The past week was bookended by developments in two areas that will play a significant role in shaping the year ahead: tariffs and technology.

Tariff man strikes

On Saturday, President Trump announced sweeping tariffs on Canada and Mexico, as well as on China. The stated reason for doing so was the failure of all three nations to stop the flow of fentanyl into the US, though that appears to have been a pretext for Trump to invoke emergency powers required to impose tariffs. You can read our instant reaction here and register for an online briefing today here. We had factored a significant increase in tariffs early in the second Trump administration into our forecasts, although in the case of Canada and Mexico we had assumed they would be left at a lower rate. The higher tariffs are likely to push both countries into recession while at the same time pushing US inflation back above 3% y/y. As our Chief US Economist Paul Ashworth notes, the window for further interest rate cuts by the Fed may have just closed.

The key questions now are whether further tariffs are coming down the track and if so, how governments around the world will respond. We have assumed the US will impose a universal tariff of 10% in the first half of this year and that retaliation by other countries will be calibrated so as not to escalate the situation. If this is the case then the economic damage outside of North America should be limited, but we acknowledge that there is huge uncertainty and bigger risks in both directions. For those wanting to brush up on the economics of tariffs it is worth rereading this piece that we published late last year.

DeepSeek’s doesn’t spell deep trouble

The tariff news has helped push DeepSeek’s emergence off the front pages – for now. Most readers will now be familiar with the story of this new, apparent threat to US AI leaders. On January 20th, while the world was watching Trump’s inauguration, DeepSeek, the AI offshoot of a Hangzhou-based hedge fund, launched a new large language model (LLM). Testing showed that its ‘R1’ model competes with more powerful, established models, such as those produced by OpenAI, while DeepSeek claims it was trained at substantially lower costs and using less advanced GPU chips than those more established models. News of a low-cost, high-performance competitor from China filtered through markets in the days after its launch, spurring questions about the strategy of leading tech firms to spend hundreds of billions of dollars developing AI and the technology that underpins it. The sudden loss of investor confidence in this strategy culminated in the tech-heavy NASDAQ Composite index experiencing its sharpest single day fall since the onset of the pandemic last Monday.

As it happens, it is far from clear that the development of new and cheaper LLMs is necessarily bad news for all technology firms (see here). However, it is striking that, in the days following DeepSeek’s tanking of the market, most attention has focused on the implications for the companies at the forefront of the AI revolution. Relatively little has been paid to its broader economic consequences.

This is how technology progresses

Crucially, one point that has been generally overlooked is that this is exactly how transformational tech technologies are supposed to work. Most start with a breakthrough technology, which others then innovate around. This helps to bring costs down, which is crucial to encouraging the adoption of new technologies and therefore embedding them within economies. Competition also helps to ensure that the value created is spread between both consumers and shareholders, rather than concentrated in the hands of a few early investors.

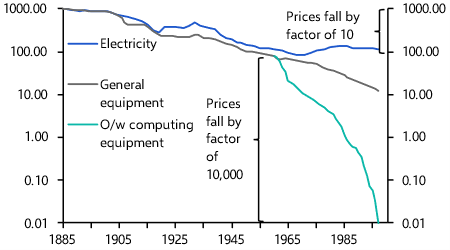

This is exactly the path followed by previous transformational technologies: competition and innovation led to a sharp fall in costs, which then encouraged adoption and helped embed technologies within economies. (See Chart 1.) These new technologies created large and durable profits for some of the firms responsible for the initial technological breakthrough. But they also led to disruption and the creation of new challenger firms that helped to innovate and embed the technology in everyday processes. This is ultimately what raises productivity.

|

Chart 1: Price Indices (log scale) |

|

|

|

Source: Jovanovic & Rousseau (2005) |

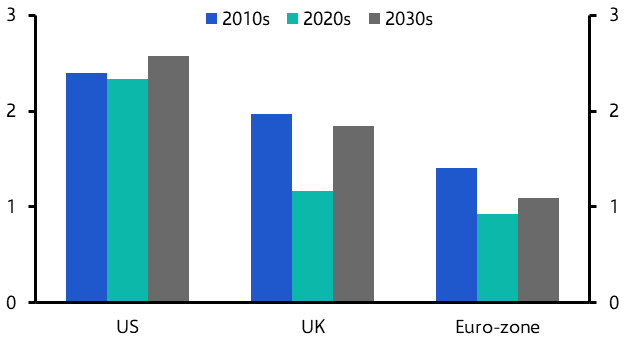

We have made the case that AI has many of the hallmarks of a so-called “General Purpose Technology”. These have a wider range of potential applications and historically have transformed economic growth (think steam power, electricity and the internet). On this basis, we have incorporated a pick-up in productivity growth in advanced economies within our long-run GDP forecasts as the benefits of AI start to bear fruit. (See Chart 2.) But in order for this to materialise there must be competition and innovation around AI and the benefits must be diffused across economies – they cannot remain concentrated in the hands of the small number of firms at the vanguard of the AI revolution. In this sense, developments over the past week are good news from a macro perspective.

|

Chart 2: Real GDP Growth (% y/y) |

|

|

|

Sources: LSEG Data & Analytics, Capital Economics |

Tech controls > tariffs?

Another potentially significant point, which brings us back to the news on tariffs, is that the DeepSeek model appears to have been built and trained using technology, including advanced semiconductors, that is now subject to export controls by the US. Exactly what is under R1’s hood is naturally unclear given the secrecy surrounding the development of these models. But it is emblematic of how, though China has made huge advances in some areas of technology, and is now the world leader in green tech, the US and its traditional allies still hold the advantage in key foundational technologies, particularly semiconductors. The image of China as the “workshop to the world” is an outdated one. But it remains dependent on technology developed by either the US or the US’s traditional allies. It is unclear what the approach of the new Trump administration towards technology controls will be, but if they can be tightened and enforced they could be a more effective way of pushing back against China than tariffs.

In case you missed it:

- The latest reading of our China Activity Proxy showed that growth accelerated towards the end of last year, but remains well below the rates suggested by the official GDP data.

- Shilan Shah argued that India’s budget will provide only a limited boost to growth.

- Jack Allen-Reynolds set out why the ECB is likely to cut interest rates by more than the markets expect.