Stimulus to deliver partial recovery

Q4 China Economic Outlook

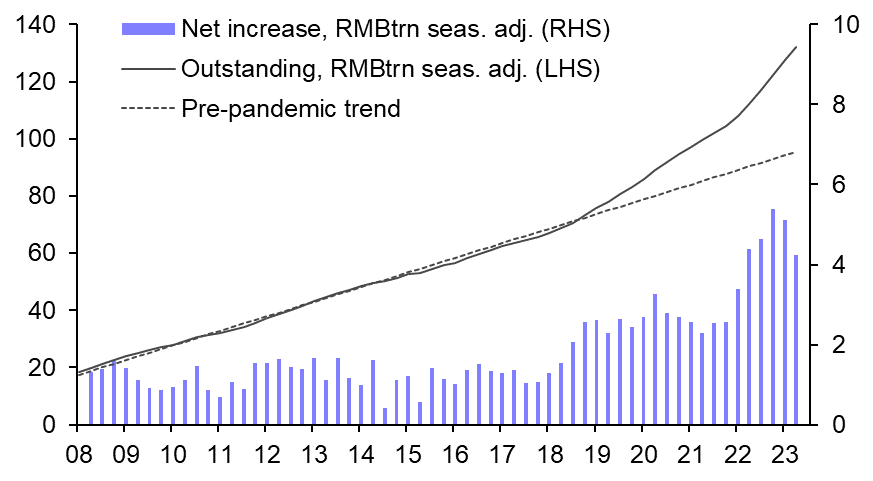

The absence of more aggressive monetary easing doesn’t rule out a cyclical rebound in lending – recent property easing measures could foster a gradual recovery in home sales and mortgage demand in the coming months. At best though, we think this will help overall credit growth stabilise. We do not expect a meaningful rebound.

Below are excerpts from our latest quarterly China Economic Outlook. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or our dedicated China Economics coverage.

Stimulus to deliver partial recovery

China’s economy is regaining some momentum after stalling for a brief period. A step up in policy support looks set to deliver a modest cyclical recovery but trend growth remains under pressure.

