A recovery, but not much of one

UK Commercial Property Outlook

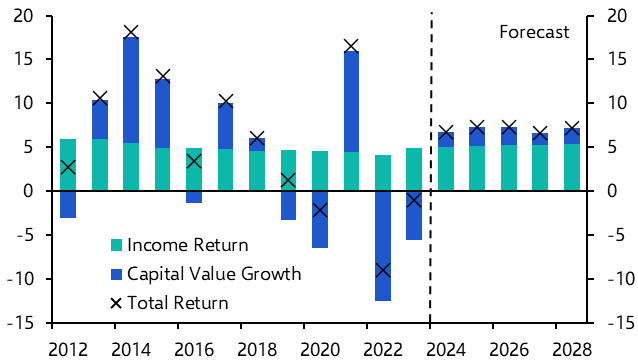

With property yields close to a peak and rental growth surprising on the upside, total returns will turn positive in 2024. But we doubt the fall in risk-free interest rates we expect will trigger any yield falls over the next five years and the recovery will therefore be modest by past standards.

These are just some of the key takeaways from our latest quarterly UK Commercial Property Outlook, originally published on 23rd February, 2024. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium service or to our dedicated UK Commercial Property coverage.

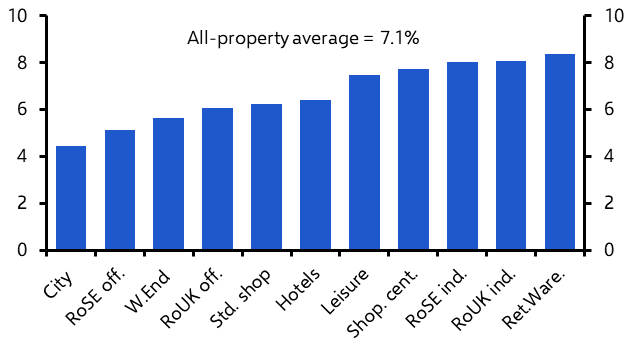

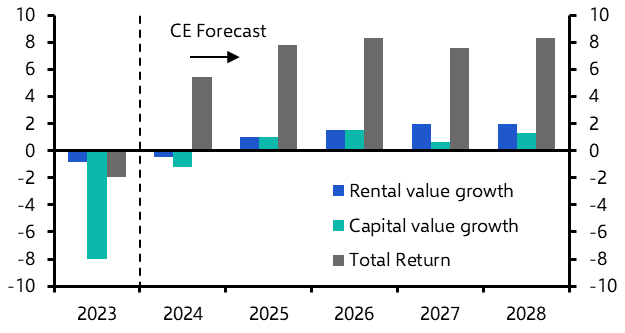

We expect all-property total returns to average just 7.1% p.a. over 2024-28. The lack of any decline in yields means capital value growth will be limited to impacts from rental growth, which will be best in the industrial sector at 4.0% p.a. over 2024-28. Retail rental growth will be more modest at 1.9% p.a., but a stronger income return will help total returns to 7.7% p.a., just behind industrial. The office sector is still coming to terms with the shift to remote work and total returns of 5.5% p.a. will leave offices as the worse performing sector by a wide margin.

Investment Market

- Investment transactions look to have turned the corner with a small rise in Q4. With interest rates set to fall back, that gradual recovery will continue. A decline in interest rates will also take the pressure off of property yields, which we think are close to a peak. Indeed, yields at the all-property level were flat in January. But with the spread of property yields against risk-free interest rates narrow by past standards we don’t expect any yield falls over the next five years. All-property total returns were negative again in 2023 at -1.3%, but will turn positive this year as capital values stabilise.

|

Chart 1: All-Property Total Returns, Income Return and Capital Values (% y/y) |

Chart 2: Sector Returns (% p.a., 2024-28) |

|

|

|

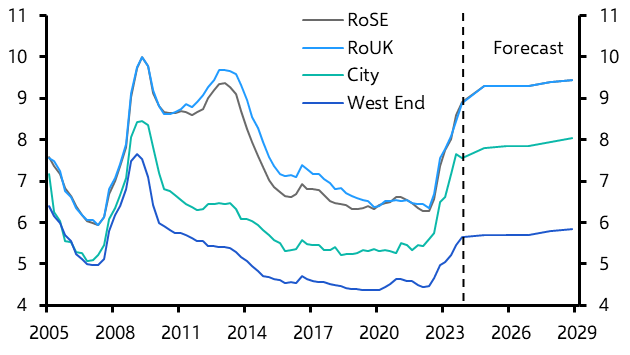

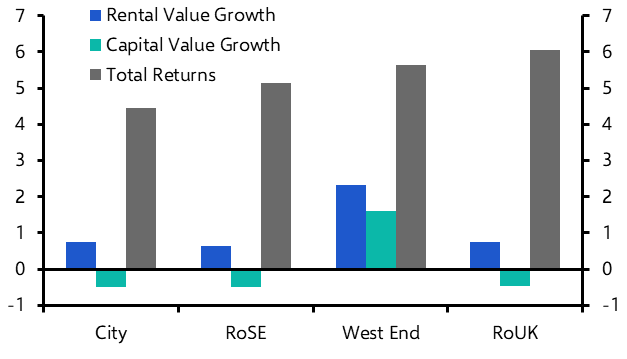

Office Market

- The increases in remote work following the pandemic is still weighing on office demand, although some markets will remain relatively unscathed. Prime assets in central locations look to be benefitting from downsizing, exemplified by HSBC’s recent move from Canary Wharf to the City. That said, Central London vacancy rates are still rising, not helped by a substantial pipeline. Despite high vacancy rates rental growth has continued to surprise on the upside. As a result, we have bumped up our forecasts and now expect growth of 1.3% p.a. over 2024-28 at the all-office level. But that is still historically weak and total returns of 5.5% p.a. will leave offices as the worst performing of all sectors by a wide margin.

