Tracking Turkey's policy shift

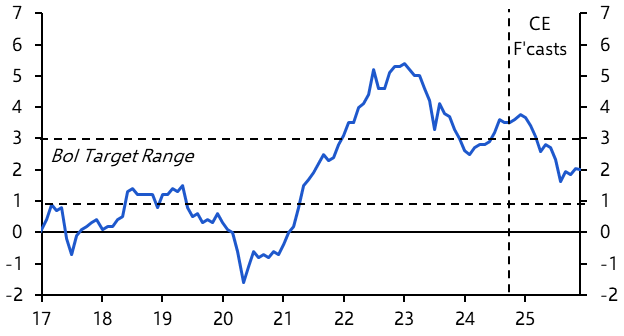

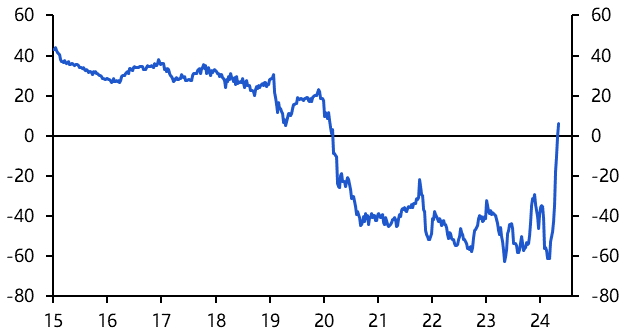

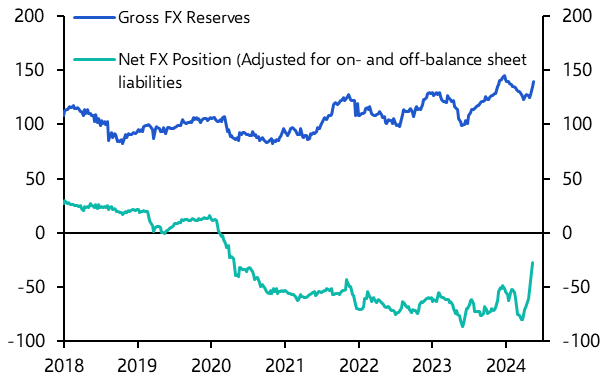

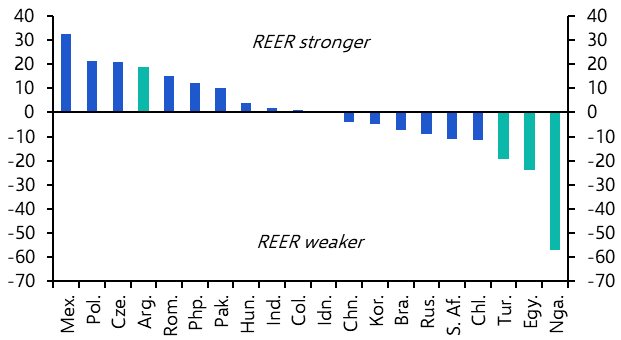

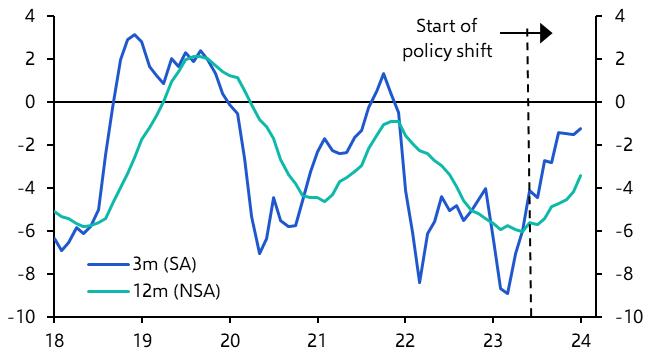

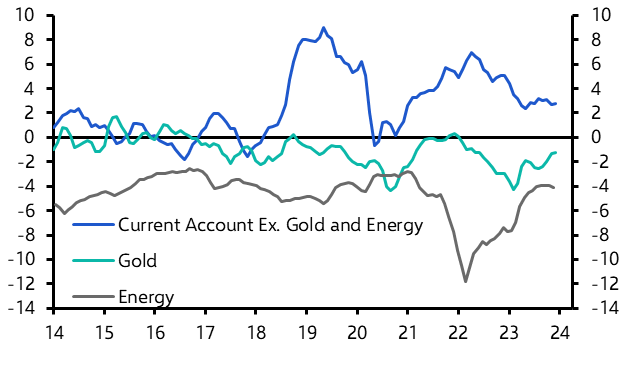

Capital Economics view (December 2024): The shift to orthodox economic policymaking in Turkey has continued to rebalance the economy and sustain investor optimism. GDP growth has slowed, inflation has declined and the current account deficit has narrowed sharply.

