The financial press is full of hot takes about how AI will revolutionise our lives, for better or worse. They are fuelling an often-breathless debate around this emerging technology that can leave investors bewildered as to what AI will actually mean for the global economy and markets.

The debate has lacked a consistent and comprehensive framework for thinking through AI’s full economic and market effects – from economic growth and jobs, to domestic policy and geo-political implications, to earnings and equity valuations.

Our forthcoming Spotlight project will present this framework, providing the answers to some of the most pressing questions about AI’s emergence. Five stand out:

1. Should the new breed of generative artificial intelligence be considered a general-purpose technology or GPT?

This might seem like an arcane point but it actually gets to the nub of the likely economic (and market) impact of AI. The key point about GPTs is that they have wide applications and transformative effects across all sectors of economies. Think the harnessing of steam power or electricity and the ways that economies can be defined in terms of before and after these developments. GPTs don’t just affect one or two sectors of economy – their impact spreads throughout, triggering further innovation and invention.

AI’s detractors, including economist Robert Gordon, argue that the technology isn’t impressive enough to meet the definition of a GPT and so won’t deliver economy-wide transformations as the printing press and railways did in their time.

But we think AI does meet most of the agreed criteria to be considered a GPT and, if we’re right, then the economic and market implications are large and wide-ranging. AI won’t just be the reserve of tech bros and Nvidia shareholders. It will affect vast swathes of economies, transforming our economic prospects, and is something that all market participants will soon need to consider when making investment decisions.

2. What is the plausible impact on productivity growth?

There’s no shortage of studies showing AI's productivity benefits for workers in a particular sector or industry (for example, call centre workers in an oft-cited Stanford-MIT study experienced a 14% productivity increase on the back of the introduction of generative AI into their workplace). But what matters for the macroeconomy is how the productivity of all workers is affected.

AI is essentially a new form of capital and so will have some impact on productivity by raising the amount of capital per worker. But the bigger impact of AI is likely to come by raising what economists call “multi-factor productivity” – that is to say, the efficiency with which labour and capital are used in order to produce output.

The key lesson from history is that GPTs have a transformative effect on multi-factor productivity by facilitating better working practices. Electrification meant workers no longer had to be organised around a centralised power source, enabling more efficient production lines. AI will have similar transformative effects both in ways we can already envisage – such as contract writing or illustration and design – but also in ways that are impossible to yet see.

Our Spotlight project will assess the potential of AI to deliver similar productivity outcomes to previous GPTs, and its ability to resolve the productivity malaise that has dogged the US and, in particular, Europe since the Global Financial Crisis.

3. What are the timeframes over which all of this will take effect?

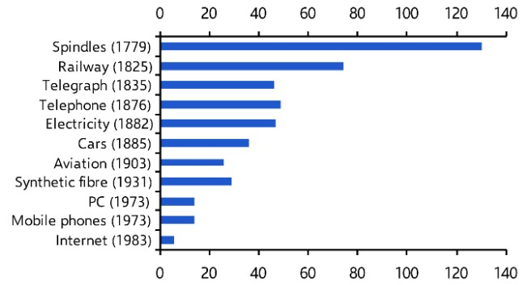

Technological changes don’t happen overnight, and neither do the productivity benefits from them. It takes time for infrastructure and processes to adapt in order to harness new technologies, but those adoption times are shortening. Steam railways were introduced in 1825 but didn’t become commonplace until later in the 19th century. Similarly it took around half a century before electricity and telephone usage became widespread. But the desktop PC had become widely adopted 20 years after its invention, and mobile phones were ubiquitous within a decade. (See Chart 1.)

|

Chart 1: Technology Adoption Lags (Years) |

|

|

|

Sources: Comin & Mestieri (2018) |

Crucially, our report shows how investors seek to crystallise upfront the benefits of a technology that are likely to diffuse only slowly through economies. AI might only become a macro story in the 2030s, but it is already becoming a major driver of equity markets and something that all investors need to understand now.

4. Will AI create or destroy jobs?

Analysis of the impact of AI on the labour market tends to start from the bottom-up, looking at where automation will be most likely and where workers could be replaced, in turn creating fodder for headline writers about obsolescence and job destruction.

