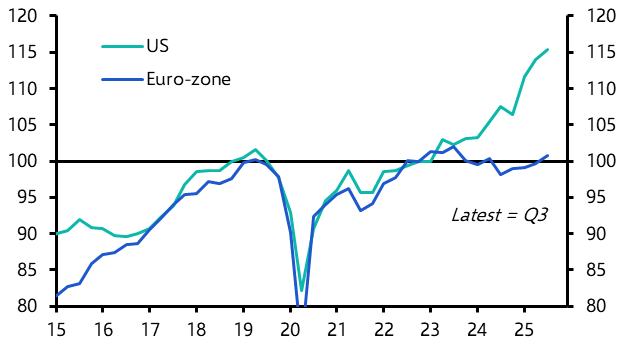

Even the perma-bears would have struggled to find much in the slew of data released over the past week that would justify recent recession fears. Admittedly, we learnt that US manufacturing production contracted by 0.3% m/m in July. But that largely reflected the combined effects of Hurricane Beryl, which subtracted 0.3% from production, and bigger-than-normal annual retooling shutdowns, which knocked out parts of the auto sector and subtracted another 0.6% from output. Those effects should be reversed in August’s data. Meanwhile, the second consecutive dip in initial jobless claims for the week before last doesn’t suggest that America’s labour market is cracking, while the acceleration in the three-month on three-month rate of growth of control group retail sales to an eight-month high of 4.9% annualised in July implies that the US consumer remains in decent shape.

Elsewhere, we also learnt that Japan’s economy expanded by a larger-than-expected 0.8% q/q in the second quarter (another win for our GDP Nowcast), while UK GDP increased by a solid 0.6% q/q in Q2. Even China’s economy is showing signs of stabilising.

Looking ahead, while the latest business surveys suggest that growth in most major economies is likely to soften over the coming months, they remain consistent with a moderate slowdown in growth rather than precipitous collapse. The bigger picture is that economies appear to be muddling through. Reflecting this, our US Macro Scenarios Dashboard continues to suggest that a soft landing is the most likely outcome.

More good news on inflation

In addition to more reassuring data on activity, the latest price data will also have provided some comfort for those still worried about a resurgence in inflation. While consumer price inflation in the UK accelerated from 2.0% to 2.2% in July, the first pick-up in eight months, this was caused by unfavourable base effects related to a sharp fall in household energy bills at the same time last year. Both core inflation and services inflation – which better reflect domestic price pressures and are more closely watched by the Bank of England – edged down.

Bumper pay deals that have been agreed with parts of the public sector by the new government risk setting a benchmark for others and therefore represent an upside threat to broader wage and price inflation. But our central forecast is that, while base effects will keep headline inflation elevated over the coming months, underlying inflation will continue to grind lower as distortions caused by the pandemic and then war in Ukraine continue to fade. Having kickstarted an easing cycle at its meeting earlier this month, we expect the MPC to keep interest rates on hold at its next meeting in September. But further 25bps cuts are likely at meetings in November and December.

The ECB is walking a similarly difficult tightrope between removing monetary restriction as inflation comes down and keeping a close eye on a labour market that is still tight. Negotiated wages in Germany are on track to increase by 5-6% this year, and the country’s largest union – IG Metall – is sticking to demands of a 7% increase in pay for the country’s electrical and metal workers. This will have set alarm bells ringing among the more hawkish quarters of the ECB. As it happens, we think that fears of a “wage-price” spiral developing in Germany are overdone. But at the same time, we also expect that policymakers will continue to tread carefully. We expect the ECB to lower interest rates by another 25bps to 3.5% at its next meeting in September, and we are sticking to our view that they will push through only one 25bps cut per quarter after that.

All eyes on Jackson Hole

However, if the summer sell-off demonstrated anything, it is that developments in the US matter most for markets. With this in mind, investors can take comfort from the fact that the past week has brought more good news on inflation for the Fed. US PPI, CPI and import price data released in recent days imply that the Fed’s preferred core PCE measure increased by 0.16% m/m in July. This would mean that the three-month annualised rate would fall to 1.9%, with the six-month annualised rate dropping from 3.4% to 2.7%.

With inflation coming down and the economy holding up, we continue to forecast that the FOMC will cut interest rates by 25bps to 5.00-5.25% at its meeting in September, rather than enact a larger 50bps cut, or even an emergency inter-meeting cut that many had speculated about only a few weeks ago. Our base case is that this will be followed by further 25bps cuts in interest rates in November and December but we should get more insight into the Fed’s intentions this week with the annual Jackson Hole Symposium. Fed Chair Powell is due to speak on Friday. As ever, all of our monetary policy analysis and forecasts are available for clients on our dedicated Central Bank Hub – see here.

In case you missed it:

- Julian Evans-Pritchard sets out how China’s government can fix its property destocking scheme.

- Paul Ashworth provides a first take on Kamala Harris’ economic plan.

- Our weekly podcast keeps you up-to-date on all things macro and markets. Sign up in Apple, Spotify and all the usual places or listen here.