The dollar is once again sending shivers through global markets as its rise again generates fearful headlines about risks to economies large and small. Central bankers are clearly getting nervous – and some have good cause to be so – but the consequences of a strong dollar are easily exaggerated.

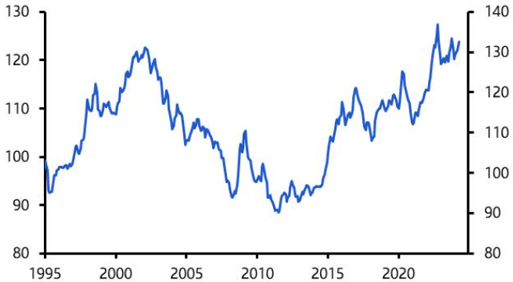

The greenback has risen by 3% in trade-weighted terms since the start of the year. That doesn’t sound like much but it takes it close to the post-Plaza Accord highs seen in 2022. (See Chart 1.)

|

Chart 1: Trade-Weighted US Dollar (Jan 1995 = 100) |

|

|

|

Sources: Refinitiv, Capital Economics |

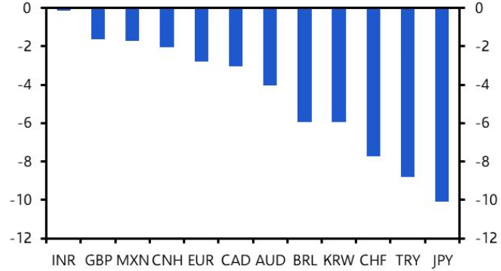

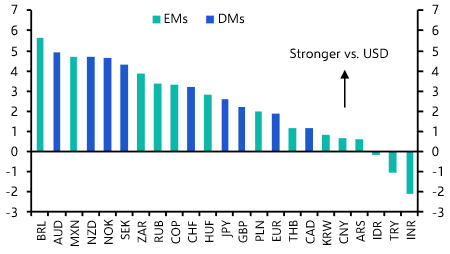

The counterpart to this is that other currencies have weakened against the dollar. The yen, Turkish lira and Swiss franc have seen the largest falls, dropping by between 8 to 10% against the greenback since the start of this year (See Chart 2.)

|

Chart 2: Change vs US Dollar (%, since Jan 1st) |

|

|

|

Sources: Refinitiv, Capital Economics |

The dollar’s strength reflects the relative strength of the US economy. Domestic demand remains robust – that softer-than-expected first quarter GDP number was principally because of drags from net trade and inventories. At the same time, inflation has been too hot to give the Federal Reserve enough confidence that it is coming under control, with the core PCE index increasing by 4.4% q/q annualised in March and pushing market expectations for that first rate cut back even further (and too far, in our view).

Channels of contagion

There are four reasons why a strong dollar could be a problem for other economies: two that come through the trade channel, and two that take effect through what we might call the financial channel.

On the trade front, because around 40% of trade is priced in dollars, its strength pushes up the local currency cost of imports and so fuels inflation risks in countries outside the US. (The flip side is that it is disinflationary in America.) There is also some evidence that because a strong dollar pushes up the local currency cost of imports for other economies, it acts as a headwind to global trade and activity more generally.

On the financial front, a strong dollar can cause balance sheet strains in companies or governments that borrow in dollars but don’t have a corresponding dollar revenue stream. This is because it pushes up the local currency cost of servicing dollar-denominated liabilities. Moreover, because rapid moves in exchange rates generate uncertainty about the future value of foreign currency-denominated assets and liabilities, they can create significant financial dislocation that then threatens broader macro stability.

Putting matters into context

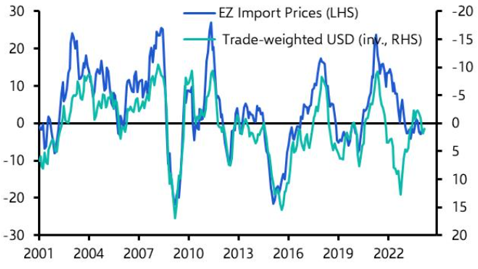

How significant are each of these channels for contagion today? The inflationary consequences of a strong dollar – and weak domestic currency – depend on several factors. These include the import intensity of the economy, the composition of imports and the size of the currency move. There is no simple rule of thumb. In fact, there is an inverse relationship between the strength of the dollar and global import price inflation (this is because a strong dollar typically weighs on commodity prices). Chart 3 illustrates this point for the euro-zone.

| Chart 3: Trade-Weighted Dollar and Euro-zone Import Prices (% y/y) |

|

| Sources: Refinitiv, Capital Economics |

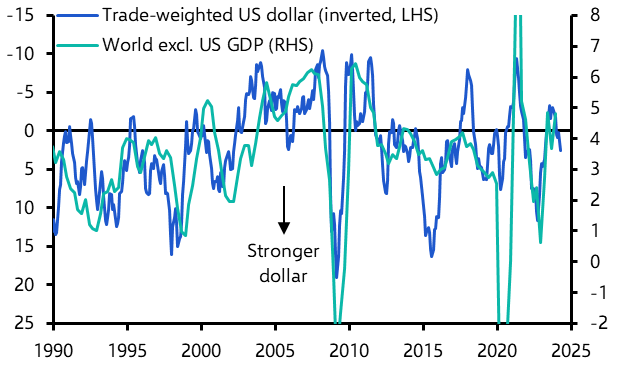

Similarly, while there are several reasons why a strong dollar might harm global trade and activity more generally, these are often overwhelmed by other factors in practice. There is a reasonable relationship between moves in the dollar and changes in world GDP, excluding the US. But this is principally because weaker economic growth leads to a rise in risk aversion in markets which pushes up the dollar. (See Chart 4.) In other words, the causation runs from the global economy to the dollar rather than the other way around. In the long run, arguably the biggest risk is that a strong dollar exacerbates global trade imbalances by weighing on US competitiveness and adding to pressure on its current account.