|

Chart 3: Office Equivalent Yields (%) |

Chart 4: Office Property Forecasts (% p.a., 2024-28) |

|

|

|

Retail Market

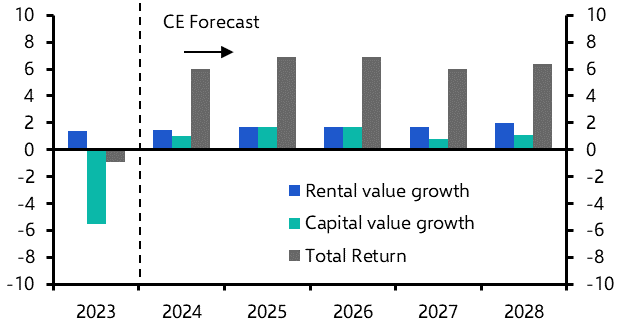

- High interest rates, weak economic activity and loose labour markets will weigh on consumer demand in the near term. But retail rents are growing - for the first time since 2017 - and are set to increase by 1.9% p.a. on average over 2024-28, a dramatic improvement on the last 5 years. With retail yields flat, we forecast retail capital growth to average 1.7% p.a. over the forecast, a marked contrast to the recent slump. Retail also has the advantage of higher income returns, which help push total returns to almost 8% p.a. on average over the next five years, with retail warehouses topping the sub-sector rankings.

|

Chart 5: Retail Yields by Subsector (%) |

Chart 6: Retail Property Forecasts (% p.a., 2024-28) |

|

|

|

Industrial Market

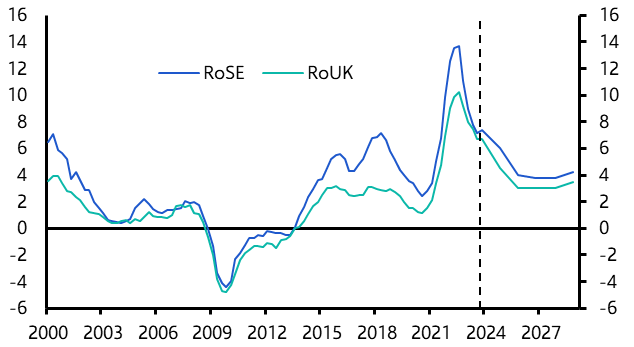

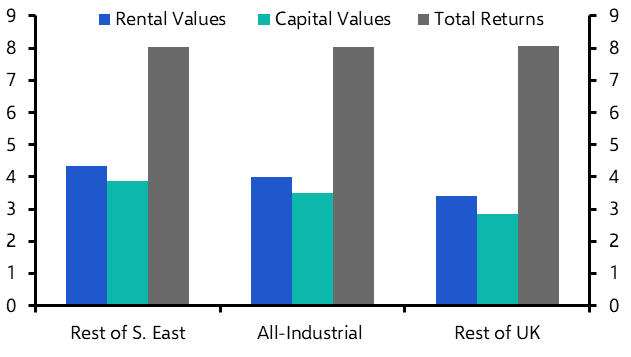

- Demand for logistics assets picked up in Q4, although a strong supply response meant vacancy rates continued to rise. But with the pipeline now shrinking and online retail sales set to hold up we expect vacancy rates will soon stabilise. Rental growth will therefore slow, but at 4.0% p.a. over 2024-28 will outperform all other sectors. Regions outside the South East are also likely to see a bigger drag from depreciation and obsolescence. With occupiers paying a larger premium for the location of a building rather than its amenities, depreciation is a less important factor for rents in the South East. Therefore, after a period in which RoUK and RoSE rental growth were closely matched, we expect RoSE rents will soon reassert their dominance. A relatively low income return will weigh on overall sector performance somewhat, but at 8.0% p.a. industrial returns will just exceed those in the retail sector.

|

Chart 7: Industrial Rental Growth (% y/y) |

Chart 8: Industrial Forecasts (% p.a., 2024-28) |

|

|

|

Leisure and Hotels

- Leisure spending has been constrained by the cost-of-living crisis, which will weigh on occupier demand and rents. Indeed, we think leisure will be the only sector to see a fall in rents in 2024. Hotels are benefiting from both the resumption of overseas travel and expensive foreign holidays supporting ‘staycation’ demand. But a low income return means hotel total returns will lag all sectors but offices at 6.4% p.a. over 2024-28.

|

Chart 41: Leisure Property Forecasts (%y/y) |

Chart 42: Hotel Property Forecasts (% y/y) |

|

|

|

Chart Sources: Refinitiv, MSCI, GfK, Local Data Company, VisitBritain, CBRE, ONS, RICS, Capital Economics

This is a sample of a 15-page report published for Capital Economics clients on 23th February, 2024. The report was written by Matthew Pointon and Giulia Bellicoso.