This week marks the launch of our annual Spotlight report, which will land in client inboxes tomorrow. This year we are exploring the economic and market impact of artificial intelligence.

As with any piece of analysis it’s useful to gauge what the market thinks about the issue at hand. This helps both to frame the analysis and identify gaps in knowledge and thinking.

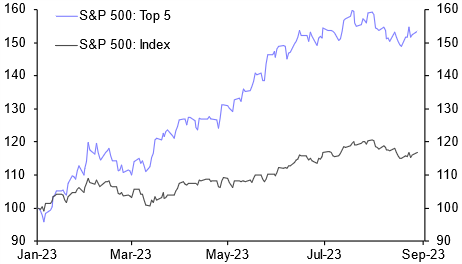

It goes without saying that there’s considerable hype about AI – that much is obvious from recent moves in the stock market. The rise in the S&P 500 since the turn of the year has been almost single-handedly driven by its biggest five companies, all of which are tech firms, as hype around AI has outweighed fears about slowing economic growth. (See Chart 1.)

|

Chart 1: S&P 500 Top 5 & S&P 500 Index (Total Return Indices, End-2022 = 100) |

|

|

|

Sources: Capital Economics |

But these market moves do not tell us much about what investors really think about the key issues surrounding AI. In order to shed more light on this, we have spent the summer surveying clients. The results are striking. They suggest that there’s an uneasy balance of optimism and caution about the impact that AI will have on economies and markets. And they get to the heart of the key issues around AI.

Let’s start with the optimism. Almost 80% of clients believe that AI will have a transformative effect on the global economy. (See Chart 2.)

|

Chart 2: Is AI a genuinely transformative technology? |

|

|

|

Sources: Capital Economics |

What’s more, this optimism is widespread. Clients from across Asia, EMEA and the Americas all report similar levels of enthusiasm about the potential impact of AI. (See Chart 3.) And while there is some divergence across sectors – real estate investors appear more optimistic than traders – a large majority of clients across all job roles believe that AI will be a genuinely transformative technology. (See Chart 4.)

|

Chart 3: Respondents that believe AI is genuinely transformative by region (%) |

|

|

|

Sources: Capital Economics |

|

Chart 4: Respondents that believe AI is genuinely transformative by job title (%) |

|

|

|

Sources: Capital Economics |

But this optimism is tinged with uncertainty. There is a divergence of views about exactly what the AI revolution will look like, and in particular whether it will be confined only to the US.

Just over two-thirds of clients believe that the AI revolution will reach across the globe. But one-fifth think it will be confined primarily to the US, while another 10% or so said they didn’t know. (See Chart 5.) Nor is this a case of regional bias – views about the extent to which AI will be predominantly a US story are split equally across Asia, Europe and the Americas.

|

Chart 5: Is AI predominantly a US story? |

|

|

|

Sources: Capital Economics |

If there is uncertainty about how the AI transformation will play out across different economies, then there is a combination of uncertainty and trepidation about its impact on markets. Almost 60% of respondents believe that a bubble is already forming around AI. (See Chart 6.)

|

Chart 6: Is a bubble forming around AI? |

|

|

|

Sources: Capital Economics |

And while 10% say they are confident that one is not, just over a quarter are unsure – making the bubble question the biggest area of uncertainty in our survey.

Interestingly, while there are similar levels of optimism about the transformative potential of AI across sectors and job roles, there is a clear difference in views when it comes to the question of whether there is a bubble forming: three-quarters of traders and two-thirds of economists believe there is, while half of real estate investors believe there isn’t. (See Chart 7.)

|

Chart 7: Respondents that believe a bubble is forming around AI (%) |

|

|

|

Sources: Capital Economics |

So where does that leave us? There is significant optimism about the transformative potential of AI. But at the same time there is substantial uncertainty about how this will play out between countries, and genuine concern that market hype may already have run ahead of the economic reality.

Our Spotlight report will provide you with a comprehensive framework for thinking through all of the ways in which AI will reshape the global economy and financial markets. We’ll show how the AI revolution has the potential to transform the growth outlook – but also how some economies are set to benefit far more than others. We’ll explain why fears of a surge in “technological unemployment” are overdone – but also how the AI revolution will bring huge dislocation to labour markets. And we’ll show how AI has the potential to drive a secular bull market in equities – but also why those concerns about bubbles are justified.

The report will be released tomorrow on our dedicated AI analysis hub, along with a suite of interactive charts and data tools that allow clients to use our analysis in their own work. This includes access to our proprietary AI Economic Impact Index, which helps you and your clients understand which economies are most likely to benefit from AI, and which will struggle. After that we’ll be hitting the road – and taking to the airwaves – to answer your questions. Sign up for our online briefings here.

In case you missed it:

By this time next year, more than two-thirds of the world’s major central banks will be cutting interest rates, says Chief Global Economist Jennifer McKeown in her wrap-up of a key moment in the global monetary cycle.

Chief Asia Economist Mark Williams addresses the key issues around Taiwan’s upcoming presidential election, not least the risk of heightened geo-political tension around cross-Strait relations.

Paul Ashworth, our Chief North America Economist, assessed the threat to the US economy from industrial action aimed at the Big Three automakers.

Paul also appears on the latest episode of our weekly podcast to explain the fundamental reason why we think AI will be a productivity growth game changer. We’ll be exploring other key aspects of our Spotlight report in upcoming episodes, including whether AI will lead to mass unemployment and why – despite its tech primacy – China will be a relative laggard in the AI race.