Softer landing, but the runway is longer

Q1 2024 UK Economic Outlook

A softer landing in activity and continued restraints on supply imply that lingering price pressures will prevent the Bank of England from cutting interest rates until after the Fed, the ECB and current market pricing of mid-2024.

This is a sample of our latest quarterly UK Economic Outlook, originally published on 4th December, 2023. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium product or to our dedicated UK Economics coverage.

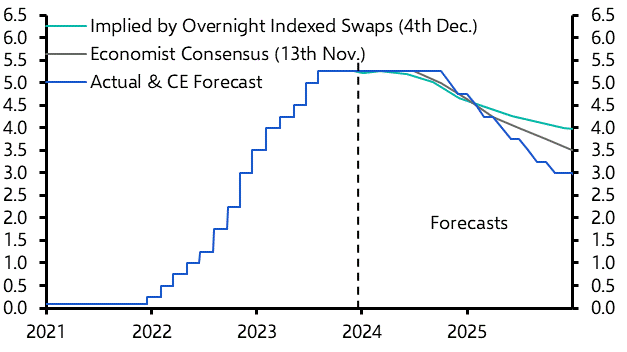

With higher interest rates taking longer to percolate through the economy, we now think the recession will be shallower and GDP growth will stay weak throughout all of 2024. It’s a softer landing for the economy, but the runway is longer. And because the restraints on supply are unlikely to fade quickly, price pressures in the UK will take longer to ease than elsewhere. That’s why we believe the Bank of England won’t cut interest rates from 5.25% until late in 2024. That would be later than the Fed, the ECB and current market pricing of mid-2024. But a stagnant economy in 2024 will lay the groundwork for a more marked easing in price pressures in 2025 and more significant interest rate cuts. Our forecast that rates will be cut to 3.00% in 2025 is lower than the cuts to 4.00% priced into the markets.

- While the Bank of England may be prevented from cutting rates until after the Fed, the ECB and the mid-2024 implied by current market pricing, weak activity next year means price pressures will fade in 2025 and lead the Bank to cut rates to 3.0% rather than to 4.0% as investors expect.

- The tiny decline in real GDP in Q3 2023 and the possibility of small falls in Q4 2023 and Q1 2024 suggest that higher interest rates may have generated a small recession. They will almost certainly restrain activity throughout 2024 too. The effects of higher interest rates can be seen most clearly in the 8% fall in real residential investment. But the 0.4% q/q fall in consumer spending in Q3 shows that households are starting to feel the pinch too.

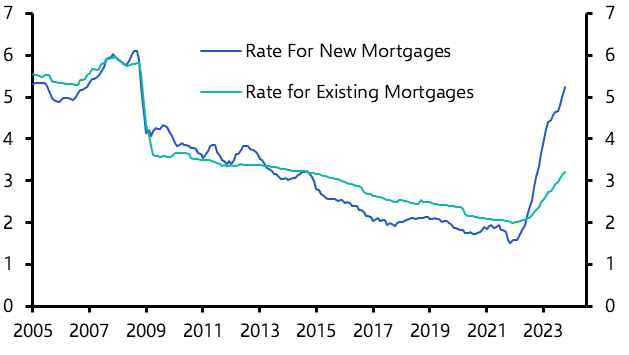

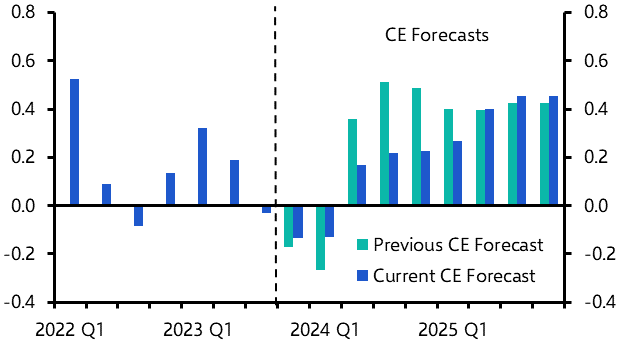

- That said, GDP hasn’t been as weak as we expected as the effects of higher interest rates have been felt more slowly. More fixed rate mortgages have meant that the mortgage rate for existing borrowers has risen by only a third of the rate for new borrowers. (See Chart 1.) That suggests a lot of the effect on households (it’s similar for businesses) has yet to be felt. But because that drag will be felt over a longer period than we previously thought, we now think that any recession will be even shallower and GDP growth will stay subdued for longer. (See Chart 2.) The same is true for employment. Our forecasts for GDP growth of 0.1% in 2024 and 1.2% in 2025 are a bit weaker than the consensus of 0.4% and 1.4%.

