Our latest monthly Drop-In on the big macro and market stories in Asia focused on new analysis making the case for Japanese inflation and the Bank of Japan policy rate both to hit 2% by 2030. We also discussed the outlook for China in 2024 and previewed the Reserve Bank of India’s December meeting.

During this 20-minute session, economists from our Asia services and financial markets addressed key issues, including:

- Why the BOJ will have to start lifting its policy rate to avoid inflation overshoots – and what that means for markets;

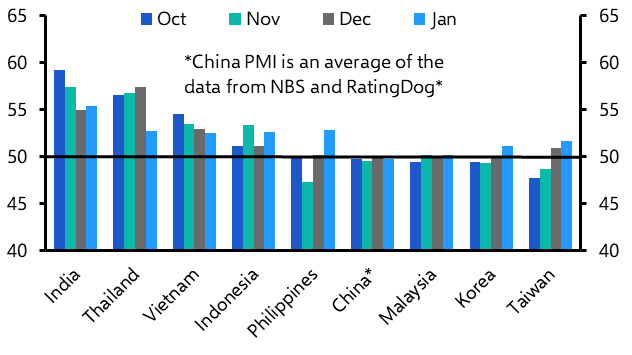

- Why any optimism around China’s economic recovery in 2024 could prove short-lived;

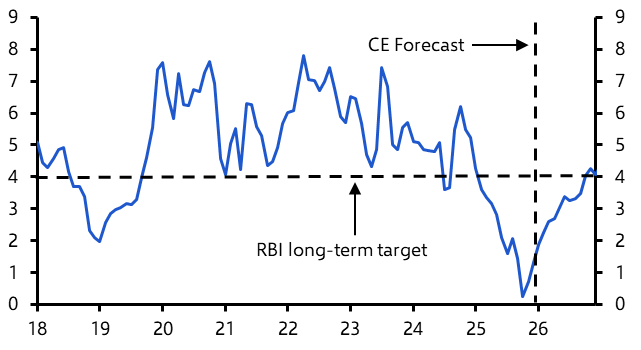

- The latest India GDP data and the timing of the first RBI rate cut.

Start date:

This content requires an active Capital Economics subscription to view. Please log into your account or contact support@capitaleconomics.com if you are interested in a complimentary access period.