Covid five years on: How the pandemic continues to shape real estate

What COVID-19 means for real estate out to 2030 and beyond

New report highlights key findings from our exploration of the post-pandemic market

Five years on from the start of the pandemic and the structural shifts it brought about continue to underpin real estate performance. This page poses the big questions that investors are grappling with and highlights our key reports answering them, incorporating a new body of work from Q1 2025 as well as the major pieces from earlier analysis.

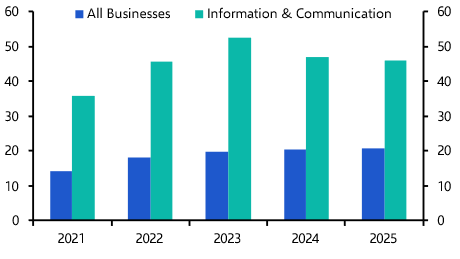

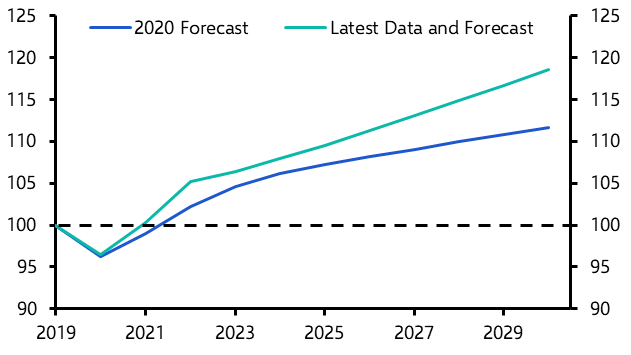

In the summer of 2020, we launched our ‘Future of Property’ work, which examined the likely long-term impacts of the pandemic on real estate – how and where we work, live and play and their effect on occupier behaviour. At the time of that initial work, the major impact of the pandemic was felt in retail and hospitality as consumers were locked down. City centre apartments suffered as renters moved out and logistics demand soared as online shopping rocketed. Meanwhile, office-based firms were broadly unaffected with employees working from home amid claims of improved productivity.

Much has changed since then, but the behaviour change brought about by the pandemic continues to drive significant divergence in performance between sectors, cities and submarkets. Our new analysis seeks to analyse what comes next for each of those.

What will the office market look like by 2030?

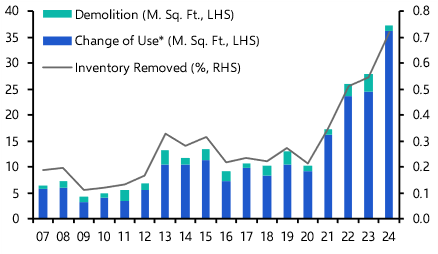

Could there be a shift back toward office attendance in the coming years and what could drive that change? Will the rate of conversions from offices to other uses ramp up further in the coming years? Will prime office continue to outperform secondary and tertiary assets? What will future CBDs look like?

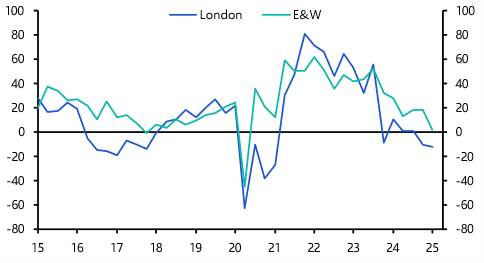

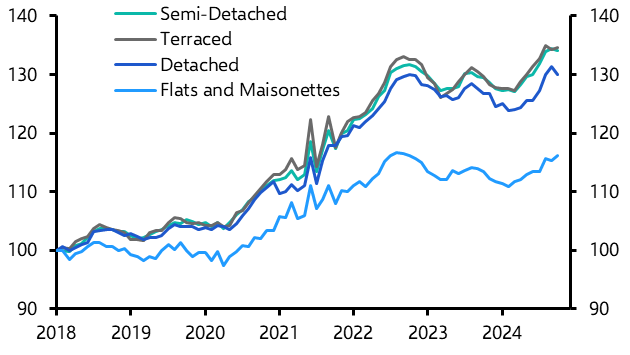

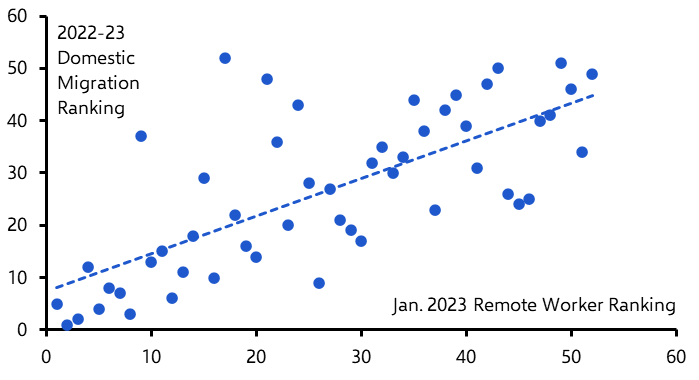

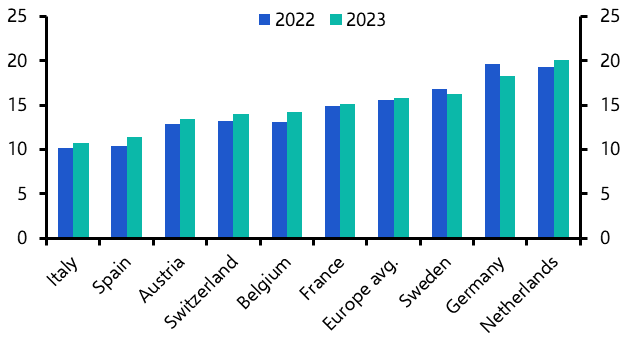

Will remote work drive residential demand?

