Q1 2025 Global Economic Outlook

Weathering geopolitical storms and tariff threats

We expect 2025 to be another year of reasonably healthy global GDP growth and a continued normalisation of monetary policy. Tariffs will do some damage, but probably less than is typically assumed. And while geopolitics is likely to dominate headlines, the economic effects will be felt over years rather than within 2025 itself.

These are the key takeaways from our Q1 2025 Global Economic Outlook, originally published on 19th December, 2025. Some forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts, near to long-term analysis and interactive data resources, is available as part of our subscription services.

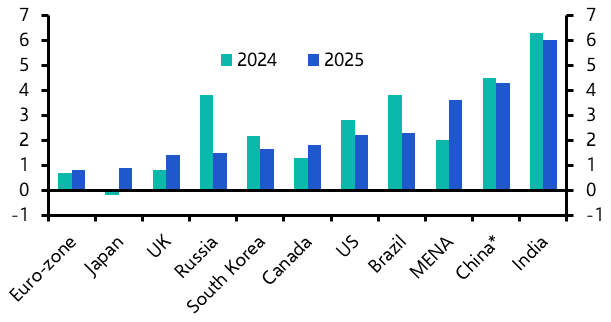

- We see economic developments over the next year being characterised by five key themes. First, the world’s major economies will experience relatively soft landings. (See Chart 1.) We expect US GDP growth to slow next year, partly due to Donald Trump’s proposed policies. But with private sector balance sheets still strong, the economy will continue to grow at a decent pace. The main downward revision to our US (and global) forecast is for 2026 when various headwinds have made us less optimistic about a recovery to come. We expect a pick-up in growth in China in the first half of next year as fiscal and monetary support takes effect. But the economy is likely to slow over the second half and in 2026 as structural forces bite.

- GDP in the euro-zone will expand very slowly as a boost from lower inflation and policy rates is set against ongoing problems in the industrial sector and gradual fiscal policy tightening. Economic activity will slow in many emerging markets, but not in MENA where increased oil production will provide a boost.

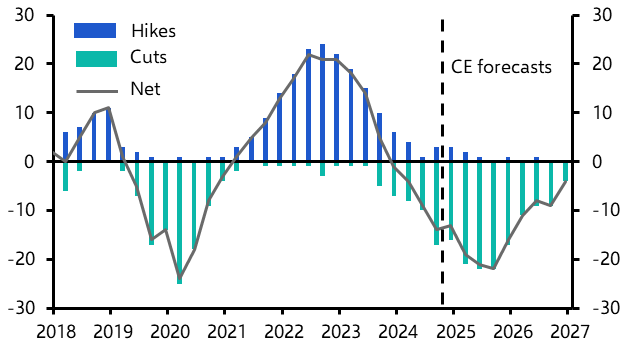

- Second, central banks will continue to cut interest rates. (See Chart 2.)

|

Chart 1: Real GDP (% y/y) |

Chart 2: Number of Rate Cuts/Hikes by Major Central Banks |

|

|

|

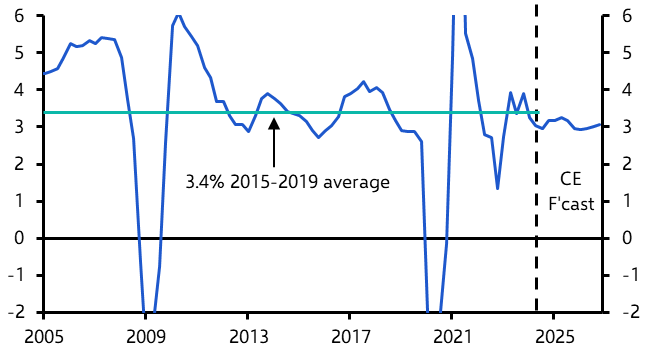

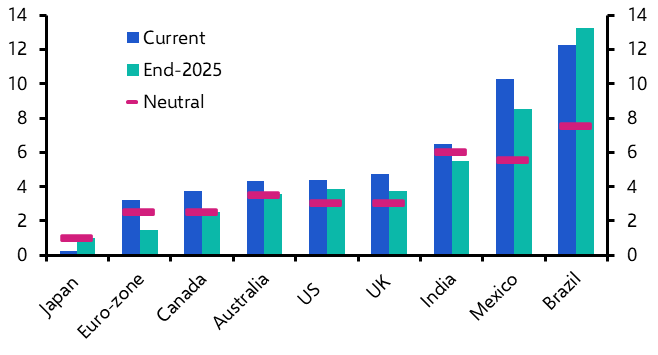

- With world GDP growing at close to its trend pace (see Chart 3), we don’t generally expect demand conditions to provoke renewed inflationary pressures. There are some nuances to this story. High wage growth and inflation in Brazil and Mexico will force central banks there to keep interest rates above our estimate of the neutral level.

