A strong September headline payrolls number whipsawed global bond markets on Friday but the net result was that yields ended the week at post-GFC highs. According to the financial commentariat, this is all part of the pain of adjusting to a “higher for longer” path of interest rates. But the sheer scale of the bond market sell-off is about to face a reckoning with the real economy.

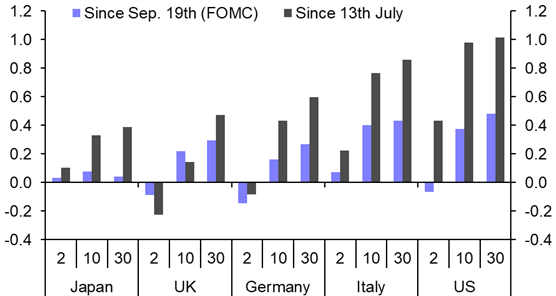

All the action over the past few weeks has come at the long end of yield curves and has been driven increasingly by a rise in “term premia” – the compensation that investors require for holding a long-term bond rather than a series of short-term bonds. (See Chart 1.) In truth, however, the term premium is a catch-all concept that covers everything about the price of a bond that can’t be explained just by interest rate expectations. This makes it something of a black box.

|

Chart 1: Changes In Government Bond Yields (pp) |

|

|

|

Sources: Refinitiv, Capital Economics |

One oft-cited reason for the rise in term premia has been a deterioration in the supply-demand balance of bonds stemming from structurally looser fiscal policy. Another explanation, which has received less coverage, may be greater uncertainty about the outlook for inflation and therefore monetary policy. As explanations go, this at least has the benefit of lining up with the trigger for the latest bloodbath in bonds, which was the “higher for longer” message pushed by Fed officials last month.

Either way, there’s more than an element of the unknown about what has driven the increase in term premia. If that sounds unsatisfactory, bond bulls can take some comfort from the fact that, as our latest Global Economic Outlook makes clear, the surge in yields is unlikely to withstand contact with economic reality. In this sense, the sell-off in bonds might prove to be self-correcting.

Bond sell-off will test economic resilience

Admittedly, the world’s major advanced economies have been more resilient in the face of monetary tightening than we had anticipated at the start of this year. This is for a variety of reasons, including changes to the maturity structure of debt, which has lengthened the pass through of tighter monetary policy to the real economy, and the lingering effects of large-scale fiscal expansion during the pandemic, which boosted household incomes and has helped cushion the one-two punch of higher inflation and interest rates.

But we doubt this resilience will last. Monetary lags are famously long and variable, and we estimate that around half of the impact of central bank tightening in this cycle has yet to be felt in the real economy. The remainder will feed through over the coming quarters. Net lending by banks to the private sector has already ground to a halt in the US, euro-zone and UK. (See Chart 2.) The next shoe to drop will be a rise in debt servicing costs on existing debt as fixed rate loans taken out in recent years expire and borrowers are forced to refinance at higher rates. (This is admittedly less of a concern in the US than it is in Europe due to the much longer tenor of household mortgages.)

|

Chart 2: Net Bank Lending to the Private Sector (3MMA) |

|

|

|

Sources: Refinitiv, Capital Economics |

At the same time, savings that were accumulated during the pandemic will provide much less of a prop to consumer spending. Measures of excess savings have already fallen and what remains now sits mainly with high income households, who have a lower propensity to consume.

Crucially, the further that bond yields rise, the more that financial conditions tighten and the greater the feedback loop into the real economy. . Our proprietary Financial Conditions Indices (available here) show that, having eased over the summer, conditions have tightened in recent weeks. (See Chart 3.) The tightening so far is relatively modest but the effect on rate-sensitive parts of the economy will already be significant. US mortgage rates hit a 23-year high last week, which will put a further dent in housing activity.

|

Chart 3: CE Narrow Financial Conditions Indices (Z-Scores) |

|

|

|

Sources: Capital Economics |

As a result, we still expect the advanced economies to weaken over the coming quarters. We don’t anticipate a collapse in output – deep recessions are typically caused by major balance sheet problems, and household and corporate balance sheets remain relatively strong. But we do expect mild recessions across much of Europe and suspect that US GDP will contract too.

