Europe's economy slowing again

Q4 2024 Europe Economic Outlook

The euro-zone appears to have lost some momentum and is likely to remain sluggish in the coming quarters.

These are just some of the key takeaways from our latest quarterly Europe Economic Outlook, originally published on 18th September, 2024. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated Europe Economics coverage.

The euro-zone's core economies are the weakest, led by Germany which is probably in another technical recession and which faces major structural challenges. In contrast, Spain will outperform, thanks in part to rapid immigration, and prospects for Portugal and Greece are fairly bright. Meanwhile, headline inflation looks set to fall well below 2% next year but services inflation will come down more gradually amid a tight labour market. Against this backdrop, we think the ECB will reduce its key policy rate by 25bp every three months until it has fallen to 2.5% in the second half of next year.

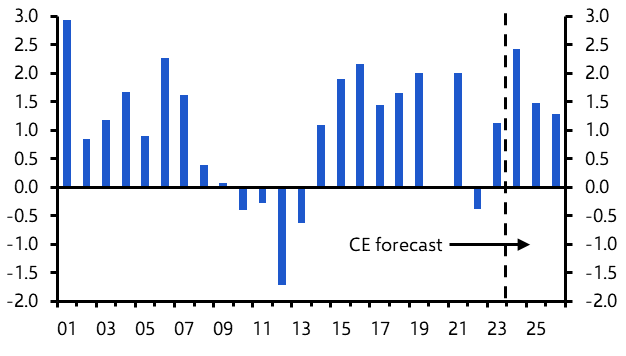

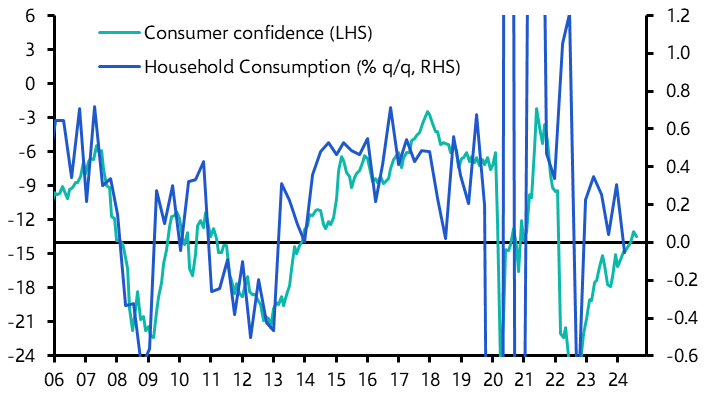

- Real household incomes are growing rapidly. (See Chart 1.) But this is not translating into rapid spending growth because high interest rates and low confidence (see Chart 2) have deterred consumption and pushed the saving rate up to a record high outside the pandemic. We think a big fall in saving is unlikely and looser monetary policy will do little to boost borrowing and spending. (See here.)

|

Chart 1: Euro-zone Real Household Disposable Income (% y/y) |

Chart 2: Consumer Confidence & Household Consumption |

|

|

|

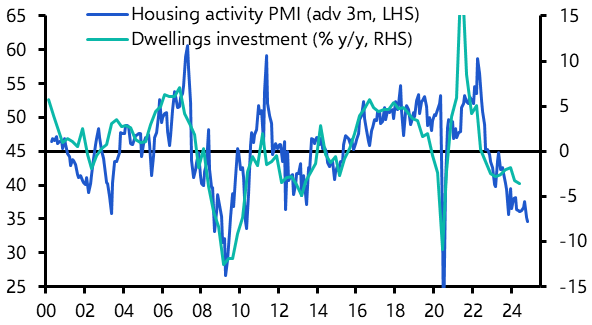

- Investment fell sharply in Q2. Housing investment has now declined in eight of the past nine quarters and the latest surveys suggest this will continue. (See Chart 3.) With corporate profits declining and industrial capacity utilisation low, we suspect that business investment will remain weak too.

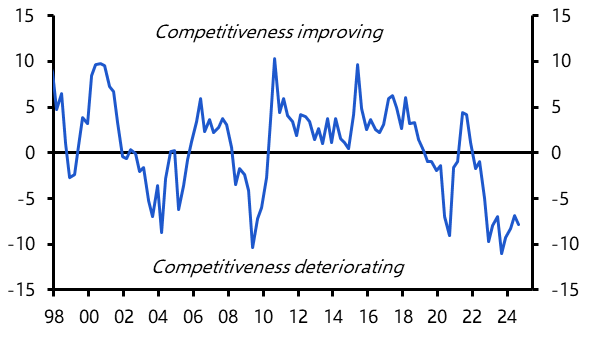

- Excluding Ireland where the data are notoriously volatile, euro-zone export growth was weak in the first half of the year. We expect competitiveness problems to continue to hamper the region’s export performance. (See here and Chart 4.)

|

Chart 3: Dwellings Investment & Housing Activity PMI |

Chart 4: Change in Euro-zone Firms’ Competitiveness (Diffusion Index) |

|

|

|

- As a result of all this, we think that GDP growth will remain weak and underperform the consensus forecasts.