| Chart 4: Fed's Broad US Dollar Index & Rest of the World GDP (% y/y) |

|

| Sources: Refinitiv, Capital Economics |

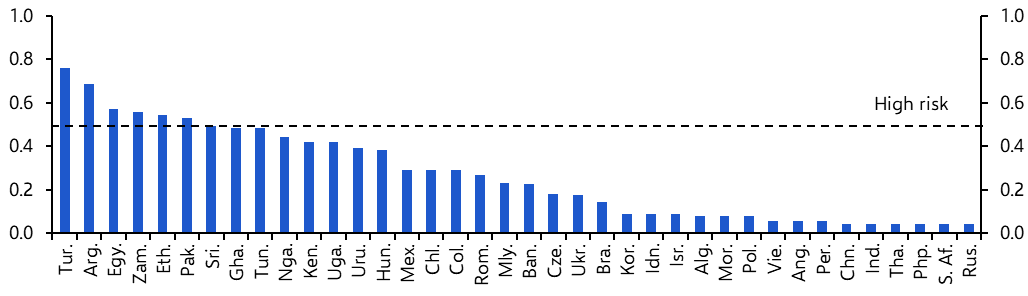

The move in the dollar so far has not been large or fast enough to cause broader financial dislocation: as noted earlier, while it is close to its highest levels in trade-weighted terms since the signing of a joint agreement to weaken the currency at the Plaza Hotel in 1985, the dollar is up by only 3% this year, moving steadily rather than abruptly higher. A strong dollar is a concern for emerging economies with large external vulnerabilities. Our proprietary EM Financial Risk Indicators suggest that currency risks are high in Turkey, Argentina and some frontier markets but relatively contained elsewhere. (See Chart 5.) A string of currency crises looks unlikely. (We’ll be publishing the next edition of our EM Financial Risk Indicators on Tuesday. Stay tuned.)

|

Chart 5: CE EM Financial Risk Indicators (Latest = Q3 2023) |

|

Currency Crisis Risk

|

|

Source: Various Sources, Capital Economics |

Yen in the firing line – but keep watch the renminbi

With that said, while it’s easy to rationalise the strength of the dollar and to downplay the potential economic fallout, it is clear that it has started to rattle some central banks. This is particularly true in emerging economies, where inflation expectations are less well anchored and financial vulnerabilities are greater (although in our view still not widespread and acute). Bank Indonesia’s rate hike last week was a pre-emptive move to stabilise the rupiah. One or two others may follow – Vietnam’s is a leading candidate – although it’s worth noting that Indonesia’s is one of the few EM central banks with an explicit mandate to maintain exchange rate stability and so tends to be particularly sensitive to currency pressure. EM central banks elsewhere, particularly in Asia, have already intervened in FX markets, while in Latin America monetary easing cycles are likely to slow.

Most attention has been on the yen. At the time of writing, a rebound in Monday trading has fuelled speculation of a possible intervention by the Japanese authorities to shore up the currency. And it is certainly the case that policymakers risk their credibility if they continue to warn about the effects of a weaker yen without taking action. But this is fraught with risk. The lesson from 2022’s intervention was that it needs to be sizeable, and that its success depends to a large extent on developments in US markets. Back then, Japanese policymakers sold $19.5bn dollars in a first intervention but it took a second, larger, sale of $38.9bn to stabilise the yen – and that was helped to a large extent by a coincident drop back in US Treasury yields and the dollar. In the current circumstances, a relatively modest intervention would risk doing more harm than good and could further undermine the yen.

Perhaps the biggest challenge is for China. Policymakers in Beijing have intervened via state banks to support the renminbi and appear to be defending a level of 7.3/$. Their concern is that allowing the renminbi to fall against the dollar could trigger capital flight and a destabilising adjustment in the currency, similar to that experienced in 2015. However, the flip side of this intervention is that the renminbi has tracked the dollar higher against other currencies such that it has appreciated by around 5% in trade-weighted terms since July. This comes at a cost. Trade-weighted appreciation risks eroding competitiveness and adding to the challenges facing a manufacturing sector already suffering from overcapacity. It also has a domestic disinflationary impact at a time when policymakers are trying to drive up inflation. So far, China has squared the circle by cutting export prices in dollar terms while intervening to stem the renminbi’s depreciation against the dollar.

The hope in Beijing is that this will buy time until the upward pressure on the US dollar fades. But if the dollar keeps rising, Chinese policymakers will face some uncomfortable choices.

In case you missed it:

Chief US Economist Paul Ashworth has more on that Q1 GDP report and what it says about the chances for a soft landing.

Our latest Global Inflation Watch makes the case for inflation across advanced economies to be within 0.5 percentage point of target by year-end.

With Apple and Amazon among the companies reporting earnings this week, Chief Markets Economist John Higgins explains why we still think the NASDAQ 100 will rise much further between now and end-2025.