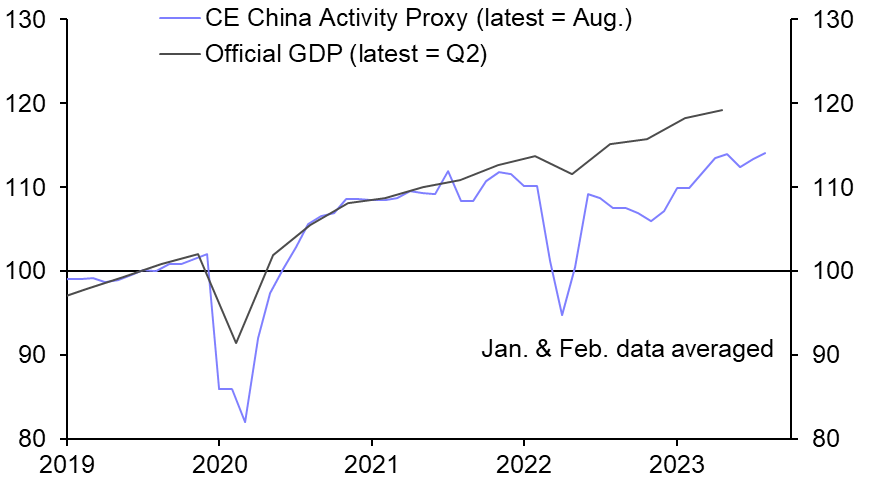

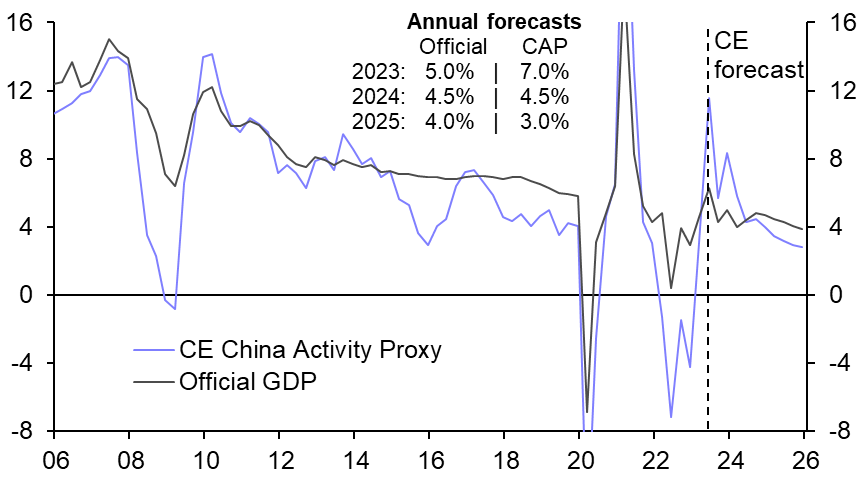

- Official GDP growth slowed to just 3.2% q/q annualised in Q2, its lowest on record outside of the pandemic lockdowns. The reality may have been even worse. Our China Activity Proxy suggests that output levelled off over the summer and hasn’t gained much ground over the past few years. (See Chart 1.)

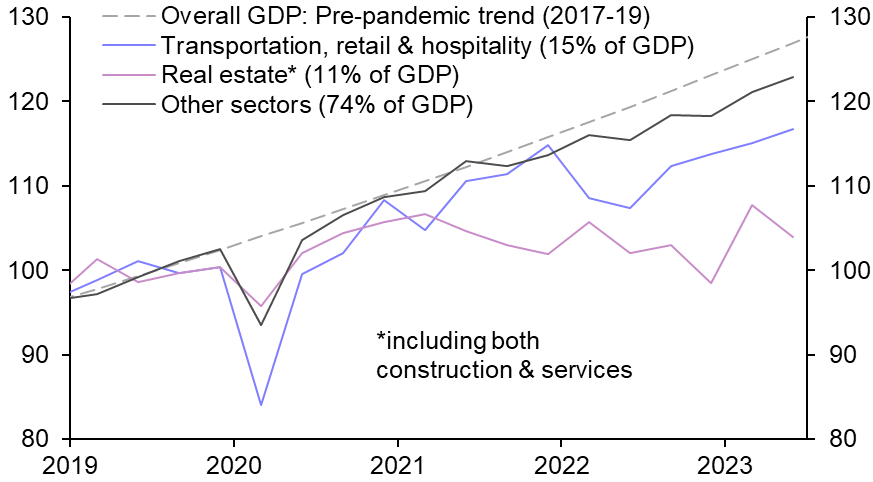

- Much of this slowdown is structural in nature. The GDP breakdown shows that it has been concentrated in the property sector (see Chart 2), which is in the midst of a protracted downturn due to unfavourable trends in demographics and rural-to-urban migration.

|

Chart 1: CE China Activity Proxy & Official GDP |

Chart 2: Official GDP by Sector |

|

|

|

|

Sources: CEIC, Capital Economics |

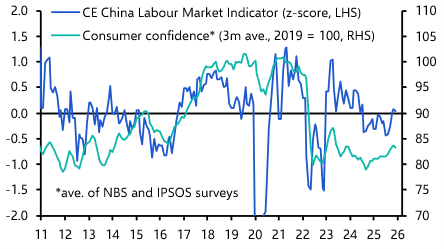

- But there is also a cyclical element to the recent weakness. This mostly reflects caution among households, who are still spending a smaller share of their income than before COVID (see Chart 3) and have shifted their wealth from property and risky financial assets into the safety of bank deposits. (See Chart 4.)

Chart 3: Household Savings Rate (%)

Chart 4: Household Bank Deposits

Sources: CEIC, WIND, Capital Economics

- The good news is that this caution can be at least partly addressed via stimulus, which is being stepped up. The PBOC has cut policy rates and reserve requirements. On its own, this won’t revive sentiment and credit demand. But it is being coupled with wider measures that, in unison, stand a decent chance of working.

- The most significant of these are aimed at shoring up near-term housing demand. The fall in home sales from their 2021 peak has gone beyond what can be explained by structural factors, suggesting that an increasing amount of genuine demand is being deferred.