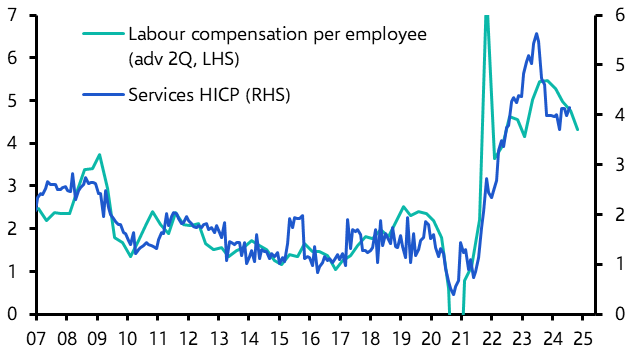

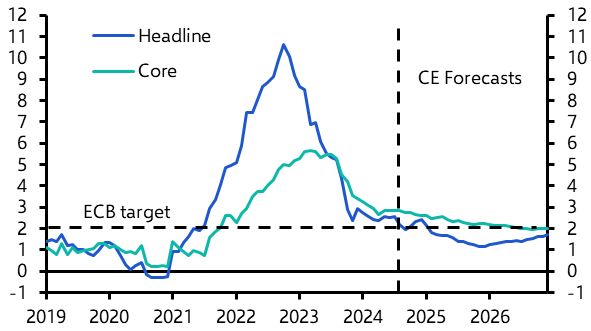

- Inflation has fallen a long way from its late-2022 peak. But so far this has mostly been driven by the reversal of the energy and global supply chain shocks. In contrast, services inflation is still very high.

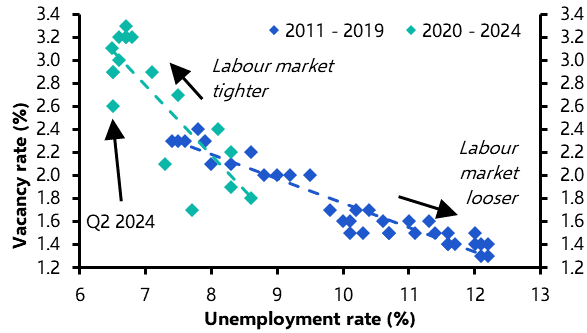

- But the labour market is normalising (see Chart 5) and wage growth is slowing. We think this will contribute to a renewed decline in services inflation in the coming months and throughout next year. (See here and Chart 6.)

|

Chart 5: Euro-zone Beveridge Curve |

Chart 6: Euro-zone Compensation per Employee |

|

|

|

- Headline inflation will edge up in Q4 due to base effects but will then resume its downward trend. If oil and gas prices fall in line with our forecasts, headline inflation could approach 1% by the end of next year before gradually rebounding. The core rate will come down more slowly. (See Chart 7.)

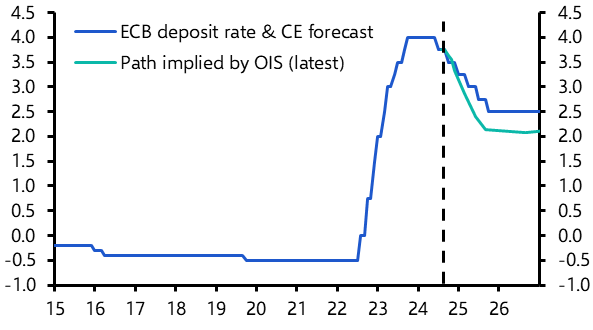

- We think ECB will cut interest rates at a steady pace. (See Chart 8.) There is no need for the ECB to start slashing rates unless downside risks materialise. But equally, we suspect that policymakers won’t want to see much more loosening in the labour market. We forecast 25bp rate cuts each quarter until the deposit rate reaches 2.5% next September.

|

Chart 7: Euro-zone HICP (% y/y) |

Chart 8: ECB Deposit Rate (%) |

|

|

|

|

Sources: LSEG D & A, Focus Economics, ECB, Capital Economics |

More insight and extensive two-year forecasts are available in our full Europe Economic Outlook, including:

- How Germany has probably fallen back into a technical recession in Q3 and will remain the worst performer among the major euro-zone economies in the coming quarters:

- Why the French economy is likely to expand at a modest pace this year but worries about the budget deficit will push up bond spreads.

- How Italy’s post-pandemic outperformance has come to an end as the construction boom has fizzled out.

- Why GDP growth looks set to remain very rapid in Spain, supported by high immigration. But productivity growth will probably be weak, in line with trends during previous economic booms in Spain.

These are just some of the key takeaways from a 24-page report published for Capital Economics clients on 18th September, 2024 and written by Andrew Kenningham, Jack Allen-Reynolds, Franziska Palmas, Adrian Prettejohn, Elias Hilmer and Oliver Wilkes.

Get the full report

Trial our services to see this complete 24-page analysis, our complete European macro insight and forecasts and much more