It's unlikely to take until at least 2030 for inflation to fall to single digits and the process will be bumpier than most expect. A key risk for 2025 is that interest rates are cut too quickly. But if we're right that disinflation will gather pace, local currency bonds have the potential to deliver comparatively high returns among EMs over the next couple of years.

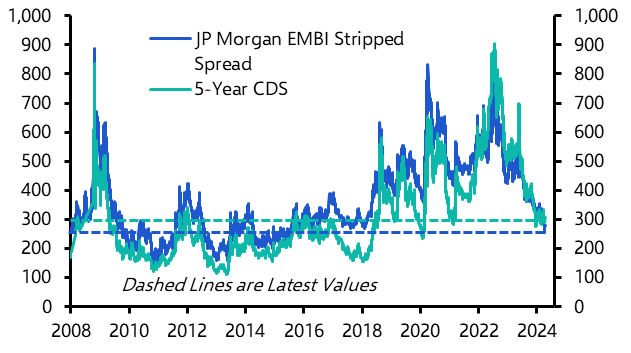

Turkey's sovereign risk premia could remain at historically low levels as the rebalancing continues. We think the country could follow a path towards an investment grade credit rating before the end of this decade.

Is Turkey’s policy U-turn the real deal?

In this Focus we set out our thoughts on Turkey's policy shift so far, what more needs to be done and our forecasts for Turkish bonds and equities over the next five years.

Key Turkey Forecasts

|

Main Economic & Market Forecasts |

|||||||

|

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 – 31 |

|

|

GDP |

11.4 |

5.5 |

5.1 |

2.8 |

2.0 |

2.5 |

2.8 |

|

Unemployment Rate (%) |

12.0 |

10.5 |

9.4 |

9.3 |

9.3 |

9.3 |

8.3 |

|

CPI Inflation (Avg.) |

19.6 |

72.3 |

53.9 |

58.8 |

31.5 |

20.5 |

12.5 |

|

CPI Inflation (End-Period) |

36.1 |

64.3 |

64.8 |

44.4 |

25.0 |

17.5 |

9.5 |

|

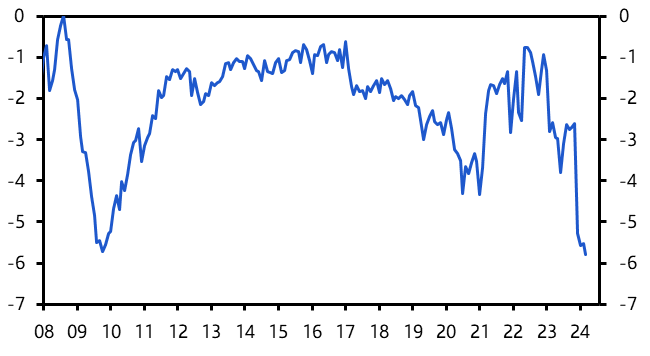

General Gov’t Bal1), 2) |

-4.0 |

-1.1 |

-5.4 |

-5.3 |

-3.5 |

-2.5 |

- |

|

General Gov’t Debt1) |

41.8 |

30.8 |

29.3 |

27.5 |

27.5 |

29.5 |

- |

|

Current Account1) |

-0.9 |

-5.2 |

-3.6 |

-0.8 |

0.0 |

-0.3 |

- |

|

1-week Repo Rate (End-Period) |

14.00 |

9.00 |

42.50 |

47.5 |

32.00 |

26.00 |

12.00 |

|

10-year Bond Yield (End-Period) |

23.10 |

9.90 |

23.70 |

27.20 |

20.00 |

20.00 |

12.50 |

|

TRY/USD (End-Period) |

13.3 |

18.7 |

29.5 |

35.3 |

45.0 |

53.0 |

65.0 |

|

Sources: CEIC, Refinitiv, Capital Economics. 1) % of GDP. 2) IMF definition of government budget balance Correct as of 10th January 2025 |

|||||||