News of who’s in – and who’s out – of Donald Trump’s government, and what that means for the US and the rest of the world, continues to swirl. While Trump’s choice of Scott Bessent for Treasury Secretary is reassuringly orthodox, there is still considerable uncertainty about the president-elect’s actual plans for government. Clients can find all of our analysis here, but key points are that the consensus is too optimistic on the prospects for further deficit-financed tax cuts, too pessimistic on the near-term consequences of higher tariffs, and too sanguine on the potential long-term implications for US institutions and geopolitical relations.

And while Trump‘s re-election is a pivotal moment for the US and global economies, there is much more happening in markets besides. Even as much of the focus has been on the policies that will follow inauguration day, three other important stories have been developing across the global macro picture in recent weeks: the ongoing rollout of AI, questions over China’s missing stimulus and, perhaps most importantly, creeping concerns over inflation.

AI – Do believe the hype

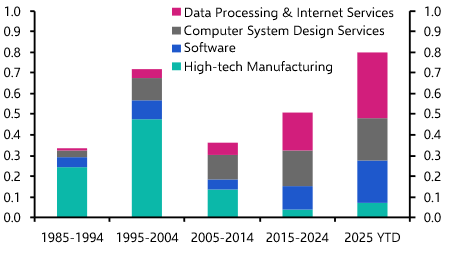

The lukewarm investor response to Nvidia’s third quarter results was all the more significant since it came on the back of big increases in both revenues and profits. This is a reminder of the extent to which expectations around AI have inflated. But the performance of the tech giants also underlines the growing demand for AI and AI products – unlike many companies in the dotcom boom, these firms are selling a lot and are highly profitable.

Our view is that a bubble is inflating in tech stocks, and that it will continue to inflate over the next year. But the financial performance of the big tech firms also illustrates that the rollout of AI products and technology is real.

Surveys suggest adoption of AI has been limited until now, but the technology’s diffusion will ultimately have a significant (and positive) impact on economic growth. To be clear, this will take time to materialise. But the steady adoption of AI could start to have a meaningful impact on productivity growth towards the end of the decade.

China’s missing stimulus

The second major non-Trump issue of the past month relates to China – and the fact that a much-anticipated package of fiscal and monetary stimulus remains missing in action. At the time of writing, the announced stimulus has amounted to relatively small cuts to interest rates, some additional financing support for local governments that will do little to boost aggregate demand, and an instruction that these governments spend funds that they have raised through bond issuance by the end of this year. This is small stuff.

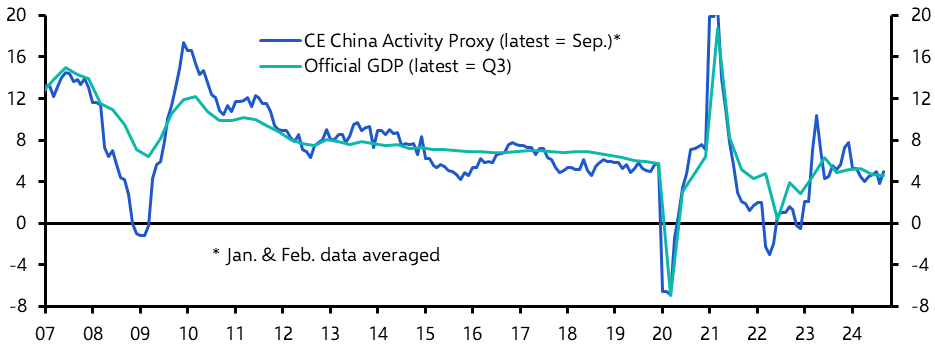

One explanation for the limited response so far is that the wheels of China’s government turn slowly and the leadership is still hashing out plans for support that will be announced in due course. The more convincing explanation in our view is that the leadership may have reached the conclusion that China’s economy does not need major policy support. Economic growth is weak by the standards of the past decade but, according to our China Activity Proxy, is not collapsing and, indeed, has actually ticked up a bit in recent months. (See Chart 1.)

|

Chart 1: Capital Economics China Activity Proxy & Official GDP (% y/y, seas. adj.) |

|

|

|

Sources: CEIC, WIND, Capital Economics |

This does not scream an economy that is in desperate need of fiscal and monetary support. On the contrary, China’s problems are structural in nature and are rooted in the supply side of its economy. The remedy lies not in stimulus but in reform (which is also notable by its absence). We expect economic growth in China to pick up over the next quarter or so as local governments respond to the instruction to spend funds raised through bond issuance. But we think growth will relapse over the second half of 2025 as structural headwinds reassert themselves.

Inflation concerns resurface

The final, and most important, development over the past month has been evidence of a renewed pick-up in inflation alongside increased central bank caution about the future pace of monetary easing. In Europe, headline inflation in the euro-zone rose back to its 2% target in October and jumped to an above-target 2.3% in the UK in the same month. The sharper increase in the UK was due to a rise in household utility bills and reflects the way that regulated prices have adjusted to a rise in wholesale natural gas prices since the start of the year. But in both the UK and eurozone services inflation also picked up. This is a concern for central banks since services inflation (as opposed to goods inflation) tends to be a reasonable gauge of domestic price pressures.

As it happens, the increase in services inflation in both the UK and euro-zone was driven to a large extent by a rise in transport prices that is unlikely to be sustained and may be reversed in future months. But the pick-up in inflation has nonetheless caused some concern among central bankers. This is especially the case in the UK, where last month’s Budget also added to costs facing UK firms. This points to a more gradual pace of monetary easing. In the UK, we expect the Bank of England to keep interest rates on hold at the Monetary Policy Committee’s next meeting in December. And while the ECB may still opt for a 50bps cut next meeting, it will be a close call.

These concerns are not just confined to Europe. The minutes from the latest RBA meeting support our view that policymakers in Australia won’t start to cut interest rates until the second quarter next year, while a jump in inflation in October has now ruled out a near-term rate cut in India. Meanwhile, in Japan, a combination of a weaker yen and a pick-up in underlying inflation last month has pushed market expectations for a December rate hike by the Bank of Japan from 25% to over 60% in the past few weeks. (We’ve been forecasting one all along.)

Yet, as ever, it is developments in the US that will have the greatest bearing on global markets. Data released this week is likely to show that the 0.3% m/m gain in core CPI in October will be mirrored in a similar increase in core PCE prices for the same month. This would represent the second consecutive month of an above-target increase in the Federal Reserve’s preferred measure of inflation. Perhaps the bigger concern, however, is the 3.4% y/y increase in unit labour costs in the US in the third quarter, a surge which hasn’t received adequate attention amid the election fallout. This is important because the growth of unit labour costs is the single biggest determinant of labour-intensive core services prices. Accordingly, unless growth drops back towards 2% y/y it will become difficult for Fed officials to claim that overall inflation can be sustained at 2% y/y. Add in the potentially inflationary consequences of additional tariffs and immigration reform, and the Fed’s job is suddenly looking much harder.

We’ll be discussing these issues, alongside how Trump’s second administration could reshape the global macro and market outlook, in our World in 2025 event in London next Wednesday, 4th December. Register here to participate and look out for virtual briefings on this topic if you can’t join us in person.

In case you missed it:

Our US team spells out why talk by Trump’s transition team about slashing the size of government may not amount to much in practice.

Our Commodities team will be explaining what will drive prices in 2025 in an online Drop-In briefing this Wednesday at 1000 ET/1500 BST. Register here to join live or be sent a recording when it ends.

While the euro-zone’s biggest economies have been struggling, Spain’s has been booming. Europe Economist Adrian Prettejohn explores what’s happening in its labour market, and what this means for the country’s inflation outlook.