Tariff uncertainty overshadows fundamental weakness

Commodities Outlook Q2 2025

The latest edition of this quarterly report from our award-winning commodities team gives investors the insight they need as the second Trump administration gets underway with a bang. These key takeaways from our client report show how near and long-term drivers of commodities markets and , including:

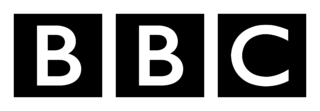

- Why we are so below-consensus on oil prices for 2026 and 2027;

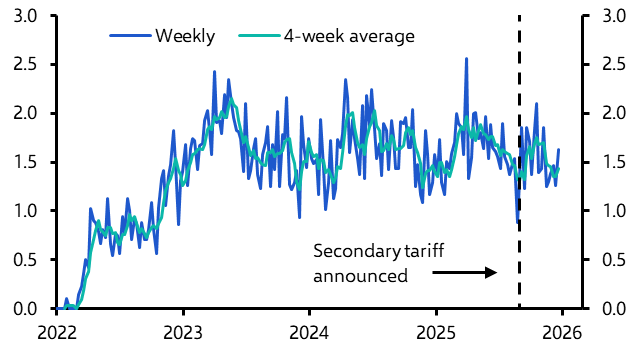

- Why we also think metals prices will fall by more than the consensus expects as near-term support gives way to unfavourable supply-demand dynamics over the longer-term;

- Why our gold forecast is a notable exception amid our generally downbeat views on commodities prices.

Download your complimentary copy of the report today.

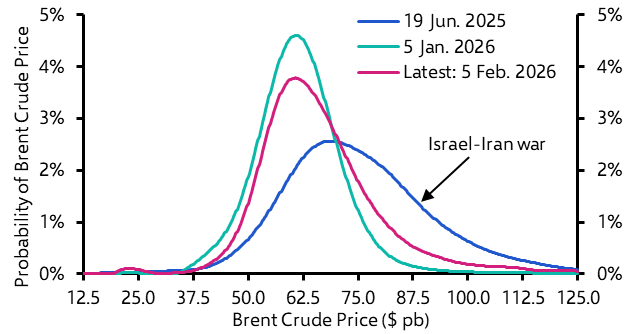

While tariffs and geopolitics complicate the near-term outlook for many commodities, the backdrop generally remains one of weak fundamentals.

Get the Commodities Outlook

Download a free copy of the report

Commodities coverage at Capital Economics

David Oxley joined Capital Economics in 2009 and is Chief Climate and Commodities Economist. David has extensive international experience as a macroeconomist in both the private and public sectors. He has lived and worked in both New Zealand and Switzerland. David has degrees in Economics from University College London and Queen Mary, University of London.

Our commodities coverage provides detailed analysis, independent forecasts, and market outlooks for a full range of global commodities. We offer rapid responses to new data and developments, along with in-depth coverage of key themes, current trends, and future market dynamics. In 2024, FocusEconomics named Capital Economics the most accurate forecaster of commodities prices, including WTI crude oil, liquified natural gas and US steel.

Award-winning research

The accuracy of our analysis and forecasting is reflected in the many awards we win each year from across the industry.

Global media relies on Capital Economics