Q3 2024 Global Economic Outlook

Recovery signs clouded by political uncertainty

While the global economy is still struggling, a recovery seems set to take hold as the adverse effects of the previous surge in inflation subside.

These are the key takeaways from our Q3 Global Economic Outlook, originally published on 27th June, 2024. Some forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated Global Economics coverage.

While the global economy is still struggling, a recovery seems set to take hold as the adverse effects of the previous surge in inflation subside. Admittedly, this is all happening against a backdrop of political uncertainty. But while there are risks of a worse outcome, we expect that inflation will generally continue to ease and that fiscal policy will be tightened gradually. This should allow central banks to loosen policy a bit more than markets anticipate and see world GDP growth return to its potential pace of just over 3%.

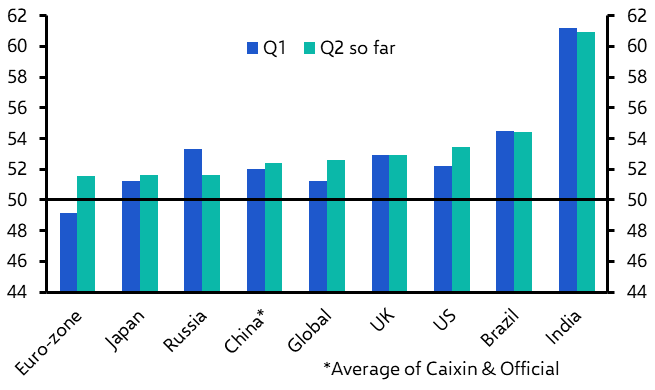

- GDP growth picked up in Europe and several EMs at the start of this year, and various surveys including the PMIs suggest that the improvement continued in Q2. (See Chart 1.)

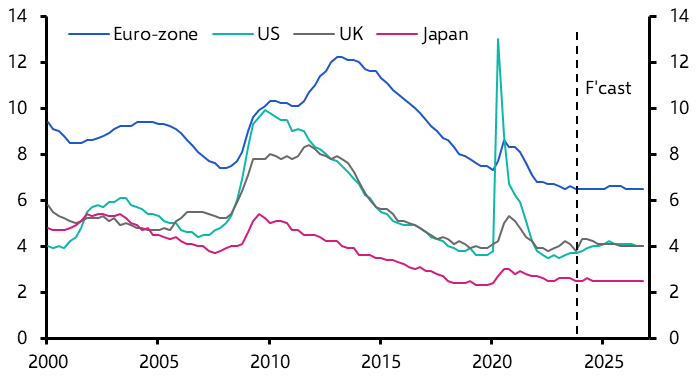

- Most economies are benefitting from recent falls in inflation which have boosted real incomes significantly. Meanwhile, labour markets are still resilient and we expect unemployment rates to remain low. (See Chart 2.) Fiscal policy is still fairly supportive in most cases and few governments intend to tighten it significantly. Indeed, government infrastructure spending has been the key factor behind China’s recovery and will continue to act as a tailwind in the near term.

|

Chart 1: Composite Output PMIs |

Chart 2: Unemployment Rates (%) |

|

|

|

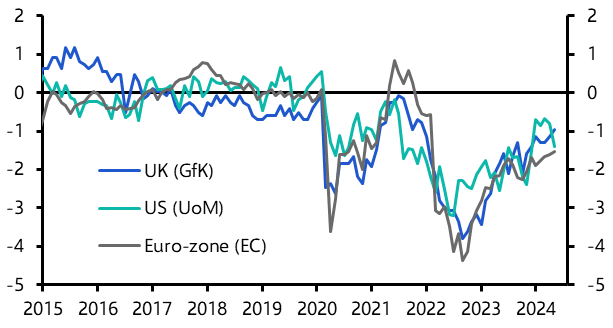

- There are a few warning signs that the pain from higher interest rates is coming with a lag. For example, having tightened lending standards over the past couple of years, banks are keeping credit conditions tight, and delinquency rates in the US have been rising. Consumer confidence is still fairly weak across the board. (See Chart 3.)

