Trade war to dampen, not derail, global growth

Global Economic Outlook

Q2 2025

Trump’s policies will drag on US growth, policy support will not prevent a slowdown in China’s economy, and looser fiscal policy will provide just a modest boost to growth in Europe.

These are the key takeaways from our Q2 2025 Global Economic Outlook, originally published on 27th March, 2025. Some forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts, near to long-term analysis and interactive data resources, is available as part of our subscription services.

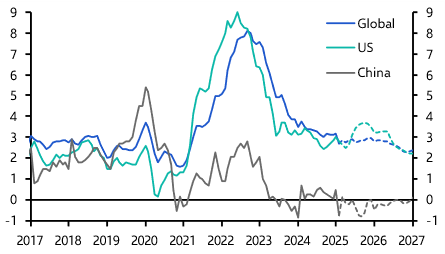

We expect the world economy to grow a touch slower in the next couple of years than it did in 2024. The trade war should not significantly dent global trade, but this view is predicated on countries refraining from escalatory rounds of retaliation to US tariff hikes. Global average inflation should flatline this year, so the scale of rate cuts will be smaller this year than last.

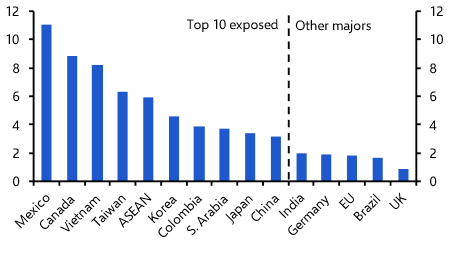

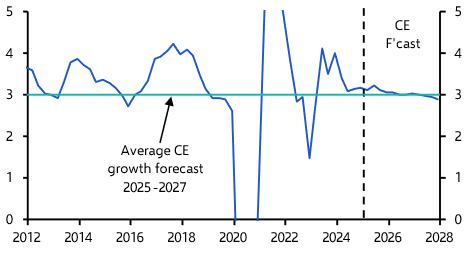

- Our forecasts are based on the US tariff rate rising in Q2 by 10%-pts on average and rising to 60% on imports from China. Until February, these were hawkish assumptions. But the risks seem skewed to even bigger tariff hikes, at least in the near term. After Mexico and Canada, medium-sized economies in Asia are most exposed to US tariffs. (See Chart 1.) While diversions of trade and moves in exchange rates should soften the blow, our base case is that tariff hikes will knock a couple of tenths of a percent off global GDP. This will contribute to global growth slowing to 3%. (See Chart 2.)

|

Chart 1: Share of Trade-Partner GDP Dependent on US Goods Demand (%, 2024 estimate) |

Chart 2: Global GDP (% y/y) |

|

|

|

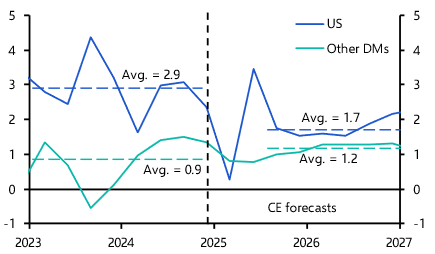

- Within advanced economies, we expect the scale of US growth outperformance to shrink markedly. Looking through the volatility of the US GDP data in the first half of this year, we forecast the US economy to grow only half a percentage point faster than its DM peers, compared to the +2%-pts GDP growth gap of the past two years. (See Chart 3.) This owes more to the US economy slowing in response to Trump’s stagflationary policies than to a significant pick-up in growth elsewhere. True, fiscal policy will be looser in the EU and especially Germany in the coming years. But the scale of stimulus will probably turn out to be smaller than many hope for, and otherwise the outlook for European industry is poor.

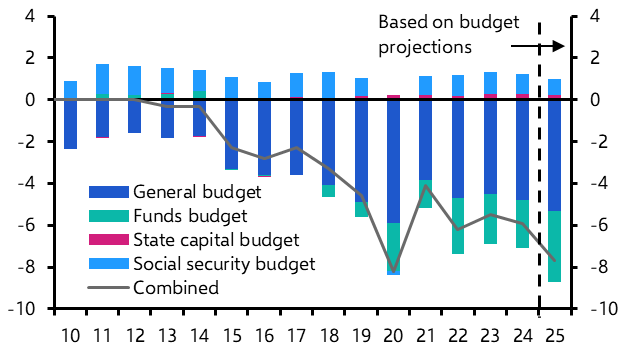

- In China, fiscal stimulus will limit the extent of the slowdown but won’t prevent it. The support package itself is not as historically big as some make out (see Chart 4), and it is overly focussed on investing in sectors with excess capacity instead of boosting consumption. Meanwhile, tariffs will exacerbate a slowdown in exports that is already in the pipeline, and property construction will weaken even if home sales are buoyed by local government purchases.

