Fed to cut rates as core inflation normalises

Q4 US Economic Outlook

The Fed has doubled down on its mantra that interest rates will remain higher for longer, with its latest projections suggesting that the economy will enjoy the softest of soft landings and core inflation will still take years to return to target. We disagree.

This is a sample of our latest quarterly US Economic Outlook, originally published on 29th September, 2023. Some of the forecasts contained within may have changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated US Economics coverage.

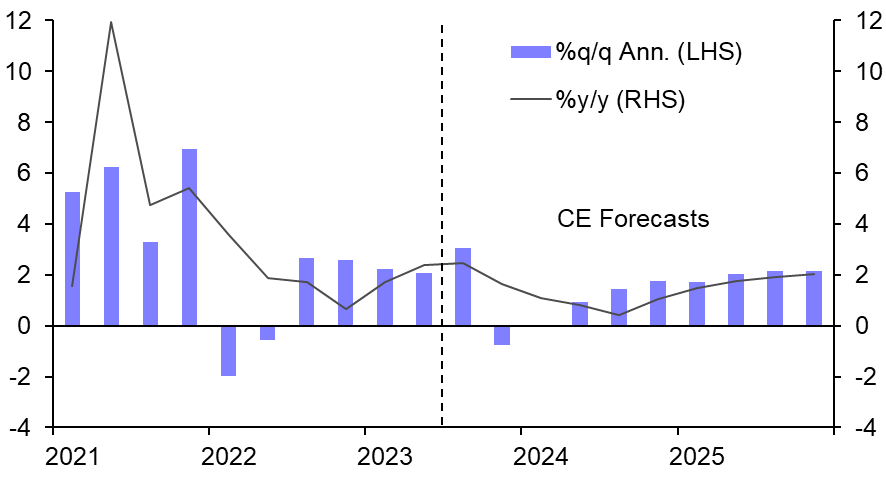

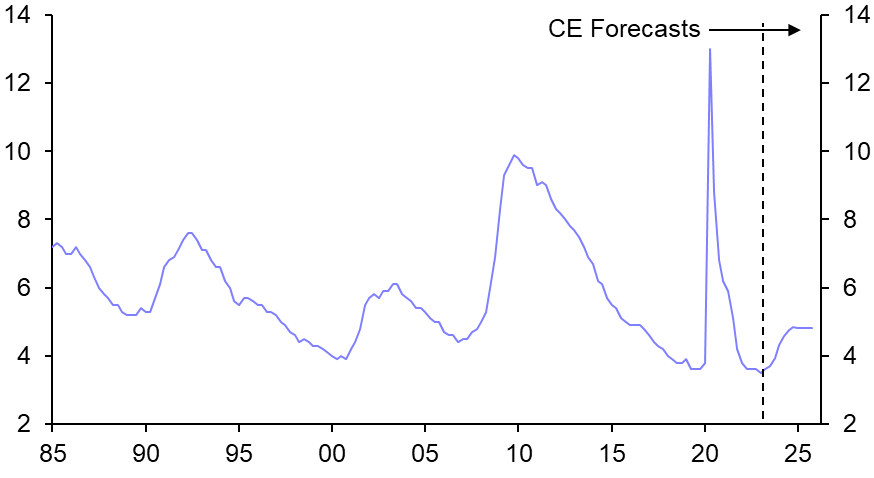

- We expect GDP growth to slow from 2.1% this year to only 0.8% in 2024, with the economy still likely to experience a near recession around the end of this year. (See Chart 1.) Core inflation will continue to fall back to the 2% target by mid-2024. Under those circumstances, we suspect the Fed will cut interest rates by 200bp next year.