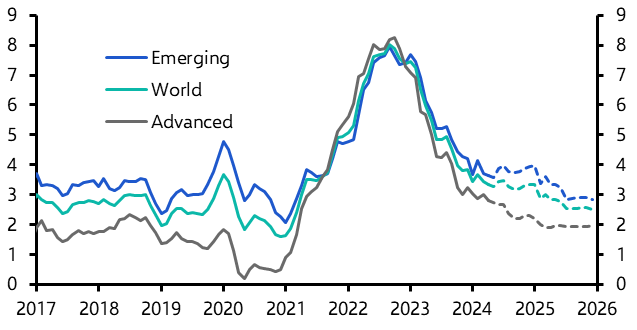

- However, we expect further falls in inflation (see Chart 4) to allow the global monetary policy easing cycle to continue and to broaden. (We’re not too concerned by the recent rise in shipping costs.)

|

Chart 3: Consumer Confidence |

Chart 4: Headline CPI Inflation (%) |

|

|

|

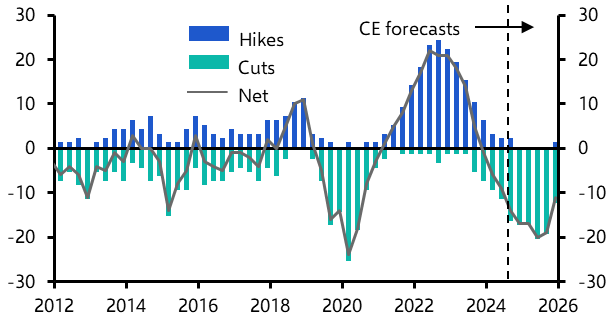

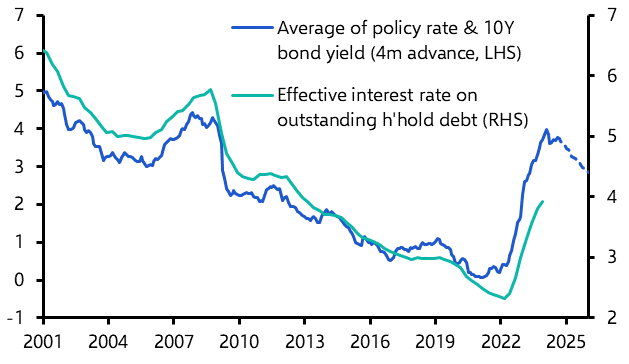

- By the middle of next year, 20 of the world’s 30 major central banks will be cutting interest rates, with the US Federal Reserve joining the party this September. (See Chart 5.) This suggests that while effective interest rates have further to climb, firms and households will gradually face lower interest rates next year. (See Chart 6.)