Ignoring better news on inflation

This should, in due course, put a floor under the world’s bond markets. But even if we’re wrong about recessions, there is better news coming on inflation. Indeed, the bond sell-off has been all the more striking because it has taken place against the backdrop of mounting evidence that underlying inflation pressures are already easing.

This is most obviously the case in the US, where a decline in core inflation has been clear for several months. But core inflation also surprised on the downside in the euro-zone in both August and September.

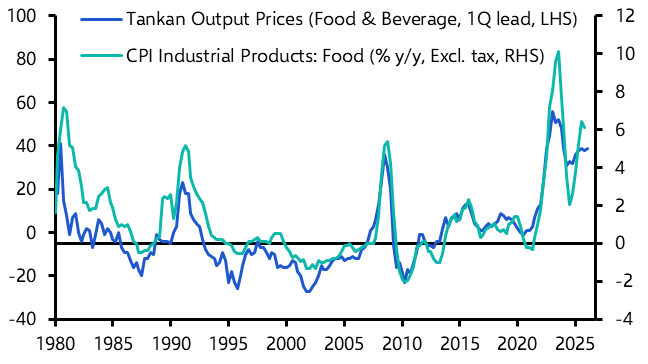

Granted, the durability of the recent fall in inflation will be challenged by the rise in oil prices over the past few months and the continued strength of labour markets across the US and Europe. But as things stand the increase in the contribution to inflation in advanced economies from oil and energy is likely to be more than offset by a decline in the contribution from food. What’s more, core inflation should continue to ease as labour market conditions cool. We expect the US unemployment rate to rise to almost 5%, which is well above the Fed’s median projection of just over 4%. All told, we forecast that US inflation will average 2.2% next year, while euro-zone inflation will average 2.5%.

If we’re right then the real stance of monetary policy is about to tighten significantly: a Fed Funds rate of 5.25-5.50% against an inflation rate of 2.0-2.5% would imply a real interest rate of 3% or more.

A new era of higher rates – but not this high

We will argue in a major report to be published next week that the neutral real interest rate (or R*) has risen since the pandemic. This is for a variety of reasons, the most important of which is that the extraordinary factors that suppressed R* in the wake of the global financial crisis have faded. What’s more, we expect neutral rates to rise further over the coming years as the balance of desired savings/investment pushes up on R* and the economic revolution brought on by artificial intelligence reinvigorates productivity growth. But without giving away the punchline, while we believe R* has risen, we don't believe it has jumped all the way to 3%.

The upshot is that we suspect that lower inflation and weaker growth will test the resolve of central banks to keep interest rates higher for longer over the next 12-24 months. We think that central banks will be cutting interest rates by the middle of next year in response to the weaker economic outlook, and that interest rates will fall by more than markets anticipate over 2024 and 2025. (See Chart 5.)

|

Chart 4: DM Policy Interest Rates (%) |

|

|

|

Sources: Refinitiv, Capital Economics |

If we are right, then the sell-off in government bonds has gone too far – and the next big move in yields will be down.

We’ve set up a dedicated page to track all our key research on the bond sell-off, including the latest analysis on country-level macro implications of higher yields and a special podcast episode on whether the sell-off will continue.

In case you missed it:

Markets Economist James Reilly explored how the rise in risk-free rates has weighed on the S&P 500, but also explained why investors shouldn’t expect a fall back in yields to translate into gains for equities.

One source of anxiety in the dollar bond market is widely quoted data suggesting that China has become a net seller of long-dated Treasuries. But Chief Asia Economist Mark Williams showed why this data is misleading and explained why Beijing remains shackled to the dollar.

The potential end of Japan’s loose policy stance – including what could be the first rate hike in nearly 17 years – is also weighing on the bond market. You can read all about what’s likely from the Bank of Japan, and its implications for domestic and global markets, on this dedicated page.