One of the truisms of macro investing is that central banks in emerging markets “follow the Fed”. Yet on the evidence of the past week, it is policymakers in the emerging world that are charting a course for their counterparts in developed markets. This is another example of how this cycle is unusual.

The highest profile EM central bank decision last week came in China, where policymakers cut the Loan Prime Rates by 10bp. But Hungary’s central bank also lowered interest rates last week, and policymakers in Brazil and Chile suggested that rate cuts may soon be on the cards too. In contrast, the Bank of England was forced to raise interest rates aggressively on Thursday, following another hike from the ECB the previous week. What’s more, both banks sent hawkish messages to markets in the statements that accompanied their policy decisions. In short, policymakers in advanced economies remain resolutely in tightening mode while those in emerging markets appear to be shifting to a more dovish position. What's going on?

China is important because of its size, but it’s an outlier in this story. It’s at a different stage of its macro cycle to other economies, in large part due to its different approach to managing the pandemic. But China also operates a closed capital account, meaning that its monetary policy cycle is less in sync with the rest of the world anyway. The bigger lessons come from the conduct of monetary policy in Brazil and other EMs. These economies are at a similar stage of the macro cycle to major DMs and also operate open capital accounts, meaning that domestic monetary policy is affected by global trends.

Part of the reason why policymakers in Brazil are starting to contemplate interest rate cuts, and why policymakers in Hungary have actually cut them, is that their initial response to the surge in inflation coming out of the pandemic was very different to that of policymakers in advanced economies. They didn’t wait to find out whether the initial pick-up in inflation would be “transitory” – they just got on with raising interest rates.

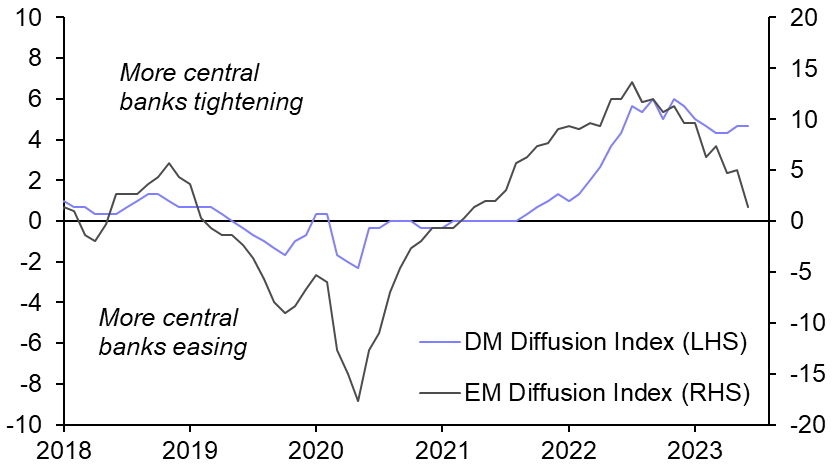

This perhaps reflects the different inflation experience of emerging markets over the past thirty years. The current crop of central bank governors in emerging economies were schooled in the inflation crises of the 1990s. Accordingly, their response to the post-pandemic inflation surge came straight out of Economics 101 – they tightened policy quickly and aggressively. This contrasts with developed markets, where interest rates came later and in smaller increments. (See Chart 1.)

|

|

|

|

|

Sources: Refinitiv, Capital Economics |

As a result, interest rates in major emerging economies peaked at well above our estimates of their “neutral” level. (See Chart 2.) Interest rates in major advanced economies are also now above our estimates of their neutral level, but they have taken longer to get there and the gap between the current level of rates and their “neutral” level is smaller.

|

Chart 2: Policy Interest Rates (%) |

|

|

| Sources: Refinitiv, Capital Economics |

Higher interest rates squeeze demand but they also support exchange rate appreciation, both of which bear down on inflation. Accordingly, core inflation in most emerging markets is now decisively on a downward path. (See Chart 3.) This contrasts with major advanced economies where core inflation has only just begun to edge down, and with the UK where core inflation has continued to rise.

|

Chart 3: Core Inflation (%) |

|

|

|

Sources: Refinitiv, Capital Economics |

The net result of this is that central banks in emerging economies are now able to consider loosening policy. They led developed market central banks in the tightening cycle and they are likely to lead in the easing cycle too.

What does this mean for investors? One consequence is that, whereas policymakers in advanced economies have come under fire during this inflation shock, those in EMs have emerged with their credibility intact. Of course, that’s not true everywhere. Turkey has kept policy far too loose, and is now having to hike interest rates aggressively to rein in rampant inflation and prevent a balance of payments crisis. But the key point is that Turkey is the exception rather than the rule. This will be remembered as the crisis where EM policymaking came of age.

Another lesson is that policy decisions, and economic outcomes, get shaped by recent experience. This helps to explain why EM central banks were much quicker to respond to the inflation threat coming out of the pandemic. The “glass half full” view is that once policymakers in advanced economies squeeze the current surge in inflation out of the system, the likelihood of them allowing something similar to develop again in the next decade or so is lower than would otherwise be the case.

And those of us based in the UK need all the good news we can get right now.

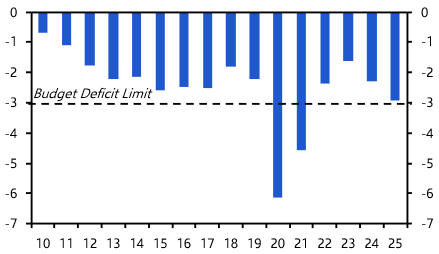

In case you missed it:

- Commodities Economist Kieran Tompkins explains how jet fuel will drive crude oil demand growth this year. Caroline Bain, who heads the team, will be joining our special Climate Drop-In on Thursday for a discussion to include aviation’s decarbonisation challenge. Register here for that session.

- We think investor enthusiasm for AI will drive the S&P 500 up 26% by end-2024 and nearly 50% higher by end-2025 from current levels – but not before a recession-induced pullback. European equities, which lack AI exposure, will lag in comparison.

- Beyoncé isn’t why Swedish inflation has surged. While the Riksbank may look through her recent Stockholm gigs and hike again this week, we also expect it to be among the first DM central banks to cut rates, further weighing on the embattled krona.