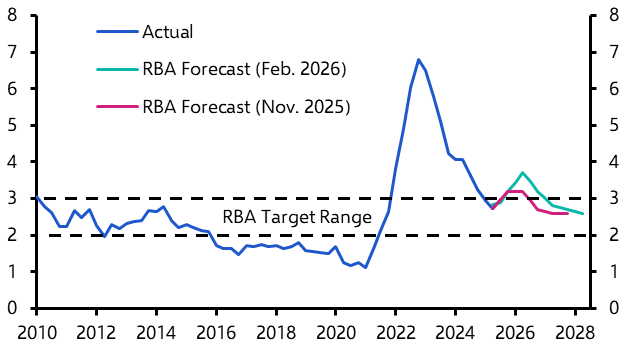

While inflation plunged in May, we still think the Reserve Bank of Australia will raise interest rates again at its July meeting – and push the economy even closer towards recession.

In this special, post-RBA briefing in which Marcel Thieliant, our Head of Asia-Pacific, held a discussion with ANZ Economist Abhijit Surya and Tom Mathews from our Markets team, about why the Bank will have to work harder to get price pressures under control, and the macro and market implications of that tightening.

During this 20=minute briefing, the team addressed key issues, including:

- Why inflation pressures require higher interest rates;

- What higher rates will do to the Australian economy;

- What this all means for the Aussie dollar and bond yields.

This content requires an active Capital Economics subscription to view. Please log into your account or contact support@capitaleconomics.com if you are interested in a complimentary access period.