This week is set to be dominated by one question: will the Federal Reserve kickstart its easing cycle with a 25 or 50 basis point interest rate cut?

Market pricing on this question has been swinging around. Having effectively priced out a 50bps cut following last week’s August CPI data, traders now see a 60% chance of that bigger move. But our US team thinks a 25bps cut is more likely, with the history of Fed easing also showing that lowering rates by a bigger magnitude has a high bar to clear.

The case for a 50bps rate cut this week hinges in part on the idea that rates are well above most estimates of neutral – if officials judge that keeping policy in restrictive territory for too long creates unnecessary risk for the economy then there is no sense in dragging their feet. We started the year forecasting that the Fed would begin loosening policy in the second quarter and there’s an argument for making up for lost time with more rapid policy loosening.

The problem is this a high bar for a large rate cut, particularly at the start of the easing cycle. If nothing else, it creates the impression that central bankers have made a mistake and fallen behind the curve. If officials opted for the larger cut, it might be interpreted as a sign that the Fed knows something worrying about the economy that markets don’t. The reaction in markets would therefore be uncertain. It’s possible that a large rate cut could cause equity markets to fall and credit spreads to widen which, all other things being equal, would tighten financial conditions. This would evidently be self-defeating.

A larger interest rate cut would therefore require careful messaging. Prominent articles in the financial press making the case for a 50bps move appear part of a communications push to tell markets that officials are at least tabling a move of that magnitude. But Fed Chair Jerome Powell would still need to persuade markets that a more aggressive approach to easing was justified, while at the same time not frightening the horses over the outlook for growth. This would be a difficult path to tread – and Powell would not have history on his side.

As the table shows, every easing cycle over the past three decades in which the Fed has started with a 50bps cut has coincided with a US recession. In contrast, in every easing cycle bar one in which the Fed has initially cut 25bps the US economy has avoided recession. Granted, each cycle is different and, as I’ve argued before, this one has been particularly unusual. The outsized role that supply-side disruptions have played in shaping economic developments in the post-pandemic era mean it is possible for policymakers to bring down inflation without driving the economy into recession. But it remains the case that large cuts in interest rates at the start of the cycle are typically reserved for times in which the proverbial is about to hit the fan.

Table: Recent Fed Easing Cycles

|

Background |

Recession? |

|

|

50bps cut at start |

||

|

Jan 2001 |

50bps cut to kick-start easing cycle that ultimately saw Fed Funds fall from 6.5% to 1% (albeit in two stages). In response to bursting of dot-com bubble and subsequent recession. |

Yes |

|

Sept 2007 |

50bps cut in response to start of housing downturn. Rates ultimately fell from 5.25% to 0.00%-0.25% as global financial crisis unfolded. |

Yes |

|

March 2020 |

50bps cut at start of pandemic. Rates ultimately fell from 1.50%-1.75% to 0.00%-0.25%. |

Yes |

|

25bps cut at start; 50bps cut later |

||

|

July 1990 |

Economic slowdown compounded by Gulf War and surge in oil prices. 25bps cut to start the cycle but pace of easing increased at various points with 3x 50bps in the cycle. |

Yes |

|

25bps cut throughout |

||

|

July 1995 |

Mid-Cycle Adjustment having tightened aggressively in response to rising inflation 1994-95. 3x 25bps cuts in total. Fed helped by productivity boom. |

No |

|

Sept 1998 |

3 x 25bps cuts in response to EM crises (Asia, Russia) and collapse of LTCM. |

No |

|

Aug 2019 |

3 x 25bps in response to a slowing economy. |

No |

| Sources: Federal Reserve, Capital Economics | ||

It’s possible that the Fed cuts by 25bps this week but that the updated Summary of Economic Projections, which will be published with Wednesday’s decision and show how officials expect policymaking to proceed, could flag larger cuts at upcoming meetings.

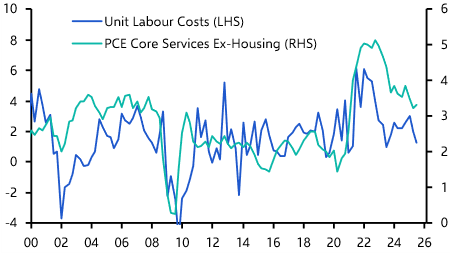

Again, such a move would be justifiable on several grounds: the labour market is now clearly weakening; housing aside, inflation has been brought under control; and, since interest rates are starting from a relatively high point, it would be propitious to dial back policy restriction relatively quickly before something cracks.

The lesson from history is that these are only likely to materialise in practice if the economic outlook deteriorates significantly. In every cycle during which the Fed has cut by 50bps, the economy has ultimately fallen into recession. (See Table, again.) As things stand, while the probability of a hard landing has edged up in recent months, our US Scenarios dashboard still pegs a soft landing as the most likely outcome for the economy.

Nonetheless, this is a decision that looks set to go down to the wire. The case for starting easing with a larger cut is lent further support by the unusual nature of this economic cycle. But set against that are the economy’s relative resilience and the inherent caution of US policymakers. In the absence of signs of more rapid deterioration in the economy, we think a Fed announcement of a 25bps cut is more likely – if only marginally so.

Note: We’ll be discussing the outcome of the Fed’s meeting, as well as the latest decisions from the Bank of England and European Central Bank, in a Drop-In on Thursday at 1000 ET/1500 BST. Sign up here for the 20-minute online briefing.

In case you missed it

Get ready for the market response to this Fed easing cycle by exploring our new Rate Cuts & Asset Returns, a dashboard showing how previous easing cycles affected returns across major asset classes.

Our Composite Economic Momentum Indicators are also a new addition to Data Explorer, our suite of interactive dashboards and provide a unique, comparative view of recession risks across major DMs. As with all our interactive dashboards, CE Advance clients get full access to the available underlying data to export into their own workflows.

Our two-year policy rate forecasts for the Fed and other major DM and EM central banks can be found on our Central Bank Hub.