- Meanwhile, Trump’s proposed immigration and tariff policies will boost US inflation temporarily, limiting the Fed’s ability to cut interest rates. (See Chart 4.)

|

Chart 3: World GDP (% y/y) |

Chart 4: Headline CPI (% y/y) |

|

|

|

- But in contrast, we think that slowing inflation and economic weakness will encourage the ECB to cut rates further than markets envisage and into accommodative territory. (See Chart 5.) The global policy loosening cycle will only start drawing to a close in 2026.

- Third, we think that world trade will be fairly resilient in the face of tariff threats. The outlook for trade is not bright and export orders are already weakening. (See Chart 6.)

|

Chart 5: Projected Policy Rates Vs. Neutral (%) |

Chart 6: Global Manufacturing PMI New Export Orders & World Goods Trade |

|

|

|

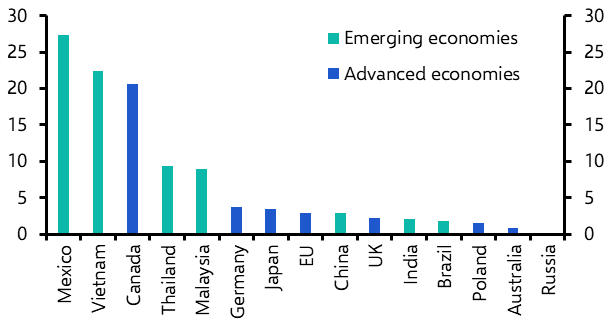

- But most economies are less exposed to trade with the US than tends to be assumed. (See Chart 7.) The size of tariffs should be curbed by negotiations and deals around other issues such as immigration, and their impact will be reduced by an appreciation of the dollar.

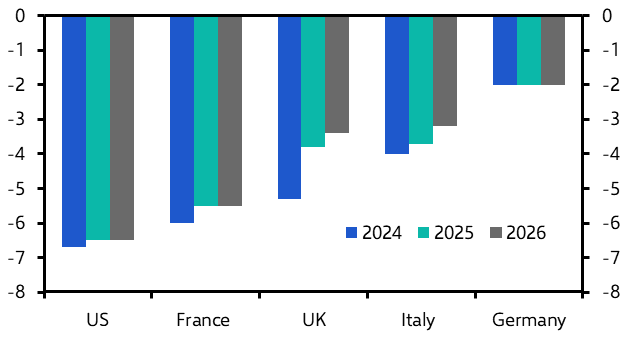

- Fourth, concerns about public finances will grow as governments fail to agree austerity programmes and borrowing stays high. (See Chart 8.) We do not expect this to cause a fiscal crisis in the next year or two. Instead, it’s more likely that fiscal vulnerabilities will constrain governments over the quarters ahead, preventing additional deficit-funded stimulus.

|

Chart 7: Goods Exports to the US as a % of Own GDP |

Chart 8: Government Borrowing (% of GDP) |

|

|

|

|

Sources: LSEG, S&P Global, Focus, Capital Economics |

- Finally, geopolitics will remain in focus. But we doubt that either a US-brokered ceasefire in Ukraine or conflict with Iran would cause the major shifts in commodity prices which would sway global demand. After all, Russia will remain largely shut out of European energy markets and there is scope for Saudi Arabia and the US to increase their oil output if Iranian supply was hit. The intense rivalry between the US and China will persist. But its most significant economic effects will play out slowly through a long-run theme of global fracturing.

These are takeaways from a 34-page report written for Capital Economics clients by Jennifer McKeown and the senior economist team, originally published on 19th December, 2025. The full report provides extensive near- to long-term economic forecasts as well as country, regional and markets analysis, including:

US – We expect the incoming Trump administration’s policies to have a mildly stagflationary impact on the economy. Assuming that Trump introduces tariffs and immigration curbs via executive action by the middle of next year, we would expect GDP growth to run close to 1.5% at an annualised pace over the following 12 months, with inflation temporarily rebounding to around 3%.

Euro-zone – We expect a combination of weak growth and below-target inflation to prompt the ECB to cut interest rates by more than most anticipate next year. The euro-zone has returned to growth but the pace of expansion is quite feeble and surveys point to a renewed slowdown in Q4. At the national level, Germany will remain a laggard. In France and Italy, the public finances are the bigger concern. We expect government bond spreads to widen in both countries, and while a re-run of the sovereign debt crisis is very unlikely, the lack of political will to bring budget deficits under control means that there is clearly a risk of much more adverse moves in the bond markets.

Japan – We now expect inflation excluding fresh food and energy to remain above the Bank of Japan’s target for most of next year as the yen remains weak for longer and the upcoming spring wage negotiations result in another sizeable pay hike. Accordingly, we expect the Bank of Japan to lift rates to 1.25% by mid-2026. Our Nowcast points to stagnant output in Q4 but we think that GDP growth will settle around trend over the coming quarters.

