Developments over the past week or so have put a dent in the until-recently widespread belief that inflation was firmly in retreat and that central banks had a clear path to cutting rates. Bond yields have crept further up from December lows as more policymakers line up to push back on any speculation of a near-term start to easing. But while it’s understandable that central bankers should be playing it cautious, some perspective is required.

Springtime in the real economy?

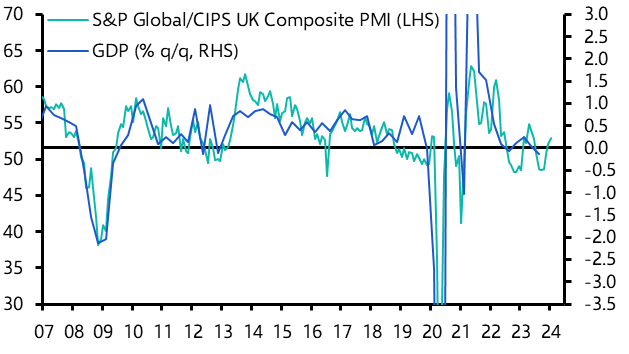

The good news is that the economic activity data have generally been a bit stronger than had been anticipated. Admittedly, German industry remains in deep trouble and the business surveys in the euro-zone remain consistent with GDP continuing to stagnate in the first quarter. But conditions have brightened a little in the UK. The housing market seems to have turned the corner, new figures from the Office for National Statistics suggest that the labour market is a bit stronger than previously thought – although concerns over the data persist – and the composite manufacturing and services PMI increased again in January. The relationship between the PMI and GDP growth has weakened over the past year or so, but at face value the survey now suggests the economy is growing, if very slowly, and that the situation is trending in the right direction. (See Chart 1.)

|

Chart 1: UK Composite PMI and Real GDP |

|

|

| Sources: Refinitiv, S&P Global, Capital Economics |

The real signs of strength, however, continue to come from the other side of the Atlantic. Attention has naturally focused on January’s blockbuster US payrolls report. But US business surveys have also improved, with both the ISM and PMI surveys picking up in January. And US trade data released over the past week showed a strong rebound in exports in December, but also a solid increase in imports, reflecting the continuing strength of domestic demand. The Atlanta Fed’s GDPNow series is currently tracking an annualised growth rate of 3.4% for the first quarter.

Inflation concerns and CRE problems back to fore

But stronger activity data has also fuelled concerns about underlying inflation pressures in advanced economies. All other things being equal, stronger labour markets mean stronger wage pressures. And evidence in the business surveys that firms are facing higher input costs may be the first sign that disruption to global shipping is starting to feed through.

Against this backdrop, there appears to be a concerted effort among central bankers to push back on talk of near-term policy easing. Isabel Schnabel, arguably the most influential member of the European Central Bank’s Governing Council, used an interview with the Financial Times to warn that cutting interest rates could “cause inflation to flare up again” while Minneapolis Fed President Neel Kashkari warned in a recent speech that, while a lot of progress has been made to bring inflation back down, “we’re not all the way there yet”. The market has now priced out any chance of a Fed cut in March and puts the probability of a move in April by the ECB at about 40% (having been fully priced in at the end of last year).

Away from the real economy, concerns about financial stability are once again simmering. A shock results warning from New York Community Bancorp has revived concerns about US regional banks and their significant exposure to commercial real estate (CRE), and to the office sector in particular. The S&P 1500 Index of US regional banks has fallen by more than 8% over the past two weeks, while lenders in Germany and Japan have reported difficulties stemming from their real estate exposure. After fading over the second half of last year, worries about the lagged effects of higher interest rates on weak parts of the financial system are coming back to the fore.