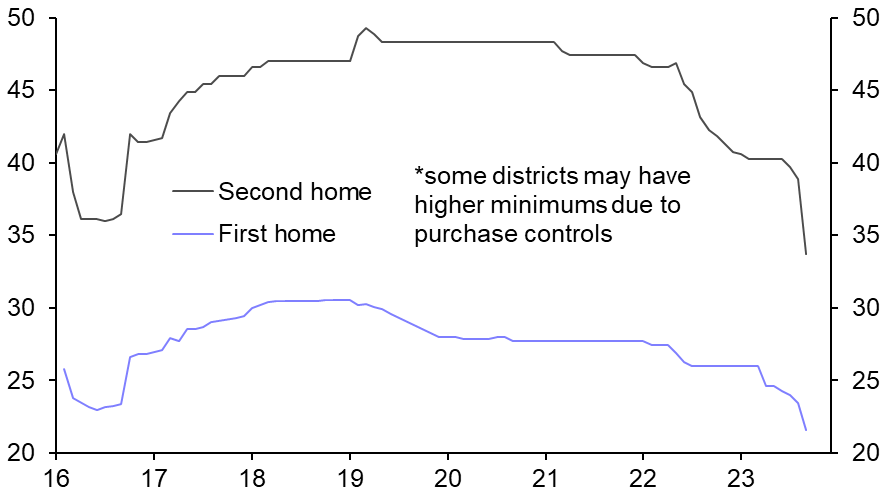

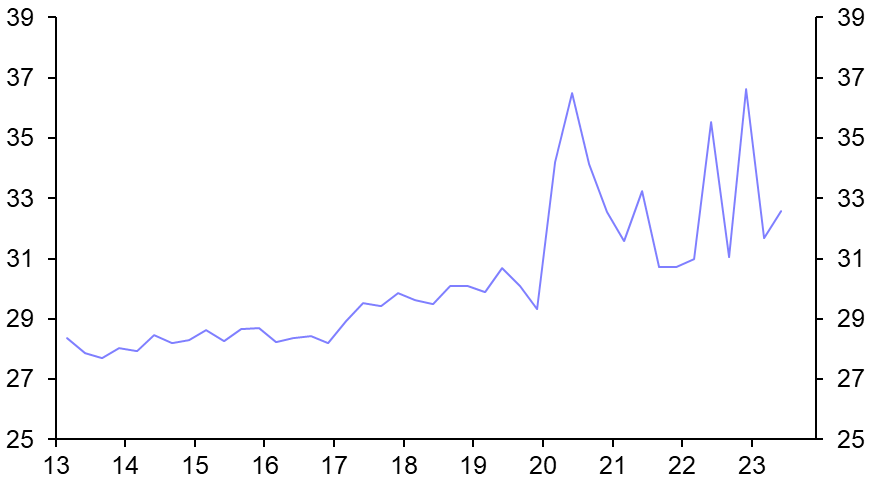

- Recent cuts to downpayment requirements (see Chart 5) and the easing of purchase controls should bring some of these buyers back into the market, driving a cyclical uptick in home sales.

