A spectre is haunting the global economy – the spectre of recession.

Central banks have launched what we expect will be the most aggressive round of monetary policy tightening in decades to combat surging inflation. Investors are spooked. They worry that jacking up interest rates will push economies into recession. After all, tightening cycles have traditionally been associated with economic downturns.

But there’s far more to this story than ‘rate hikes cause recession’. A new Capital Economics research series examines the potential economic and market implications of higher interest rates to show how – while acknowledging very real downside risks – the outlook may not be as gloomy as more hysterical headlines suggest.

There’s no question that central bank tightening will be intense and aggressive by historical standards. Our Global Economics team is forecasting the average rate to rise by around 240 basis points within less than two years, which would be comparable to the tightening cycle seen in the late 80s/early 90s.

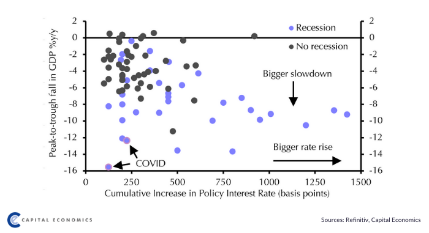

Although that cycle did end in recession, one doesn’t automatically often follow the other. Jennifer McKeown, who heads our Global Economics service, and Senior Global Economist Simon MacAdam, reviewed all 81 G7 tightening cycles since 1960 and found that, until rates were increased by 400 basis points or more, recession generally didn’t follow.

In their report on how higher rates could affect the global economy, McKeown and MacAdam also noted the specific factors, such as banking sector vulnerabilities, which have previously helped push economies into recession following tightening cycles.

In many respects, this cycle is different. For starters, central banks will be shrinking their balance sheets on an unprecedented scale alongside raising policy rates. Quantitative tightening isn’t expected to have a major impact on the real economy – our Markets team sees long-term government bond yields only grinding higher rather than anything like a sharp spike – but this is a policy step into the unknown.

Furthermore, central banks are raising rates in a global economy with significantly higher levels of debt. At nearly 260% of GDP, global non-financial sector debt has nearly doubled since the start of the Global Financial Crisis.

Despite this increase, the authors show how governments, firms and households may be more resilient to higher rates, helped in part by a lengthening of debt maturities which reduces sensitivity to changes in market rates.

For existing borrowers, this tightening cycle will result in a squeeze on disposable incomes, but not by enough to cause widespread defaults or a big drop in demand.

“Higher rates will mainly weigh on new credit demand, causing growth in interest-rate-sensitive spending to slow,” said McKeown and MacAdam.

So far, so sanguine. But our new series also highlights areas of global economic vulnerability and acute downside risks to the outlook.

Forty years ago this year, Mexico defaulted on its dollar debt, marking the first of a series of debt crises that dominated emerging market investing in the 1980s and 1990s. Given those crises were often triggered when the Federal Reserve tightened monetary policy, investors would be forgiven for thinking we’re in for a repeat.

But William Jackson, Shilan Shah and Kimberley Sperrfechter from our Emerging Markets team show in a report how emerging markets are less sensitive to Fed tightening. For the most part, the exchange rates of these countries have been allowed to float and local currency debt issuance and foreign exchange reserves have grown. They do note exceptions to this general rule. Unsurprisingly, these include Turkey, but the team also warn that markets are not paying enough attention to vulnerabilities in economies such as Chile, Romania and Hungary.

Although this new series explains why we think equities prices face more weakness, our economists also show how changes in house prices tend to be more relevant for households than share prices. In a report identifying property as “the weak link” in a world of rising rates, Vicky Redwood, our Senior Economic Advisor, and Chief Property Economist Andrew Burrell show how overvalued markets – and New Zealand is the most overvalued in our coverage – are vulnerable as rates rise, increasing the risk of an economic hit to those countries.

On a global level, the anticipated end of pandemic-era housing booms – or even moderate falls in prices – in most developed markets needn’t mean recession.

But our view that the world economy faces a slowdown rather than outright recession is underpinned by an assumption that interest rates won’t have to rise much above neutral levels to nip inflation in the bud. Even after the significant tightening that we anticipate, the average policy rate in developed markets will be little higher than 2% and even in the US, our economists currently forecast that they’ll peak at under 3.5%.

But that view relies on an uncertain inflation outlook, the authors admit. Inflation has continued to surprise on the upside and there’s no guarantee that it won’t continue to do so. Our team assessed what might happen if rates rose by 100 basis points more than they are currently forecasting and their findings were worrying, with private sector interest costs seeing their biggest jump since the 1980s and sharper and more widespread declines in house and equity prices.

“The key threat, then, is that the inflation genie may already be out of the bottle and that central banks will work much harder to get it back in,” McKeown and MacAdam said.

At that point, talk of global recession is no longer headline fodder.