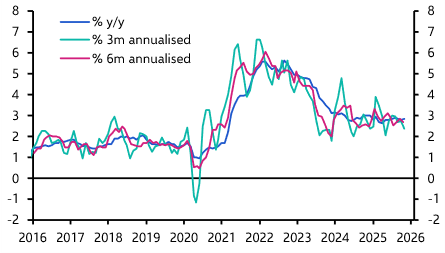

Tariffs should have a one-off impact on the price level rather than triggering a more persistent bout of elevated inflation. With core inflation already running above target for several years, however, we suspect that Fed officials will be reluctant to dismiss the threat of second-round effects, particularly if labour market conditions loosen only slightly.

The latest edition of this quarterly report assesses the profound implications for the US economy of Donald Trump's tariffs roll-out. It addresses key economic and policy issues, including:

- The extent to which tariffs will push up inflation and weigh on economic growth;

- Why a widespread immigration crackdown will limit a rise in the unemployment rate, even as jobs growth cools below 100,000 per month;

- Why we expect the Federal Reserve to remain on the sidelines until next year.

Download a complimentary copy of this report now to understand how the US economy will fare in this pivotal moment.

Get the US Economic Outlook

Download a free copy of the report

Report authors

-

Paul Ashworth

Chief North America Economist

Paul Ashworth is our Chief North America Economist, with overall responsibility for our coverage of the US and Canada.

-

Stephen Brown

Deputy Chief North America Economist

Stephen Brown is our Deputy Chief North America Economist has been with Capital Economics since 2014. He has worked from both our London and Toronto offices, covering the economies of Europe, Canada and the US. In 2021, Stephen was named the most accurate forecaster of the Canadian economy by Refinitiv, FocusEconomics and Consensus Economics. He holds a degree in Economics from the University of Bath and an MSc in Economic History from the London School of Economics.

Award-winning research

The accuracy of our analysis and forecasting is reflected in the many awards we win each year from across the industry

US economics coverage

Our US Economics coverage provides detailed analysis and independent forecasts for the US economy and financial markets, offering both rapid responses to new data and developments, and more in-depth coverage of key themes, current trends, and future developments.

Global media relies on Capital Economics