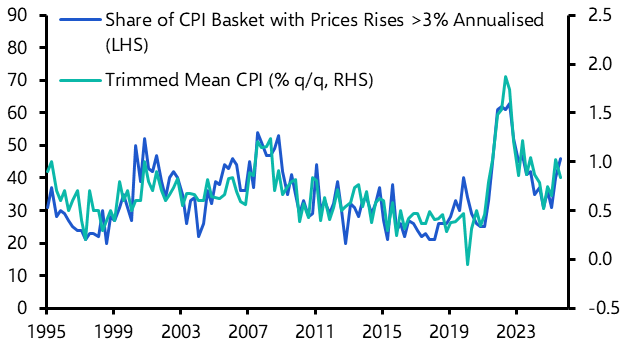

Australia is exceptional. Monetary easing cycles may be in full swing in many advanced economies, but the Reserve Bank shows no appetite to cut rates yet. Even though headline and core inflation are cooling, the labour market remains too tight for comfort and we think that will keep the Bank from lowering rates until the start of 2025.

Market pricing shows investors are coming round to our view, though all eyes will be on the release of the Q3 CPI report on Wednesday, 30th October for signals about the path ahead for monetary policy.

Economists from our ANZ team held an online briefing shortly after that CPI release to discuss the Australian inflation and rate outlook and market implications – and why the RBNZ could soon step up its easing pace even as the RBA continues to hold fire.

This content requires an active Capital Economics subscription to view. Please log into your account or contact support@capitaleconomics.com if you are interested in a complimentary access period.