Keeping perspective

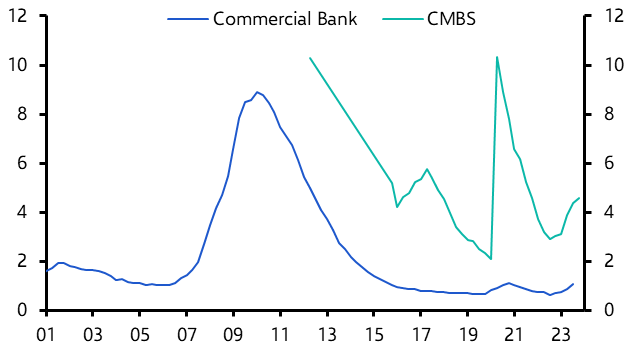

Despite these apparent challenges, the reality isn’t quite as alarming as suggested by the headlines. In the real estate sector, distress in office markets is likely to deepen. The increase in delinquencies on CRE bank loans has so far been modest but the increase in delinquencies on commercial mortgage-backed securities, which tend to adjust faster, has been greater. (See Chart 2.) However, while this process has further to run, it shouldn’t pose a systemic risk to the US banking system. We estimate that US banks face losses on CRE loans of around $60bn, a number that is dwarfed by the more than $2trn of equity capital currently in the US banking system. Loan-loss provisioning by banks has increased over the past year and the latest Senior Loan Officer’s Survey, released last week, suggests that the worst of the lending squeeze in the US is over. Some lenders will run into trouble but a wider banking crisis is unlikely.

|

Chart 2: US Commercial Real Estate Loan Delinquency Rates (%) |

|

|

|

Sources: FED, Capital Economics |

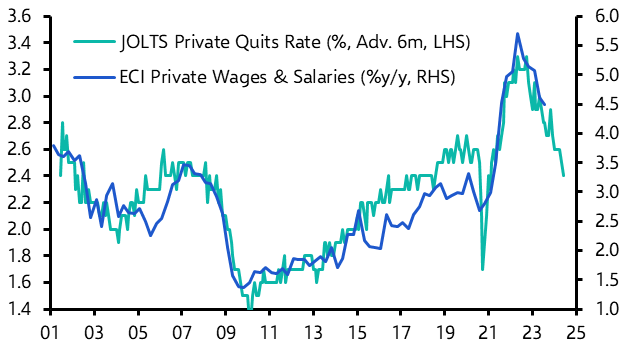

A little perspective is also required in assessing the inflation threat. While unemployment remains low, other measures of labour market slack, such as the voluntary quits rate, continue to point towards slowing wage growth. (See Chart 3.) As things stand, leading indicators are pointing to wage growth slowing towards 3.0-3.5% y/y in the US, which may actually be consistent with below 2% inflation given the recent revival in productivity.

|

Chart 3: US Job Quits and ECI Wage Growth |

|

|

| Sources: Refinitiv, Capital Economics |

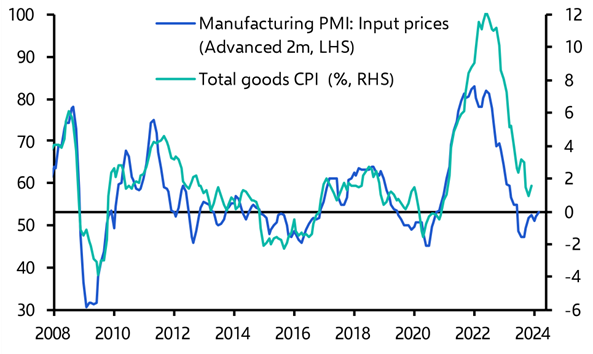

And although the prices paid balances in the PMI surveys have edged up, they remain consistent with very low rates of goods inflation. (See Chart 4.)

|

Chart 4: DM Manufacturing Input Prices & Goods Inflation |

|

|

|

Sources: Refinitiv, Capital Economics |

As ever, the challenge is to separate the signal from the noise. Our view remains that the US economy is on course for a soft landing, with inflation falling further over the coming months and growth starting to cool. The growth outlook for the euro-zone and UK is weaker, but we do expect inflation to fall further in those economies over the first half of this year.

Hopes for rate cuts this spring have been dealt a blow, but the Fed, ECB and Bank of England are all likely to start easing policy by the middle of this year. And as rates come down, that should make it easier to manage the financial fallout from problems in pockets of the CRE market.

Recent headlines may suggest a more challenging environment for monetary policy deliberations, but central bankers – and investors – need to maintain a sense of perspective.

In case you missed it:

Staying on the theme of keeping perspective, UK CPI and GDP data due for release this week could prompt headlines about the challenges of getting inflation back to target and about economic recession. Chief UK Economist Paul Dales explains why it will be best to ignore them.

Senior Asia Economist Gareth Leather explains why the outlook for Pakistan’s economy was poor, even before an election outcome that has thrown the country’s politics into greater turmoil.

Jonathan Petersen, who covers FX on our Markets team, shows how our “dollar smile” framework helps with understanding how the macro environment will shape the greenback’s performance this year.