|

Chart 1: Mortgage Rates (%) |

Chart 2: Real GDP (%q/q) |

|

|

|

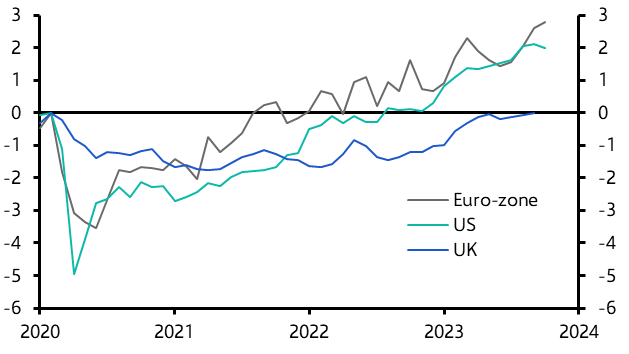

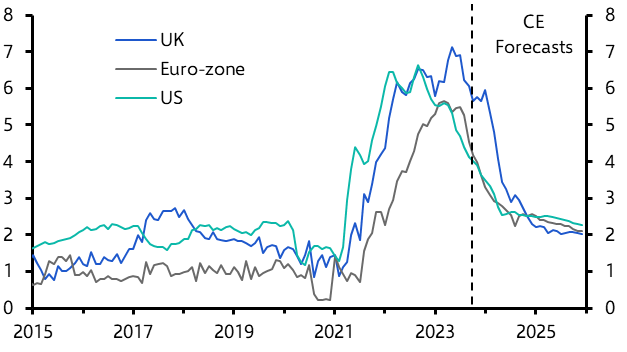

- At the same time, there is little evidence that the restraints on supply that have contributed to high inflation and rapid wage growth in the UK will fade quickly. We’re assuming that the UK’s pool of available workers won’t catch up with the previous gains in the US and the euro-zone in 2024, and that the mismatches between available workers and vacant jobs won’t ease dramatically in 2024 either. (See Chart 3.)

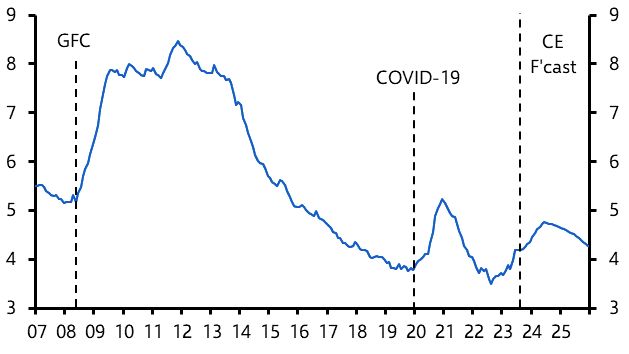

- As a result, we now think the unemployment rate will rise more gradually from 4.2% in September to a peak of 4.8% in mid-2024 and that the upward pressure on wage growth will abate a bit more slowly. (See Chart 4.)

|

Chart 3: Labour Force (% Change Since February 2020) |

Chart 4: Unemployment Rate (%) |

|

|

|

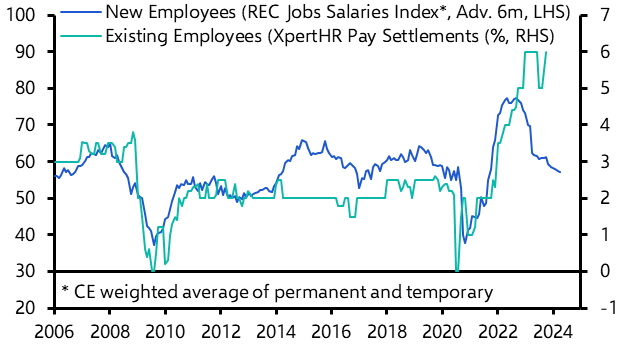

- This doesn’t mean that wage growth and CPI inflation won’t continue to fall. Pay for new employees has been growing more slowly for a while and pay deals for existing workers have probably peaked. (See Chart 5.) But the lingering restraints on supply will mean domestic inflationary pressures fade more slowly in 2024 than elsewhere. (See Chart 6.)

|

Chart 5: Pay Changes for New & Existing Employees |

Chart 6: CPI Core Inflation (%) |

|

|

|

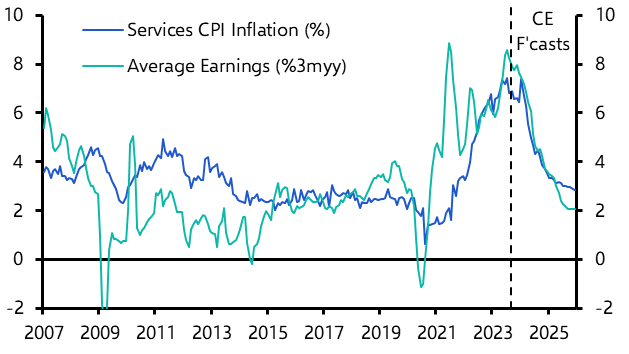

- Wage growth may not fall from 7.9% in September to the rates of 3.0-3.5% consistent with the 2% inflation target until later 2024. And services CPI inflation may not ease from 6.6% in October to its long-run average of 3.5% until around the same time. (See Chart 7.) That’s why, despite weak activity, we doubt the Bank of England will cut interest rates from 5.25% until late in 2024.

- That said, the cumulative effect of weak growth in 2023 and 2024, and some rebound in supply in 2025, should lead to a more marked fading in price pressures in 2025. To boost activity and support inflation, the Bank may cut interest rates to 3.00% in 2025. (See Chart 8.)

|

Chart 7: Services CPI Inflation & Average Earnings |

Chart 8: Bank Rate (%) |

|

|

|

|

Sources: Refinitiv, ONS, XpertHR, Bloomberg, Capital Economics |

The economic outlook would be similar if Labour were to win an election in 2024. As the current government will further trim the planned tightening in fiscal policy in 2024/25 before the election, whoever wins will need to tighten policy by more in 2025/26. Fiscal policy will therefore underline the need for interest rates to stay high in 2024 and be cut in 2025.

This is a sample from a 13-page report published for Capital Economics clients on 4th December 2023 and written by Paul Dales, Ruth Gregory, Ashley Webb, Alex Kerr, Joe Maher and Pollyanna Hall.

Get the full report

Trial our services to see this complete 13-page analysis, our complete UK macro insight and forecasts and much more