UK – Despite weak news on the domestic economy and the deterioration in the outlook for the UK’s key trading partners, we think lower inflation and interest rates will contribute to a stronger UK economy than most expect. Over the next two years, the economy will face several challenges. The downgrade to our forecast for US GDP growth because of Trump’s policies and our forecast for a period of weak growth in the euro-zone suggest the external sector will be a small drag on UK GDP growth.

Canada – The near-term outlook for the economy has brightened and we expect GDP growth to accelerate in the first half of 2025. The pick-up will be short-lived, however, with growth set to suffer as immigration slows sharply and the US imposes import tariffs. Annual GDP growth is likely to be subdued, at 1.8% in 2025 and 1.5% in 2026. Nonetheless, a renewed rise in inflation above the 2% target will prevent the Bank from cutting its policy rate below 2.50%.

Australia & New Zealand – Although their recent performance leaves much to be desired, we believe that both Antipodean economies are on the cusp of a cyclical upswing. But while the RBNZ has ample room to support the recovery without stoking inflation risks, the same cannot be said of the RBA. The Australian economy barely muddled along in Q3, as private demand continued to languish. But with Stage 3 tax cuts boosting households’ real incomes, consumer spending should soon rebound in earnest.

China – The leadership has signalled that policy will be loosened further, which will provide a near-term prop to activity. But we still expect China’s growth to slow next year, amid a more challenging external environment and a further decline in property prices and construction. Our China Activity Proxy suggests that growth has ticked up recently. The CAP breakdown shows a broad-based improvement, though industry remains the star performer and construction the laggard. The main driver of the turnaround has been fiscal spending, following stepped-up efforts to deploy unused funds from the existing budget. Officials have signaled that the deficit will be increased in 2025, with spending likely to be front-loaded at the start of the year.

India – After a stellar run, India’s economy has entered a softer patch that will continue for a few more quarters. We think that will portend an underperformance in local equities relative to other major benchmarks. Headline CPI inflation is likely to have peaked and, under new leadership, we think the RBI’s MPC will turn less hawkish and begin cutting interest rates at its next meeting in February. The economy has performed exceptionally well in recent years and is now 25% larger than it was on the eve of the pandemic. But the GDP data for Q3 show a slowdown, and that is corroborated by evidence in other activity data. We think the economy will remain subdued over the coming quarters.

Other Asia – With growth set to remain weak and inflation set to stay low, central banks are likely to cut interest rates further over the coming months. We expect economic growth to slow across most of Asia in 2025 and forecast below-trend and below-consensus growth nearly everywhere. On the plus side, central banks have started to cut interest rates which should provide some support to consumption and investment. However, the boost from looser monetary policy will be offset by other factors. Labour markets are starting to weaken, which is weighing on wage growth. Tighter fiscal policy will also drag on demand in most places as governments focus on reducing budget deficits.

Emerging Europe – Slowing growth across Emerging Europe has set a downbeat tone heading into 2025 and we think that most economies will disappoint consensus expectations next year. Inflation remains an ongoing concern and we think that above-target inflation will keep interest rates higher than most expect to end-2025.

Latin America – Tight policy, deteriorating terms of trade and, in Mexico’s case, US trade protectionism will keep GDP growth in Latin America weak and below consensus expectations in the coming years. Public debt risks will remain in the spotlight as governments across the region fail to meet their fiscal targets, leaving Latin American currencies on the backfoot. We expect growth in most countries to slow as the region runs into mounting headwinds.

Middle East & North Africa – We expect GDP growth in the Middle East and North Africa to pick up over 2025-26, bolstered by higher oil and LNG output in the Gulf. While monetary policy is easing in the region, this will be more than offset by tight fiscal policy that drags on domestic demand.

Sub-Saharan Africa – Falling inflation and looser monetary policy will help GDP growth to accelerate across Sub-Saharan Africa from early next year. But tight fiscal policy will constrain the recovery. Growth this year has been bumpy to say the least, with a wide variation across countries, and surveys point to an underwhelming end to the year. Next year, the external environment should be favourable to many. Although a shift towards trade protectionism in the US and the potential removal of AGOA is a threat, the economic costs risk being overstated.

Commodities – Most energy and industrial metals prices will fall in 2025 as structural headwinds to demand build and supply rises. Geopolitical developments remain a wildcard and could be a source of price volatility. Looking ahead, the latest delay to the planned start of gradual supply increases by OPEC+ will, all else equal, tighten conditions in the oil market. We now think the market will be roughly in balance in 2025. But given the deterioration in the global economic outlook, the risks to oil demand from cyclical factors are on the downside. And the rollout of electric vehicles shows how structural headwinds to oil demand are starting to emerge. All told, we are sticking to our below-consensus forecasts for Brent crude to fall to $60pb by end-2026. A key downside risk for oil prices in the coming years is that Saudi Arabia decides it would be in its long-term interests to ramp up production to claw back market share.

Get the full report

Trial our services to see this complete 34-page analysis, our complete Global Economics insight and forecasts and much more