Will households continue to be willing to pay for more space to facilitate remote work? Will the pace of migration to cheaper and more desirable cities and locations persist? Has the impact of pandemic moves played out and is the US self-storage boom over?

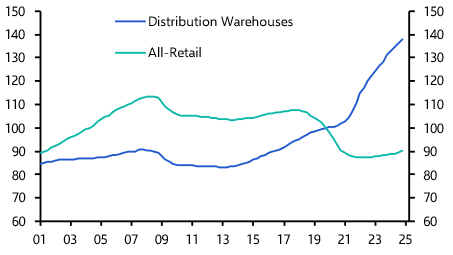

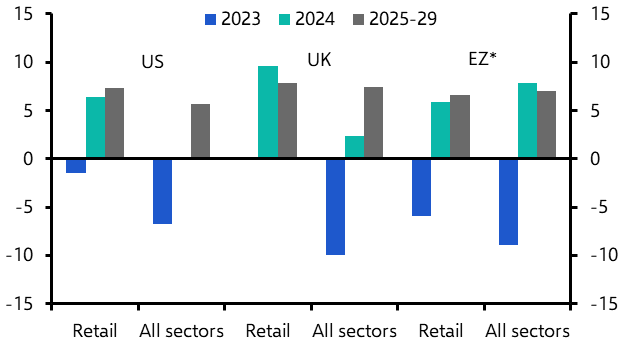

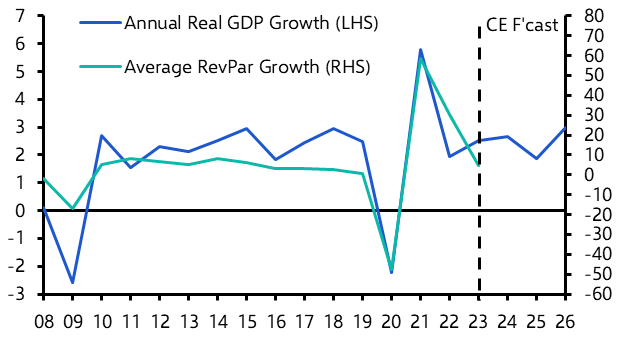

The impact of changing spending habits on retail, hospitality and warehousing

Will online shopping continue to trend higher and dent retailer demand? Will retail completions remain as weak as over the last 5-10 years? Will out-of-town locations continue to outperform or can the recent improvement for shops be sustained? Will the shift to mixed-use and experiential retail continue?

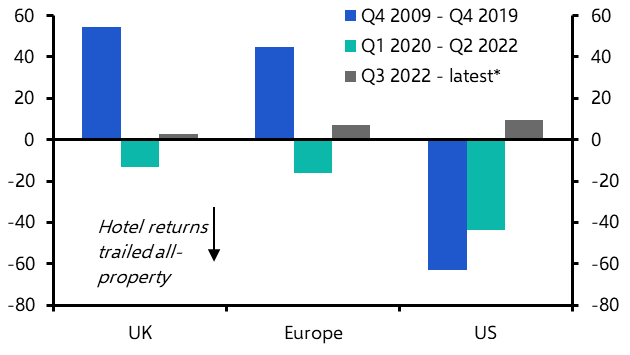

Will overnight business stays ever return to pre-pandemic levels? Will cities that have seen a drop in leisure stays see a recovery any time soon?

Will warehousing absorption revert to pre-pandemic rates? Will distribution networks continue to expand to support faster delivery through more last-mile facilities? Can the problem of expensive returns be solved?

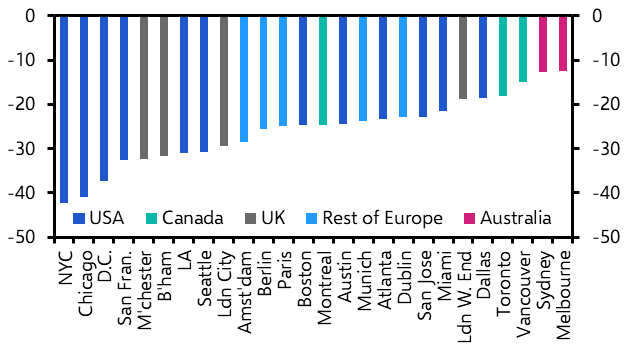

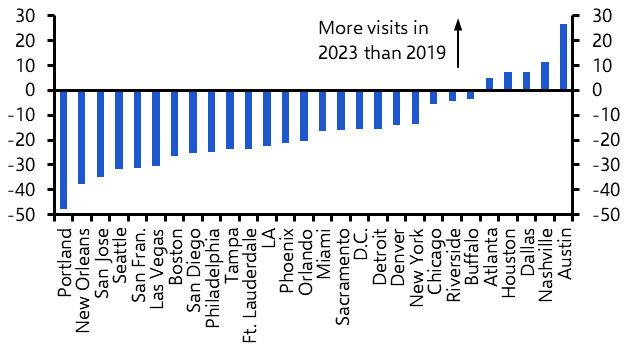

Can cities recover?

Which city types stand to outperform in the coming years? Will the hardest hit downtowns recover?

Table of Contents