Bond markets have been on the proverbial rollercoaster over the past month, with long-dated yields shooting up over the second half of October only for both long and short-dated yields to collapse over the past week. The net result is that 10-year US Treasury yields are now 4.6% — broadly unchanged from where they were at the start of October. The turmoil in bond markets has crystallised questions about fiscal sustainability. This is difficult terrain and it is easy to get lost in a thicket of jargon and muddled thinking.

Part of the problem with any discussion about fiscal sustainability is that it tends to be framed in excessively binary terms (i.e. are the government’s fiscal plans sustainable or not?) when in practice perceptions of debt sustainability are constantly shifting. Another problem is that fiscal sustainability means different things in different economies.

In countries where governments issue debt in foreign currency, or where there is no sovereign central bank to back local currency bonds – such as in the euro-zone – unsustainability often means being on a pathway to default. But most governments now issue debt in their own currency, the supply of which is controlled by the national central bank. This makes a default on government debt extremely unlikely.

What’s more, even in countries where governments don’t issue debt in currencies that have the direct backing of national central banks, timeframes matter. There is a big difference between a country with shaky long-term public finances that runs a primary budget surplus (e.g. Italy) and one facing an acute funding crisis (e.g. Greece in 2010).

For most governments that are not facing an imminent funding crisis, a better yardstick for sustainability might be that the public debt-to-GDP ratio remains stable – and that bond markets remain comfortable lending to governments at non-punitive rates.

The public debt ratio is governed by a relatively simple formula:

Debt Ratio (Year T) = Debt Ratio (T-1) * (nominal interest rate/nominal GDP growth) - primary budget balance as a % of GDP.

In other words, keeping the debt ratio stable over time depends on a combination of nominal interest rates, nominal GDP growth and the primary budget balance (i.e. the budget balance before debt interest costs).

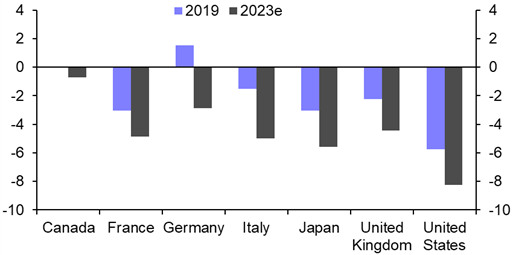

Two things have happened since the pandemic. First, fiscal deficits have widened substantially. (See Chart 1.) And second, interest rates (and government borrowing costs) have increased. These two developments are, of course, related: fiscal expansion has pushed up interest rates and bond yields, which has then fed back into higher debt servicing costs for governments and further increased budget deficits.

|

Chart 1: General Government Budget Balance (% GDP) |

|

|

| Source: Capital Economics |

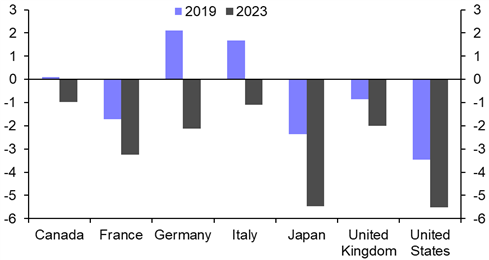

But the key point is that underlying all of this has been a substantial loosening of fiscal policy. This is clear from the significant deterioration in primary budget balances across advanced economies since 2019. (See Chart 2.)

|

Chart 2: General Government Primary Balance (% GDP) |

|

|

|

Source: Capital Economics |

None of this would matter from the point of view of fiscal sustainability if economic growth had also increased. But we don’t expect the strength of third quarter US GDP to be sustained and the UK and euro-zone economies have stagnated for the past year.

This is the point where perceptions and confidence start to matter. Most fiscal crises over the past five years or so have been caused by a belief within markets that the government in question has lost – or is losing – fiscal credibility. This has not always been the result of a change in actual policy, so much as a belief that their commitment to fiscal rectitude has waned. The crisis that followed in the wake of Liz Truss's disastrous “Mini-Budget” in the UK last year is a good example.

Something similar, albeit on a smaller and less dramatic scale, has played out in recent weeks as concern about the US fiscal position contributed to a rise in term premia, and thus bond yields. This appeared to be unwinding before a soft auction of 30-year US Treasury bonds on Thursday last week led to a renewed rise in yields. Moody’s outlook downgrade for its US credit rating to “negative” from “stable” at the very end of last week isn’t immediately significant – an outright ratings cut would follow similar moves from Standard & Poor’s and Fitch – but it adds to the mood music. One lesson from all of this is that governments have much less room for fiscal manoeuvre in a higher rate environment.

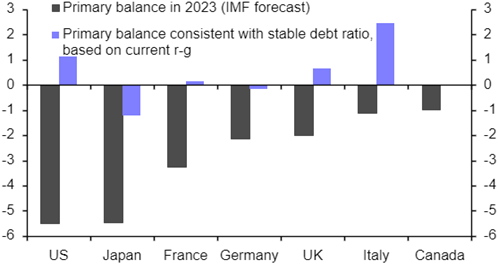

The fact that primary deficits are much larger now than in 2019 (when most economies were also at what most would consider to be full employment) points to the need for widespread fiscal consolidation. Governments need credible plans to rein in deficits and they need to communicate a commitment to fiscal rectitude to markets. This is most urgent in economies where primary deficits are either very large (such as the US, see chart 2 again) or large relative to interest rates and underlying growth (most notably Italy but also France and the UK, see chart 3).

|

Chart 3: Government Primary Balance Consistent with Stable Debt Ratio (% GDP) |

|

|

|

Sources: IMF, Capital Economics |

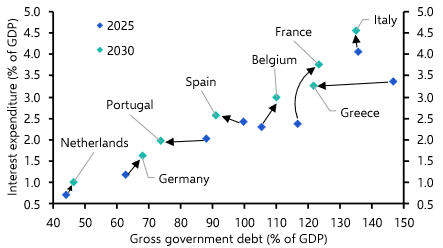

Further out, our work suggesting the equilibrium interest rates will rise further over the next decade has led to lots of questions from clients about long term fiscal sustainability. We’ll have more to say about this in forthcoming work but a key point to note is that in most countries we anticipate that higher interest rates will be accompanied by faster growth. This has echoes of the mid-1990s (albeit with government debt and deficits starting from a much higher position). There are plenty of reasons to be pessimistic about the fiscal trajectory of the US but it’s possible that policymakers could be helped out by a period of faster economic growth.

Instead, the really ugly mix will come in countries where interest rates are pulled up by global or regional factors without a corresponding increase in growth. Italy has flown under the radar in recent years, thanks in part to the Meloni government pursuing a more fiscally responsible path than seemed likely when it came to power. However, Italy’s long term debt dynamics are grim and the country operates within the straitjacket of monetary union. We doubt it will stay out of the firing line forever.

In case you missed it:

Oil prices have been shrugged off the heightened geopolitical tensions around the Israel-Hamas war. Gold less so. Commodities Economist Kieran Tompkins discusses the war’s impact on gold – but also the likelihood of Fed rate cuts next year – in explaining our price forecast hike.

The fall in oil prices, despite the war, should also be reflected in US October CPI, which is due on Tuesday. Paul Ashworth and Andrew Hunter for their post-release Drop-In at 10:00 EST/15:00 GMT – register here for that 20-minute online briefing.

Jonas Goltermann, our Deputy Chief Markets Economist, explains why we think the dollar will edge higher through the end of this year.

Despite growing evidence of widespread disinflation, central bankers have been sounding relatively hawkish of late. It’s something we discuss in the latest episode of our weekly podcast.