There have been two major developments in markets over the past week. The first is the initial round of voting in France’s parliamentary election, which was won by Marine Le Pen’s far-right National Rally party but where a strong turnout and the formation of cross-party alliances in next weekend’s second round could deprive her of an outright majority. The euro and French government bonds have edged high in early trading today. I covered France’s fiscal travails in my note last week and clients can find all of our coverage of the election and its macro and market implications – including our rapid response to yesterday’s vote – on a dedicated page of our website.

The second major development has been the collapse – and partial recovery – of the share price of Nvidia, the advanced chipmaker that has ridden the wave of an investment boom driven by the enthusiasm around artificial intelligence. Its share price fell 18% between from the 18th to the 24th June, wiping $550bn off the value of the company in the process. The price has since partially recovered, and is now 12% below its mid-June peak.

Some much-needed context

The drop in Nvidia’s share price must be viewed in the context of its sharp run-up over the past two years, and the past six months in particular. Nvidia shares have still more than doubled since the start of the year, and it remains the third largest company in the US. However, the fall has also come amid growing doubts about the ultimate economic benefits of the AI revolution that has so transformed Nvidia’s fortunes.

Less than two years after Chat GPT’s launch, there are signs of a backlash, with a growing number of reports highlighting the technology’s shortcomings as a productivity booster and critics pointing to market behaviour as evidence of another hype-driven tech bubble. What should we make of all of this?

Technology needs time

A clearer picture comes through separating the macro consequences of AI from the technology’s market implications. In our Spotlight report last year, we argued that the AI revolution was likely to result in a substantial pick-up in productivity growth, but that the impact would vary between countries and – most importantly – that it would take time to feed through.

Throughout history there has been a lag between the development of new technologies and their impact on productivity. This reflects the time taken to diffuse them through economies, and for infrastructure and processes to adapt so that firms can harness their productivity potential.

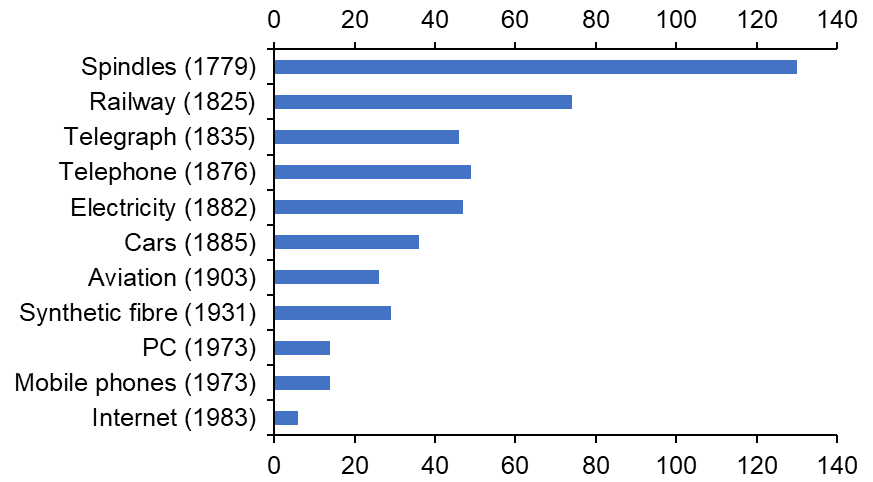

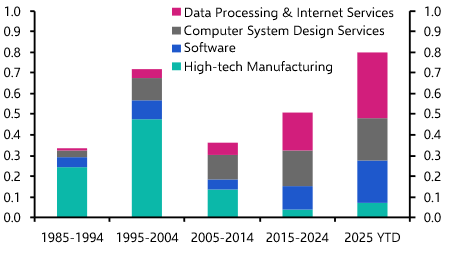

These lags have shortened over time. It took over 70 years for the steam locomotive to become widely adopted after its invention, but this adoption lag was cut to 5-10 years for the key technologies that formed the cornerstone of the computing and ICT revolution of the 1980s and 1990s. (See Chart 1.) Yet for most of the 1980s and early 1990s observers were questioning whether digital technologies would have any impact at all on economic growth. This prompted the now-infamous quip by Nobel-Laureate Robert Solow that one “can see the computer age everywhere but in the productivity statistics”. However, by the mid-1990s the effects had become visible in the data, and over the second half of the decade US productivity expanded at roughly double the pace it did in the 1980s.

|

Chart 1: Technology Adoption Lags (Years) |

|

|

|

Sources: Comin & Mestieri (2018) |

Tracking the ‘hype cycle’

