Zeitenwende!

Q2 2025 Europe Outlook

These key takeaways from the latest client edition of our Europe Economic Outlook provide key insight into the euro-zone economies at a pivotal moment. Download the report now to find out how Germany's move to loosen fiscal constraints and a region-wide push to boost defence spending might – and might not – transform the economic outlook.

Download the report now and learn:

- What Germany's decision to boost fiscal spending will mean for its economic growth in 2025 and beyond;

- Why other key euro-zone members will struggle to match Germany's pivot, and what that means for growth;

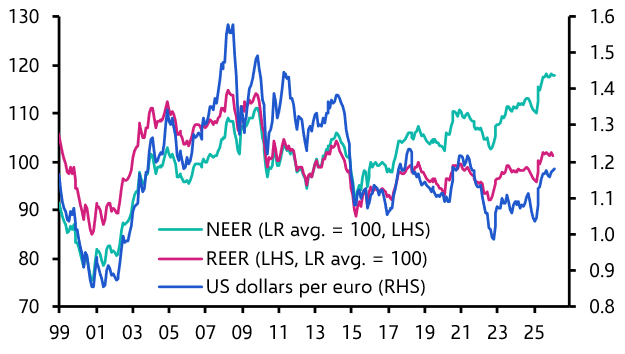

- Why we expect the ECB to shift from rate cuts this year to rate hikes in 2026.

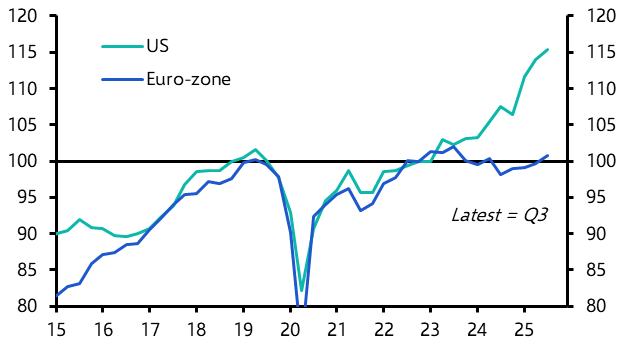

The euro-zone will get a boost from Germany’s decision to ditch its fiscal rules and ramp up defence spending, as well as the relaxation of the EU’s budget rules.

Get the latest Europe Economic Outlook

Download a free copy of the report

About the author and our Europe coverage

Andrew Kenningham has been with Capital Economics since 2011 and leads our coverage of Europe's economy. Formerly with the Foreign and Commonwealth Office and Merrill Lynch, Andrew also contributes more generally to our international economic analysis.

Our Europe Economics coverage provides in-depth macro analysis and independent market forecasts for the euro-zone and its member states, as well as for the Nordic economies and Switzerland. From timely analysis of market developments to insight into longer-term issues, this service benefits from our Europe team’s close understanding of the political dynamics that shape the region’s economic and policy outcomes.

Award-winning research

The accuracy of our analysis and forecasting is reflected in the many awards we win each year from across the industry

Global media relies on Capital Economics

Our economists are frequently quoted by the world's leading news organisations