It’s a sign of our inflationary times that even the Bank of Japan could soon consider raising interest rates in what would be the first such move in 16 years. But how supportive are conditions for a rate hike, how far could the Bank go to lift rates, and where would that leave Yield Curve Control?

This month’s Asia Drop-In was all about signs of a looming shift in the Bank of Japan’s monetary policy strategy and its implications for domestic and global markets.

During this 20-minute online briefing, Chief Asia Economist Mark Williams, Marcel Thieliant, our Japan research lead, and Senior Markets Economist Thomas Mathews, answered client questions as they addressed key issues around the BOJ’s next steps, including:

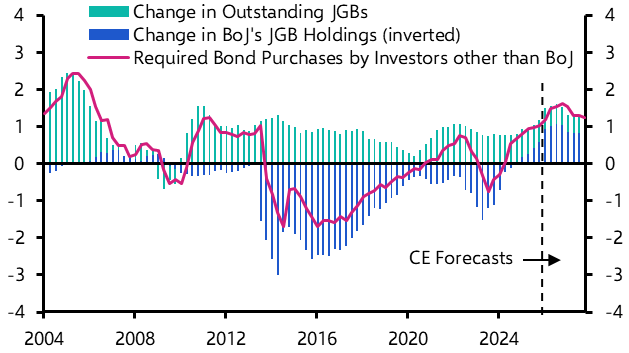

- Whether negative Japanese interest rates will soon be a thing of the past, and whether Yield Curve Control will be scrapped;

- Potential implications for bond yields and the yen;

- What this could mean for Japan’s public finances and financial institutions and global financial markets elsewhere.

This content requires an active Capital Economics subscription to view. Please log into your account or contact support@capitaleconomics.com if you are interested in a complimentary access period.