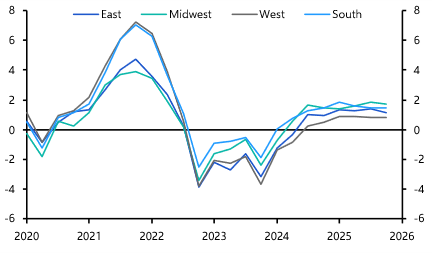

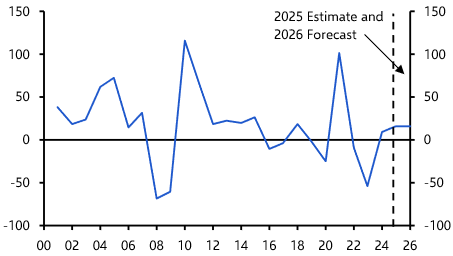

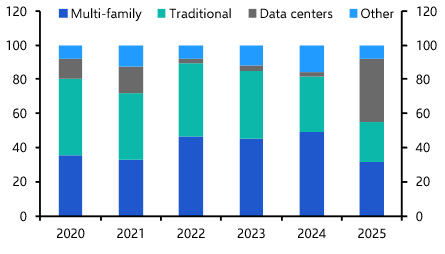

The bad news around US commercial real estate continues to roll in, but appraisal-based indices have so far only fallen by 10%. How much further do they have to fall, which sectors and regions are most vulnerable, and where is outperformance most likely?

Kiran Raichura, the head of our US Commercial Property coverage, held this online briefing about the outlook for CRE values in the coming years. Kiran answered client questions as he provided updates on our refreshed five-year forecasts for the main sectors and addressed key issues, including:

- Return-to-office mandates and their impact on the office outlook;

- How much further values will decline and the relative winners;

- Where the upside – and downside – risks to our forecasts lie.

This content requires an active Capital Economics subscription to view. Please log into your account or contact support@capitaleconomics.com if you are interested in a complimentary access period.