In the latest episode of The Weekly Briefing from Capital Economics, Chief Global Economist Jennifer McKeown speaks about the macroeconomic implications of the global IT outage before going on to explain what’s happening to the world inflation and monetary policy picture.

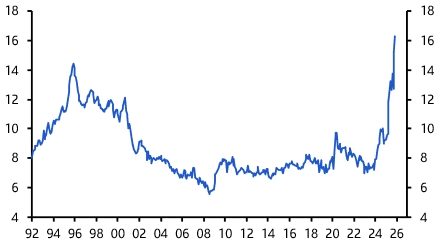

Jenny talks about the challenges posed by sticky services inflation, discusses why central banks can’t afford to wait to cut rates and looks ahead to outline where prices and rates are going over the medium-term.

Jenny talks about the challenges posed by sticky services inflation, discusses why central banks can’t afford to wait to cut rates and looks ahead to outline where prices and rates are going over the medium-term.

Julian Evans-Pritchard, our China Economics head, is also on to talk about the outcome of the Chinese Communist Party’s Third Plenum, explaining why the official communications so far suggest that the economy’s fundamental problems aren’t going away any time soon.

Analysis and events referenced in this episode:

The economic threat from cyberwarfare

What explains the stickiness of services inflation?

Global rate-cutting cycle is not “one size fits all”

Third Plenum fails to resolve policy tensions

CE Advance

R-Star Dashboard

Analysis and events referenced in this episode:

The economic threat from cyberwarfare

What explains the stickiness of services inflation?

Global rate-cutting cycle is not “one size fits all”

Third Plenum fails to resolve policy tensions

CE Advance

R-Star Dashboard