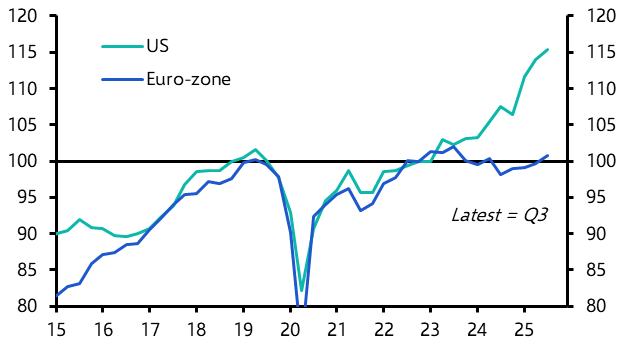

As it happens, there are tentative signs that the AI revolution may have started to boost related areas of business investment in the US. But this is evident in only one or two quarters of data, and is yet to be seen in other countries. We remain of the view that the boost to productivity from AI will be substantial (perhaps as much as 1.5%-pts a year in the US, though much less in Europe) but that this boost won’t arrive until the second half of this decade.

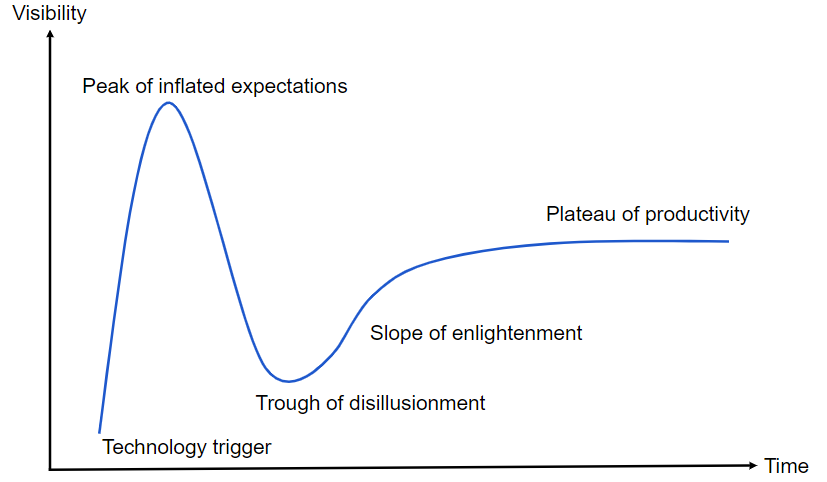

To this end, we are not particularly concerned that there is not yet much evidence of AI having transformed productivity growth. Indeed, what appears to be happening is that AI is following the ‘Gartner Hype Cycle’, which illustrates how views about the impact of new technologies evolve over time. (See Chart 2.) We must surely be somewhere close to the peak of inflated expectations, at least as far as the macroeconomic impact of AI is concerned. This suggests that we will now go through a period of scepticism before we reach peak pessimism and, eventually, the productivity benefits start to reveal themselves.

|

Chart 2: Gartner Hype Cycle |

|

|

|

Sources: Gartner |

Nvidia investors are part of a long tradition of attempting to capture the benefits of new technologies ahead of them fully materialising in the real economy. This was true during the ‘Railway Mania’ of the late 19th century, and more recently during the dotcom boom at the end of the last century. The result is that the hype around new technologies makes them prone to bubble behaviour.

We believe that AI is following a similar playbook and have argued for more than a year that, as the bubble inflates it will drive the US stock market to record highs. As it happens, we think that this process still has further to run. The experience of the dot.com bubble suggests that, under these conditions, US equity valuations can rise further – and the anticipation of additional multiple expansion fuelled by AI optimism is why we think the S&P 500 may peak at 7,000 next year.

Of course, no two bubbles are the same, and in any case the upward march of equities was never likely to be linear. In this sense, the fact that some air has come out of the most stretched parts of the market is not a great surprise. But if we are right in thinking that an asset price bubble is growing around AI – as they have inflated around other breakthrough technologies – then it is likely to inflate further before it bursts.

And burst it will. It’s an immutable fact of markets that bubbles come and go. They’ve grown and then burst around fads offering little practical use – think unwanted tulip bulbs and Beanie Babies. But they’ve also tended to inflate around economy-transforming technologies. When these burst, they leave behind thousands of miles of railroad and fibre-optic cable. When this AI market bursts, its legacy will be vast infrastructure to help diffuse the technology’s benefits throughout the global economy.

In case you missed it:

- Matthew Pointon argues that further distress is likely in pockets of the commercial real estate market, but that the risk this triggers a systemic crisis is low.

- Jennifer McKeown recaps the latest state of play following June’s central bank meetings.

- We are holding several online client briefings this week covering the key themes from our latest global economic forecasts, the outlook for commodity markets, and wrapping the outcome of the UK election and its key macro and market implications. Registration details for all our events can be found here.