|

Chart 3: US & Other DM GDP (% q/q annualised) |

Chart 4: China Budget Balance (% of trend GDP) |

|

|

|

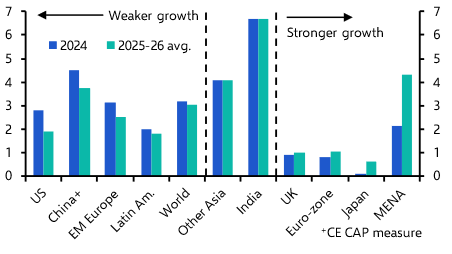

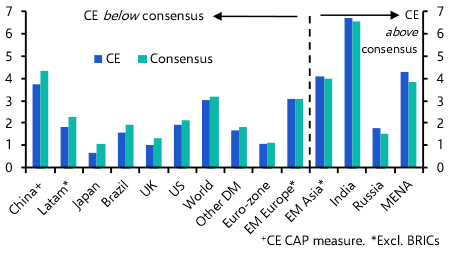

- In addition to slowdowns in the US and China over the next couple of years, we see weaker GDP growth in Latin America and Emerging Europe. The scale of these slowdowns should outweigh slightly faster growth in developed Europe and Japan, as well as an oil-production-boost to GDP in the Gulf states. (See Chart 5.) Apart from MENA, Russia, and India, our GDP forecasts generally lie below those of other forecasters. (See Chart 6.)

|

Chart 5: 2024 Vs. 2025-26 GDP (% y/y) |

Chart 6: CE Vs. Consensus 2025-26 Average GDP Forecasts (% y/y) |

|

|

|

- Meanwhile, the global trend of disinflation will be less broad this year. A 10%-pt hike in the average US tariff rate will boost inflation there by a little under 1%-pt, though this price level change should drop out of the year-on-year comparison in 2026. Further falls in headline inflation in the euro-zone and Japan are likely to be matched by slight increases in inflation in many EMs outside Asia. China will remain the global outlier, with excess capacity keeping inflation stuck just below zero. (See Chart 7.)

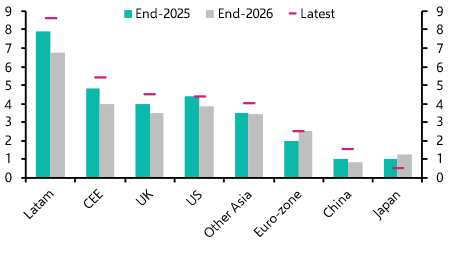

- Slower disinflation and upside risks from tariff escalation and higher defence spending will mean that central banks tread carefully. Most will continue cutting rates, but the depth of the rate cuts will be reduced compared to 2024. In fact, the Fed will refrain from cuts until price pressures subside in 2026. And sustained 2% core inflation will give the Bank of Japan the green light to continue hiking. (See Chart 8.)

|

Chart 7: Headline CPI Inflation (%) |

Chart 8: Policy Interest Rates (%) |

|

|

|

|

Sources: OECD, LSEG, CEIC, Focus, Trade War Dashboard, CE |

These are takeaways from a 34-page report written for Capital Economics clients by Jennifer McKeown and the senior economist team, originally published on 27th March, 2025. The full report provides extensive near- to long-term economic forecasts as well as country, regional and markets analysis, including:

US – We expect the Trump administration’s policies to have a mildly stagflationary impact, with GDP growth slowing to 1.5% annualised and inflation rebounding to around 3.5% later this year. This will keep the Fed on hold this year, but as inflation falls back in 2026 we see scope for the Fed to cut interest rates.

Euro-zone – Looser fiscal policy will boost both GDP growth and inflation somewhat in 2026 and 2027, meaning the ECB will revert to rate hikes next year.

Japan – With GDP growing around trend and strong wage growth keeping inflation above the 2% target, the Bank of Japan will be able to hike interest rates to 1.5% by 2027.

UK – Although a rebound in inflation this year may prompt the BoE to pause its easing cycle, we expect weak GDP growth to eventually bring inflation back to 2%, meaning rates will be cut by more than most expect.

Canada – We expect US tariffs to push Canada into recession this year, prompting a step up in policy support.

Australia & New Zealand – Both economies will gather momentum, but the RBA will cut by less than the RBNZ.

China – A step up in fiscal loosening should help to offset the various headwinds facing the economy from US tariffs, a struggling property sector and persistent supply and demand imbalances. But it won’t be enough to prevent GDP growth from slowing in the coming years.

India – Target-consistent inflation should allow the RBI to loosen policy further this year.

Other Asia – GDP growth will slow and inflation will stay low, but the impact of US tariffs is a key uncertainty.

Emerging Europe – GDP growth will pick up across most of the region, but slow sharply in Russia and Turkey.

Latin America – Tight policy and lower commodity prices will weigh on GDP growth in most economies, while Mexico is particularly vulnerable to US tariffs.

Middle East & North Africa – Higher energy production should lift GDP growth in the Gulf economies.

Sub-Saharan Africa – Growth should gather pace in the coming years, but debt concerns won’t go away.

Commodities – We expect most energy and industrial metals prices to fall by end-2026 as structural headwinds to demand build and supply rises. But tariffs and geopolitical uncertainty present risks to the near-term outlook.

Get the full report

Trial our services to see this complete analysis, our comprehensive Global Economics insight and forecasts and much more