With inflation still running hot, the Bank of England has little choice to keep raising interest rates. But how high will policymakers take Bank Rate, and – with headlines dominated by news of 6% mortgage rates – what will that mean for the UK economic outlook?

Chief UK Economist Paul Dales hosted a briefing with Deputy Chief UK Economist Ruth Gregory, Andrew Wishart, the head of our UK housing market coverage, and Markets Economist Adam Hoyes shortly after the release of the MPC’s June statement about the direction of the UK economy and monetary policy.

During this 20-minute session, the team addressed key issues, including:

- How many more rate hikes are in this cycle – and when cuts could begin;

- The impact of ever-tighter monetary policy on UK economic activity;

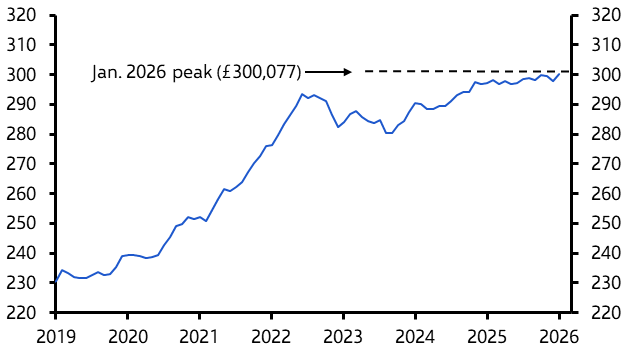

- What the surge in mortgage rates means for the UK housing market;

- ‘Stagflation nation’ – why we expect UK economic underperformance to continue.

Start date: