Last week we held a series of online briefings on the outlook for 2024. In this week’s note, I answer three of the most commonly asked questions by clients during the sessions.

Why have advanced economies been so resilient and will it last?

Some economies have been more resilient than others. The US economy has grown by about 3% over the past year whereas Europe’s economy has stagnated, dragged by a German economy which has shrunk a little. The defining feature of the global economy this year has been one of US outperformance rather than broad resilience.

With that said, all advanced economies have fared better than we had anticipated at the start of this year. A lot has to do with the weirdness of this cycle. On the demand side, lengthening maturity structures have dampened the pass through of tighter monetary policy to households and businesses. (The flow of new credit has collapsed but the cost of servicing existing debt has not risen by much.) At the same time, households have been able to draw on the savings accumulated during the pandemic to support spending in the face of a substantial real income squeeze. Meanwhile, the continued fading of pandemic-related distortions in both labour and product markets has improved the supply picture.

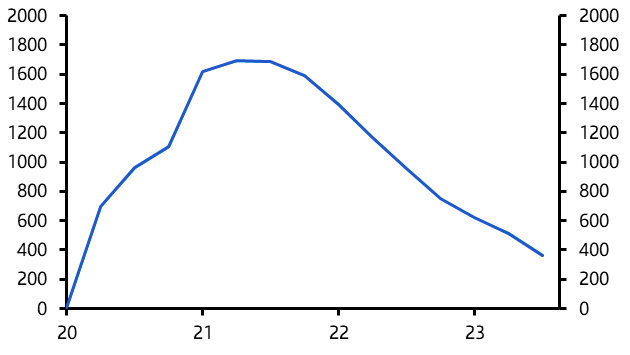

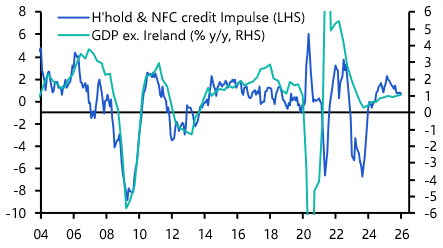

Putting this together helps explain why economies performed a bit better than we had feared 12 months ago. Whether that can last is another question. Accumulated savings have been largely exhausted in the US (see Chart 1) and most supply-side distortions have now unwound. Moreover, while monetary policy has lost some of its power it is not entirely impotent. We expect all advanced economies to slow substantially over the coming quarters and, while in most cases our forecasts would still qualify as a soft landing given the huge distortions that developed over the past two years, several, particularly in Europe, are likely to experience mild recessions.

|

Chart 1: US Household Stock of Excess Savings ($bn) |

|

|

|

Sources: Refinitiv, Capital Economics |

Which central banks will loosen policy first and why?

We forecast that the Fed and the Bank of Canada will be among the first central banks to cut interest rates, but in truth we wouldn’t put much weight on the timing of rate cuts – the key point is that most central banks are likely to be lowering interest rates by around the second quarter of next year.

Any decision on when to cut interest rates will be governed by two things. The first is the outlook for growth and inflation, and the second is the central bank’s response to shifts in that outlook (the so-called “reaction function”).

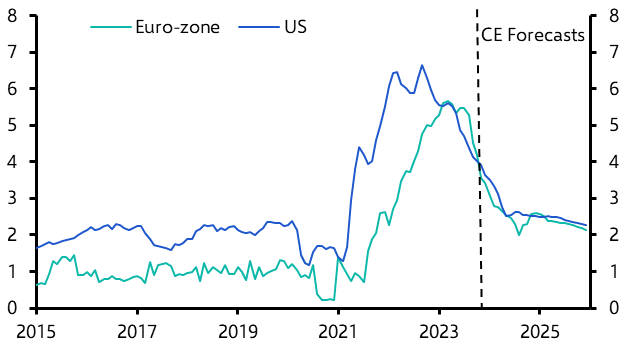

The fact that inflation cycles across advanced economies are highly synchronised – albeit with the US leading Europe – suggests that the common shock of the pandemic is still the primary driver of inflation outcomes. (See Chart 2.) In the case of Europe, this has been exacerbated by the effects of the energy price shock following Russia’s invasion of Ukraine. However, the impact of both of these is fading, suggesting that inflation will continue to fall over the coming months and quarters. We forecast that core inflation will be close to 2% by mid-2024 in both the US and the euro-zone. (Again, see Chart 2.)

|

Chart 2: Core CPI Inflation (%) |

|

|

|

Sources: Refinitiv, Capital Economics |

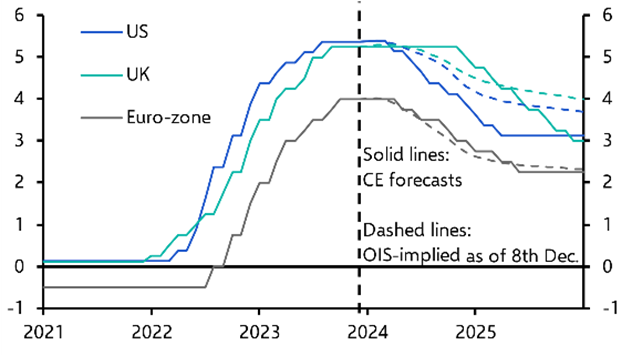

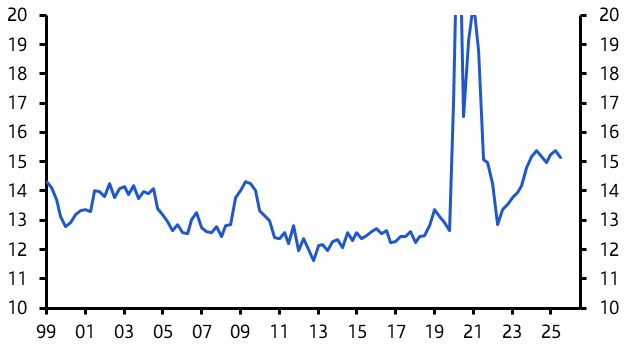

This leaves the “reaction function” as a key determinant of the timing of the first rate cuts. No self-respecting central banker is going to declare victory in the fight against inflation until they are certain that the battle has been won, but history and recent experience suggests that policymakers in Europe are institutionally more hawkish than their counterparts in the US. For this reason, if pushed, we suspect the ECB may be a bit later to cut than the Fed – even though the growth outlook in the euro-zone is significantly worse. (See Chart 3.)

|

Chart 3: Policy Interest Rates (%) |

|

|

|

Sources: OIS, Capital Economics |

Against this backdrop of broad policy easing, two developed market central banks stand out. The first is the Bank of England, where supply-side concerns are greater and mean that interest rate cuts could come later than in the euro-zone or US. The second is the Bank of Japan, which, having missed out on the great tightening cycle of 2022-23, could sneak in a rate hike in early-2024 before other central banks start cutting.

Where might your forecasts be wrong?