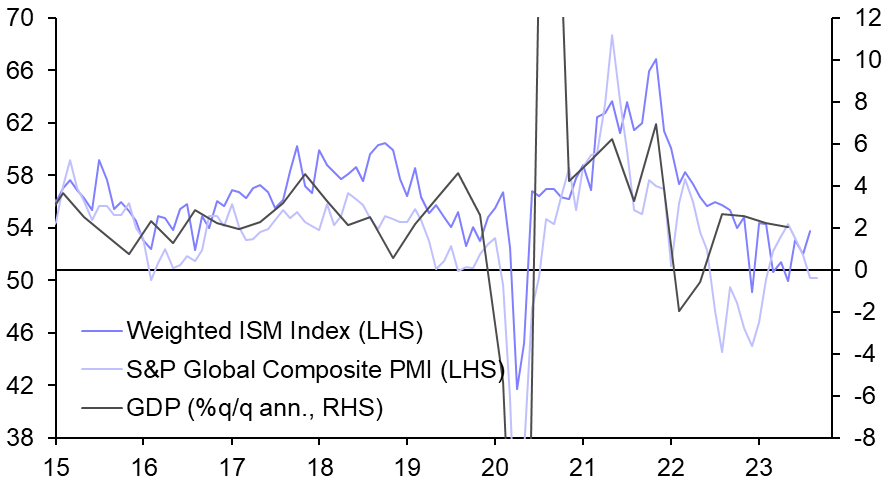

- Real GDP growth has held up surprisingly well this year, although the downbeat survey-based activity evidence suggests that the third quarter was something of a fluke. (See Chart 2.)