|

Chart 5: Number of Central Banks Cutting Interest Rates |

Chart 6: DM Average Interest Rates (%) |

|

|

|

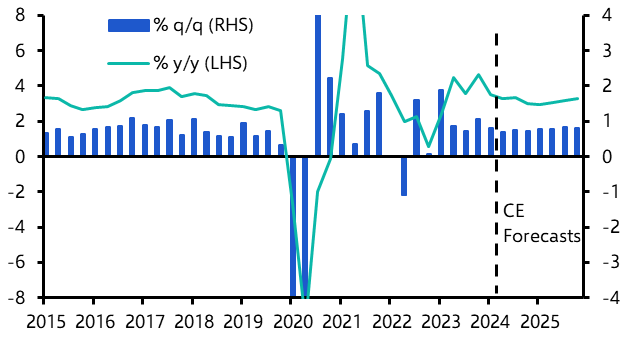

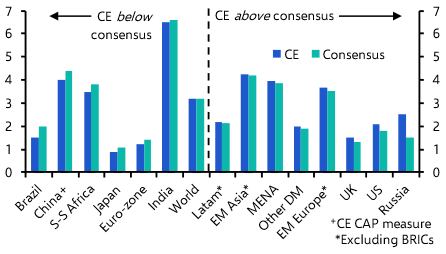

- So after a soft spot around mid-year, we expect growth in most economies to accelerate towards the end of 2024 and into 2025. (See Chart 7.) GDP growth in the US, UK and Emerging Europe will outpace consensus expectations, but the euro-zone and parts of Latin America will underperform. (See Chart 8.) So too will China once policy support fades and structural forces weigh on growth again from next year. Indeed, its slowdown will be a key factor preventing average global growth from meaningfully exceeding the 3% mark.

- The risks to this view are skewed to the downside. It’s always possible that commodity prices throw a spanner in the works. But in fact, we think that the risks in this regard have receded a little recently and still see oil prices falling slightly as OPEC+ raises its supply.

- Instead, the major threat now stems from domestic politics. Concerns over India’s election were perhaps overdone – while Modi emerged with a weakened mandate, he will govern with a stable coalition which is unlikely to upend the reform agenda. And we doubt that the imminent election in the UK will alter its recovery prospects. However, the US election later this year could trigger inflationary, growth-sapping tariffs. Meanwhile, the presidential election in Mexico and the upcoming snap parliamentary election in France have added to fiscal risks for both economies.

|

Chart 7: World GDP |

Chart 8: CE vs. Consensus 2025 GDP Forecasts (% y/y) |

|

|

|

|

Sources: Refinitiv, S&P Global, Focus, Capital Economics |

These are takeaways from a 34-page report written for Capital Economics clients by Jennifer McKeown and the senior economist team, originally published on 27th June, 2024. The full report provides extensive near- to long-term economic forecasts as well as country, regional and markets analysis, including:

US – GDP growth will remain lacklustre this year but, as the shift in monetary policy begins to boost spending, growth should reaccelerate from 2025. Slower wage growth and strong productivity growth will bear down on core inflation, prompting the Fed to cut rates in September. But the upcoming election adds to uncertainty.

Euro-zone – After a long period of stagnation, a modest economic recovery is now underway. Inflation will continue to gradually fall, allowing the ECB to cut interest rates to 2.5% next year.

Japan – Rising real household incomes should contribute to a rebound in GDP growth over the next couple of years. But as inflation continues to slow, the BoJ will only have scope for one further 20bp rate hike this year.

UK – Economic growth will be stronger, inflation lower and interest rates cut further than most are expecting. This will probably be the case regardless of who wins the general election on July 4th.

Canada – Further falls in core inflation will allow the BoC to cut rates faster than markets anticipate.

Australia & New Zealand – While the RBNZ will cut rates in Q4, the RBA won’t follow suit until mid-2025.

China – A step-up in policy support and strong export growth linked to overcapacity in industry will continue to boost economic activity in the near term. But policies aimed at supporting the property sector are falling flat, and growth will weaken further ahead as the prop from exports fades and the construction downturn takes hold.

India – Growth will be strong enough to allow India to become the world’s third largest economy by 2027.

Other Emerging Asia – Slower growth and inflation mean central banks will join the EM easing cycle this year.

Emerging Europe – Recoveries in activity will keep inflation elevated and policy restrictive across the region.

Latin America – Growth in Brazil and Mexico will disappoint, while high inflation will keep policy restrictive.

Middle East & North Africa – Higher oil output should lead to stronger growth in Gulf economies in 2025-26.

Sub-Saharan Africa – While the external environment should improve, tight policy will constrain recoveries.

Commodities – Commodity prices will generally fall next year as OPEC+ unwinds its oil supply cuts and a downturn in China’s construction sector weighs on demand for industrial metals.

Get the full report

Trial our services to see this complete 34-page analysis, our complete Global Economics insight and forecasts and much more