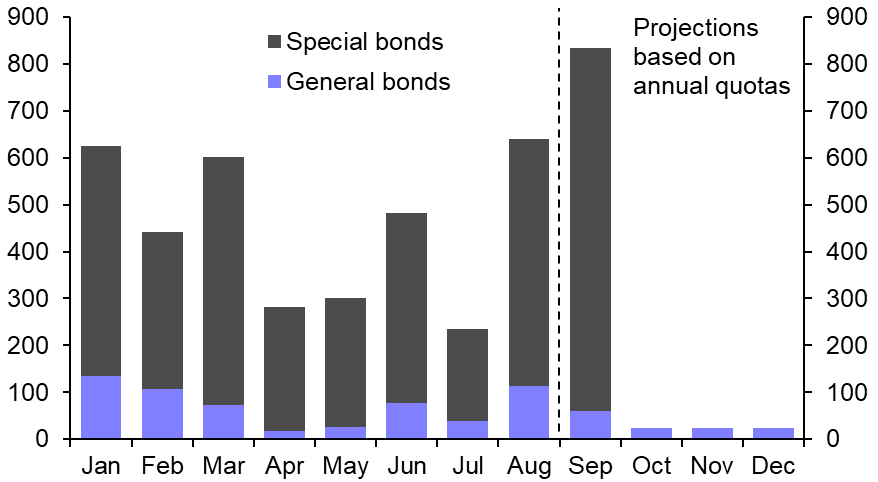

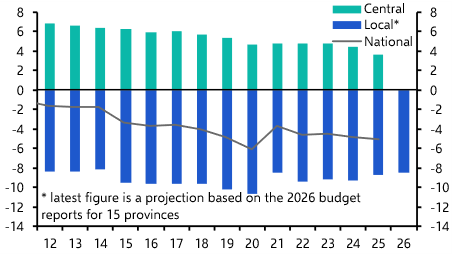

- Local government spending is also picking up thanks to a push to fully utilise their special bond quotas by end-September and deploy the funds by end-October. (See Chart 6.) On paper this implies there will be a pullback in fiscal support later in the year. But officials can lean on quasi-fiscal tools to keep infrastructure spending strong until a new, and likely more-supportive, budget is rolled out next year.

|

Chart 5: Minimum Downpayment Required* |

Chart 6: New Local Government Bond Issuance (RMBbn) |

|

|

|

|

Sources: CEIC, Capital Economics |

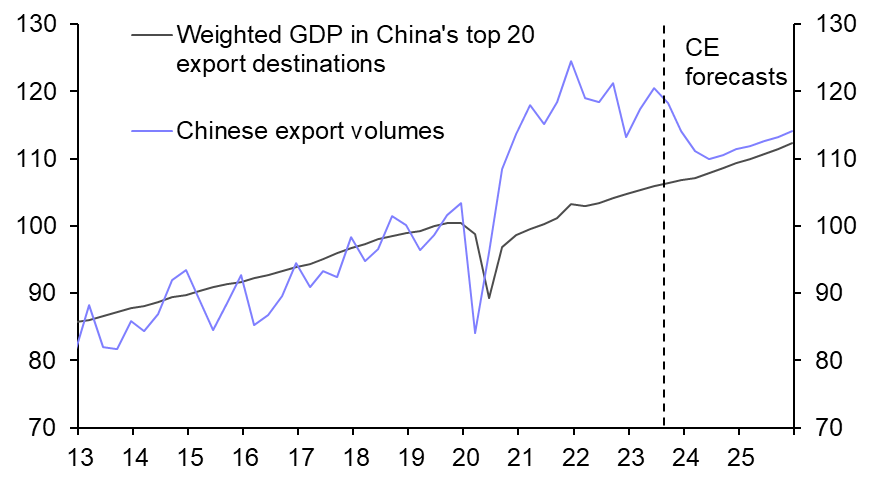

- The external outlook is still challenging. Export volumes remain well above their pre-pandemic trend but that resilience is unlikely to last as goods spending in developed economies softens and geopolitical tensions encourage some production to shift out of the country.

- But Chinese exports should bottom before too long as global growth recovers, putting a floor beneath foreign demand. (See Chart 7.) And in the meantime, the pullback in exports probably won’t be enough to prevent a wider policy-driven pick-up in economic momentum.

- Indeed, a reacceleration in growth is already getting underway. The PMIs, activity data and our CAP have all improved lately. As a result, we have nudged up our forecast for growth this year, as measured by the CAP, from 6.5% to 7.0%. Official GDP, which doesn’t have as far to recover from last year’s downturn, is likely to come in close to the 5.0% target. (See Chart 8.)

- A sustained turnaround is unlikely, however. Structural drags from demographics, global fracturing and diminishing returns to investment mean that trend growth will continue to fall, reaching 2% by the end of the decade.

|

Chart 7: Exports & Trade Partner GDP |

Chart 8: CE China Activity Proxy & Official GDP |

|

|

|

|

Sources: CEIC, WIND, Refinitiv, Capital Economics |

This content is based on a report for Capital Economics clients written by Julian Evans-Pritchard, Sheana Yue and Zichun Huang published on 27th September, 2023.

Make faster informed decisions

CE Advance, our new premium product, equips organisations with actionable macroeconomic data and insight to stay ahead of the curve.