|

Chart 1: Real GDP |

Chart 2: GDP & Survey-Based Activity Indicators |

|

|

|

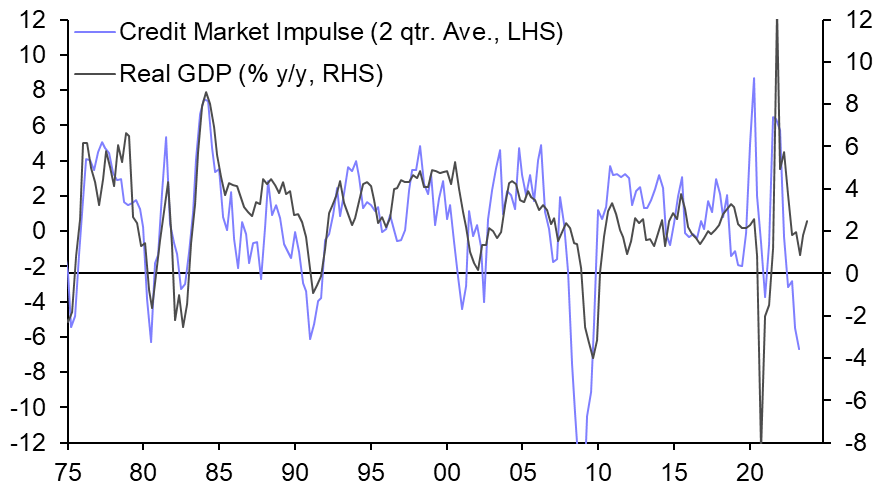

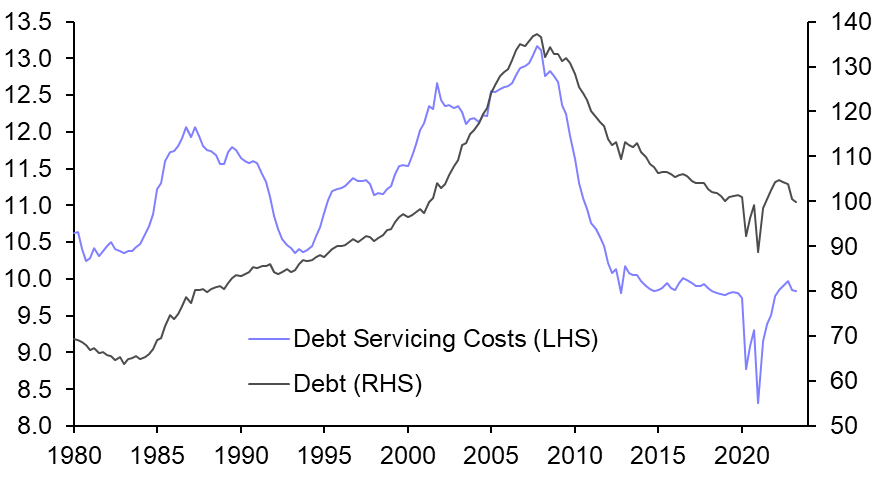

- The surge in borrowing costs has triggered a big slowdown in new debt origination – with the credit impulse consistent with a recession. (See Chart 3.) But the greater prevalence of fixed-rate debt now, particularly in the residential mortgage market, means that the cost to households of servicing their existing debts has barely increased at all. (See Chart 4.) Coming out of the pandemic, household debt was also relatively low.

|

Chart 3: Credit Impulse & GDP Growth |

Chart 4: H’hold Debt & Debt Servicing (As % of Income) |

|

|

|

- The contraction in new credit will have a mounting negative impact on the real economy, however. In addition, the flipside of the increased prevalence of existing debt arranged at near-zero rates during the pandemic is that cutting interest rates next year will provide less of a boost to GDP growth when it is needed most.

- Pandemic-era savings may also have helped to offset the initial impact of higher rates, but that boost now looks to be exhausted.

- Finally, going into the fourth quarter, the economy faces a number of headwinds – including a government shutdown, the UAW strike, the resumption of student loan payments, and the delayed deadline for tax payments by Californians.

- Employment growth has already slowed sharply and we expect declines in employment early next year. The unemployment rate is expected to climb to a peak of 4.8% which, while that would be well above the Fed’s median projection at 4.1%, would still be much lower than the peaks reached during previous economic cycles. (See Chart 5.)

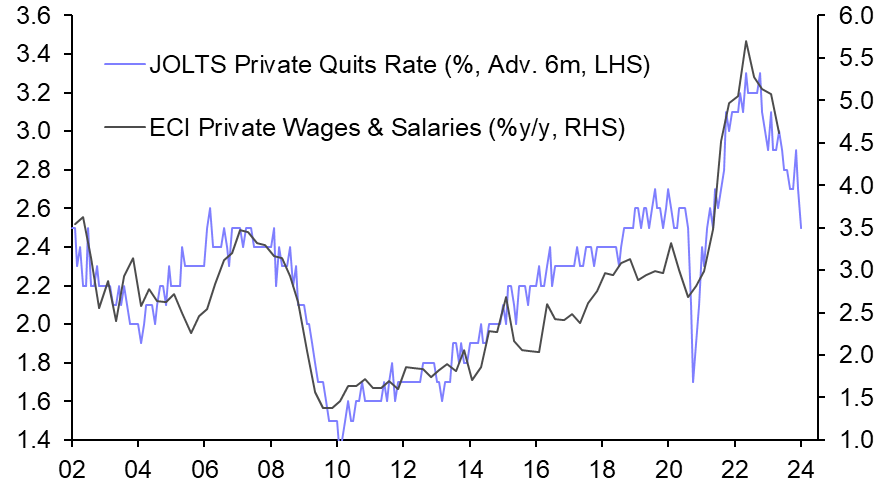

- Even without a meaningful rise in the unemployment rate, the rebalancing in labour market conditions evident in other measures of slack – like job quits – we have already seen points to a further slowdown in wage growth. (See Chart 6.)