This is economic illiteracy. It fails to acknowledge the demand for jobs related to AI and the many ways that this technology will complement, rather than replace, existing jobs. Furthermore, the rise in productivity and real incomes caused by AI will boost aggregate demand and create new jobs in all sectors. What matters is the balance between the overall demand for and supply of labour.

Our report will show that fears of widespread technological unemployment are misplaced. But it also warns of potentially enormous dislocations within labour markets, and in turn explains how policymakers will need to respond to mitigate these.

5. How will AI diffuse within and between economies?

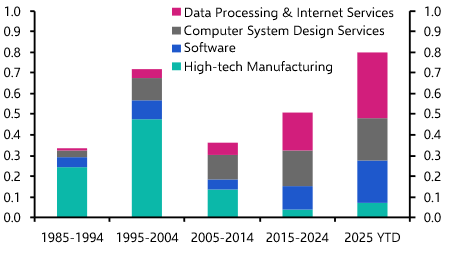

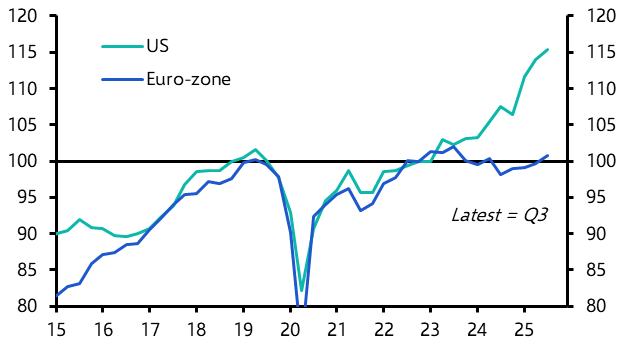

A key problem with most assessments of AI’s is the implicit assumption that all economies will be affected equally. In practice, the success with which economies adopt and adapt to new technologies varies enormously. The ICT revolution was a boon for the US in the 1990s, but left productivity growth in Germany and France broadly unchanged. (See Chart 2.) Attempts to rank economies according to their “AI potential” typically focus on their ability to innovate new technology. These exercises are incomplete, failing to take into account the ability of economies to diffuse that technology, and then to adapt to the opportunities and challenges presented, including to the disruptions that AI will inevitably cause.

|

Chart 2: EZ vs US GDP per employee |

|

|

|

Sources: Capital Economics |

This is why our proprietary AI Economic Impact Index accompanies our report, ranking economies according to their ability to innovate, diffuse and adapt to AI. It will show US leadership in AI development, but also quantify its success in adopting and diffusing AI technology relative to competing economies like the euro-zone and China.

From these findings flow enormous implications that will come to define – or reinforce – key geo-economic trends in this century, not least around the issue of US-China economic fracturing.

Our project on AI won’t be the last word on the vast implications of this emerging technology. We’ll continue to track and analyse how AI is shaping economic and market outcomes as the technology develops and diffuses (and subscribers to CE Advance, our full-access, premium platform, will receive all of our coverage on this issue, as well as access to the data underpinning our analysis to use in their work).

But the report will make the case for AI as a transformative technology that’s much more than market-driven hype – though that hype will support elevated market valuations – and something that, regardless of your business or investing time horizon, simply cannot be ignored.

Our Spotlight report, ‘AI, Economies and Markets – How artificial intelligence will transform the global economy’, will be published on 26th September. You can learn more about the report and the events around our Spotlight project here.

In case you missed it:

With oil prices on the rise, we looked at the market’s supply risks as well as the potential implications for US and UK inflation (our EM Asia team has already raised inflation forecasts as a result of rising fuel prices). Energy prices also came up in the latest episode of our weekly podcast.

The podcast also includes discussion of the geo-economics around the chip in Huawei’s new flagship smartphone. It follows this analysis from our China team about whether the Mate 60 Pro’s technology really does suggest the White House’s export controls aren’t working.

Our Climate Economics coverage has recently explored several flaws in UK climate policy – for the most part centring around the question of cost – including those related to onshore and offshore wind, greening buildings and tackling vehicle emissions.