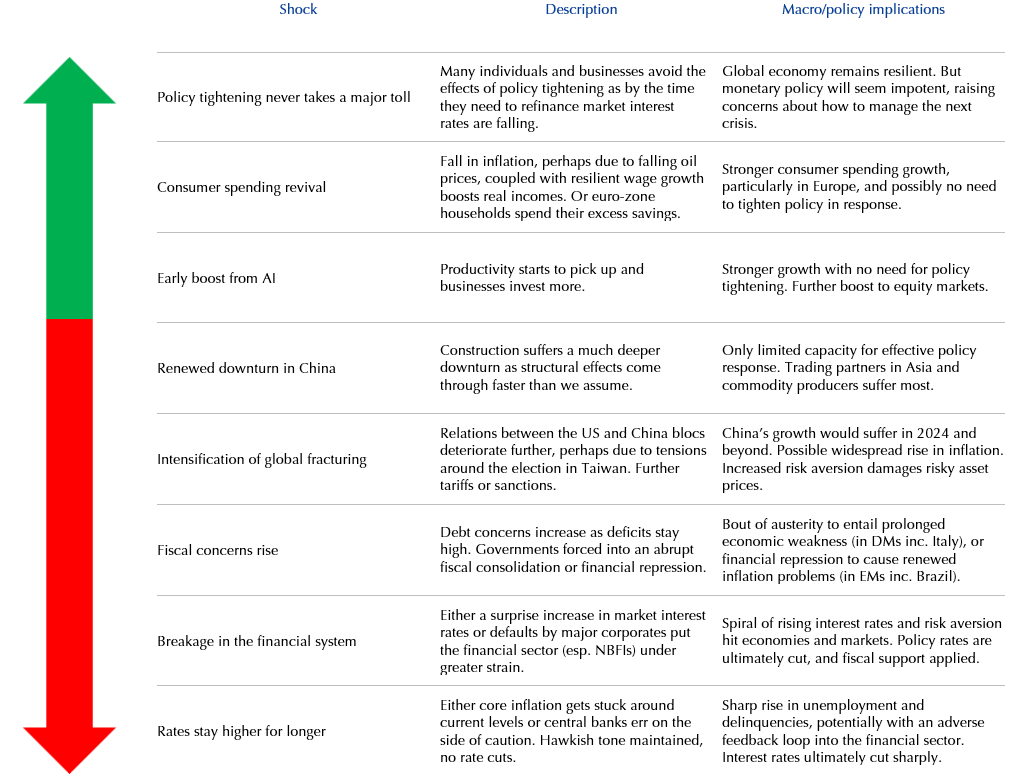

We set out the key risks to our forecasts in a recent note. There are several non-macro risks that could shift the outlook, to the upside as well as to the downside. This includes the threat of war, extreme weather events and surprise results from a packed election calendar. Some of these, particularly elections, could have immediate market implications even if the macro effects will take years to play out. On the macro front, the principal risks relate to the unusual nature of this cycle and associated uncertainty around the effect of policy tightening over the past 18 months.

On the upside, the effects of tighter policy could continue to feed through more gradually than we anticipate which, coupled with a fall in inflation, could mean that consumer spending remains stronger than we currently forecast.

On the downside, it’s possible that the large increase in interest rates over the past 18 months suddenly exposes vulnerabilities in the financial system (non-bank financial institutions are a potential source of risk). At the same time, it’s possible that inflation does not fall as far as we anticipate or it rebounds, which could require central banks to delay easing or even restart tightening cycles. This in turn could rekindle concerns over fiscal sustainability in developed markets. Meanwhile, the risks to China’s economy lie mainly on the downside given structural headwinds in the property and construction sectors.

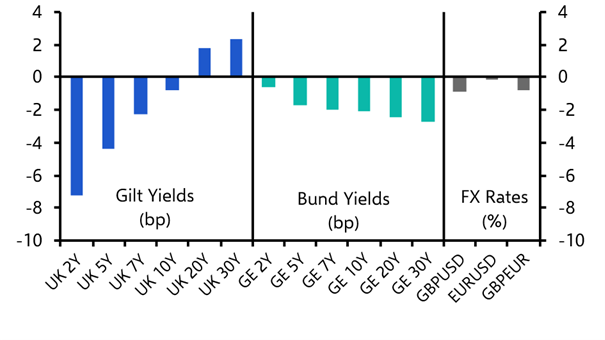

One point that comes through in our analysis is that it is easier to identify downside than upside risks (even if the economic impact of these risks might differ). (See Chart 4.) Lower inflation and interest rates aside, the one development that could genuinely transform growth prospects would be an AI-related boom in productivity. But while we would place ourselves in the techno optimist camp, we suspect the associated increase in productivity will take several years to materialise.

|

Table 1: Summary of Key Risks for 2024 |

|

|

| Sources: Capital Economics |

In case you missed it:

Our dedicated World in 2024 page has more on the coming year’s key themes, core risks and the answers to your questions, as well as our Q1 2024 Outlook reports with our latest analysis and forecasts from across our coverage areas.

In a busy week for central bank meetings – with decisions expected from authorities including the ECB, Bank of England, SNB, Banxico and the Fed – our Central Bank Hub is where you can find all our policy rate forecasts for major DM and EM banks, as well as links to the latest meeting previews and reactions.

The market’s muted response to the change in Moody’s outlook on its China credit rating to “negative” says much about investors’ risky belief in the implicit state backstop.