|

Chart 5: Unemployment Rate (%) |

Chart 6: Wages & Voluntary Job Quits |

|

|

|

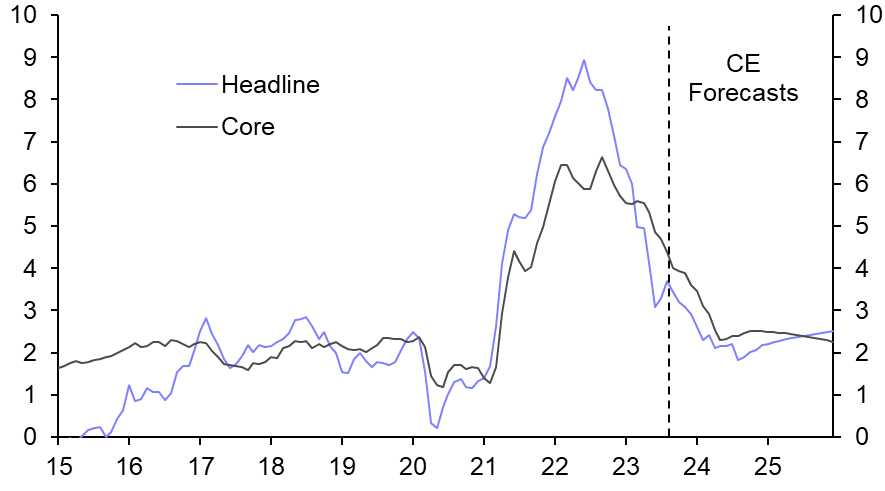

- With core goods prices falling back as supply shortages have eased, and the drop back in the growth rate of new rents pointing to a coming slowdown in the lagging CPI and PCE housing inflation components, slower wage growth should push down labour-sensitive core services inflation. We expect core inflation to return to the 2% target by mid-2024. The latest rebound in crude oil prices will add only a few tenths to headline inflation. (See Chart 7.)

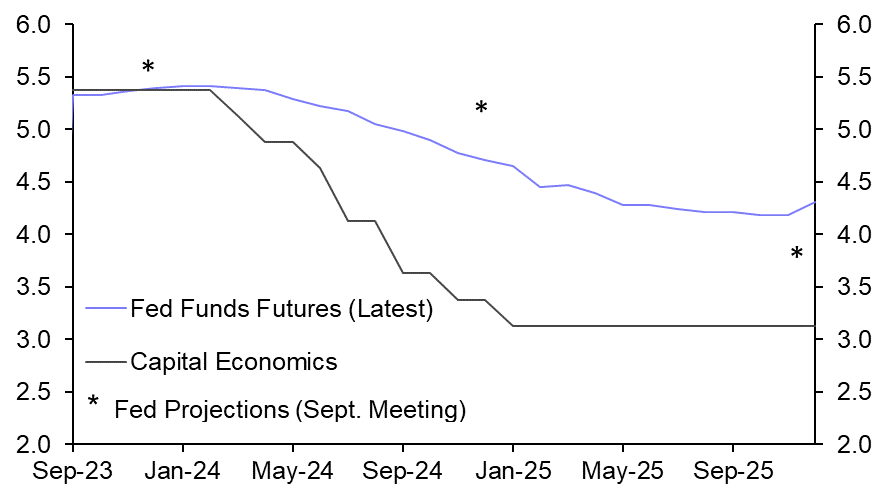

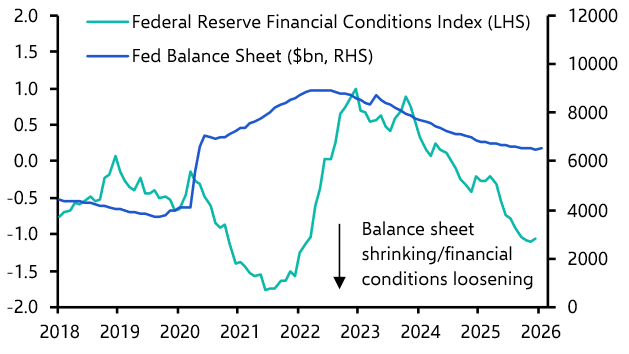

- If we are right about that disinflation, then we would expect the Fed to abandon its current ‘higher for longer’ mantra and to cut rates by up to 200bp next year, if only to prevent a tightening in the real stance of policy. (See Chart 8.)

|

Chart 7: CPI Inflation (%) |

Chart 8: Fed Funds Rate Expectations (%) |

|

|

|

|

Sources: Refinitiv, Federal Reserve, NY Fed, CE |

Make informed investment decisions quickly

CE Advance, our new premium product, equips organisations with actionable macroeconomic data and insight to stay ahead of the curve.