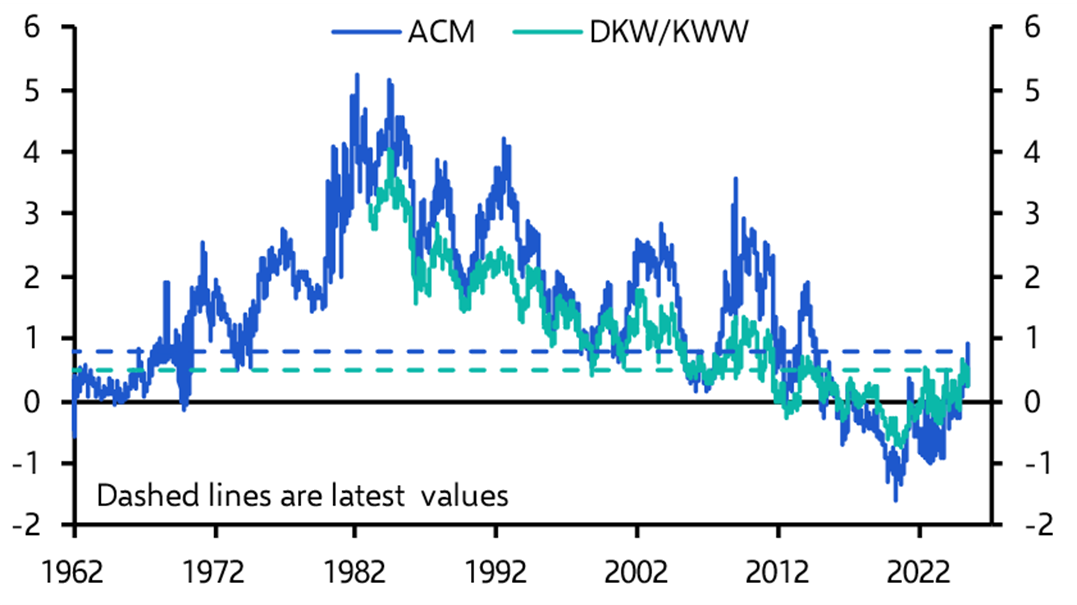

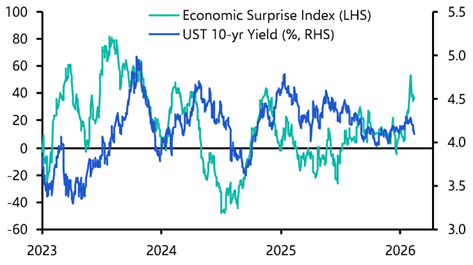

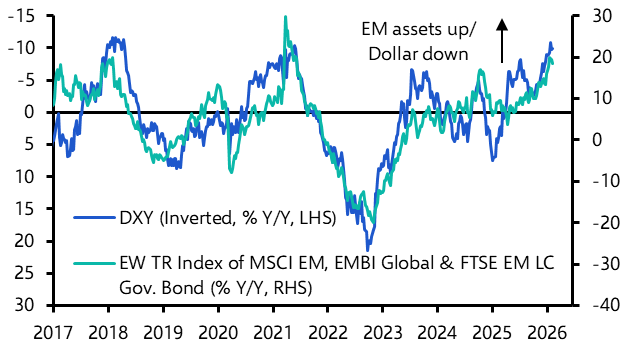

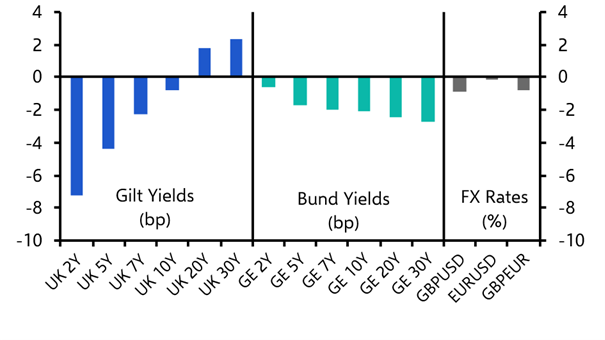

Higher long-term yields are here to stay

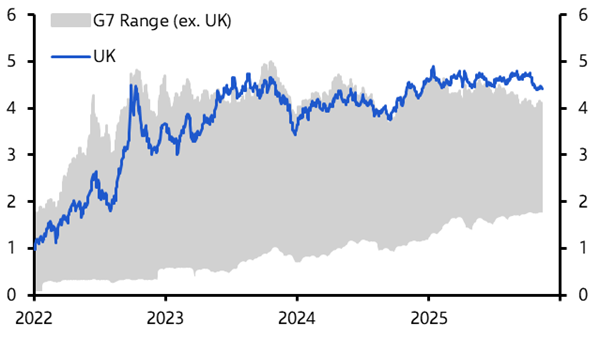

Government bonds in several major markets face structural headwinds on account of fiscal profligacy, quantitative tightening, and reduced demand from key buyers such as pension funds. While the tail-end of the global monetary easing cycle will support bond markets to a degree, we think long-term yields and the volatility of government bonds will remain significantly higher than in the 2010s. In particular, we expect JGB yields to rise further as the BoJ continues to hike rates, while French government bonds will struggle as fiscal risks worsen.