Q3 2024 China Economic Outlook

Manufacturing boom to shore up growth a while longer

Below are some of the key takeaways from our latest quarterly China Economic Outlook, published 25th June, 2024. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium product or to our dedicated China Economics coverage.

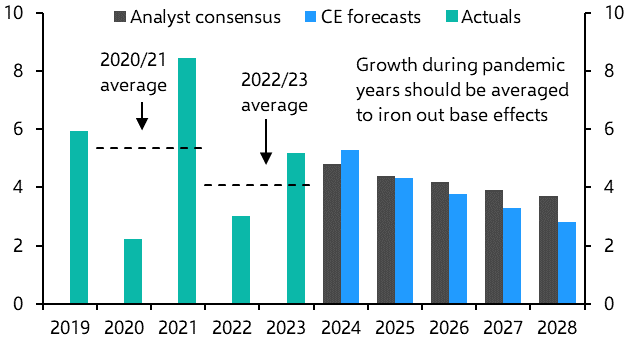

China’s economy is on course to expand by 5.5% this year, buoyed by policy support and strong exports. But we remain less sanguine about the medium-term outlook.

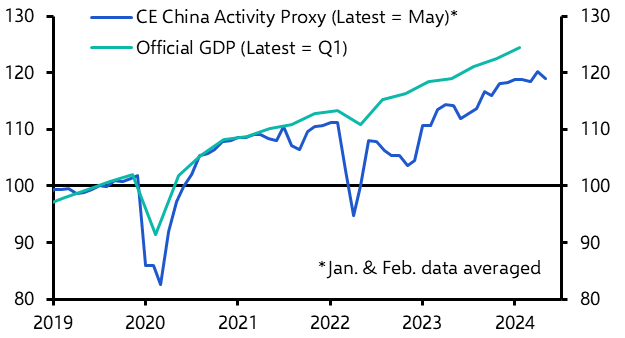

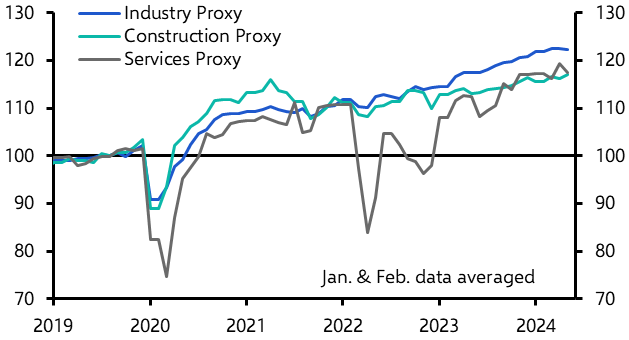

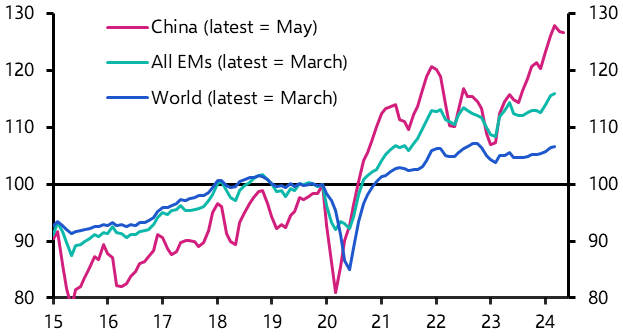

- Our China Activity Proxy (CAP) suggests that the economy is now 20% larger than in 2019, less than the 25% rise shown by the official GDP figures. (See Chart 1.) But both measures point to growth exceeding 5.0% y/y so far this year. The CAP breakdown shows that industry has been the star performer in recent years, while construction activity has lagged. (See Chart 2.)

|

Chart 1: Official GDP & CE China Activity Proxy (2019 = 100, seas. adj.) |

Chart 2: CAP – Sector Proxies (2019 = 100, seas. adj.) |

|

|

|

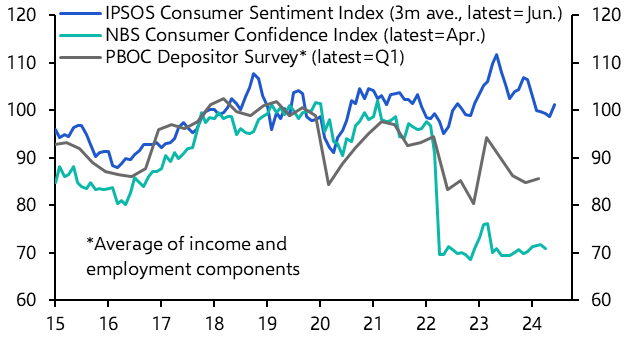

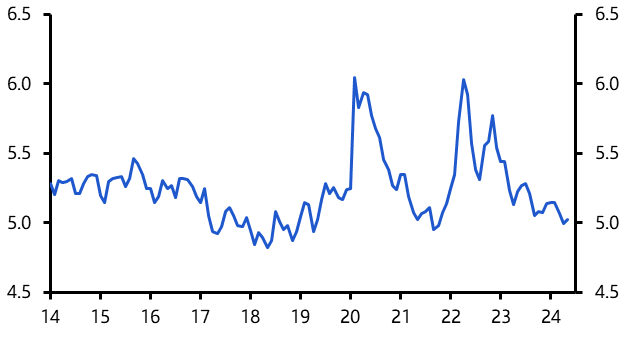

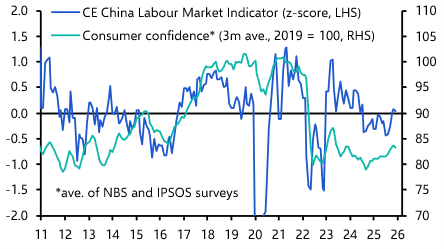

- We think the economy will continue to make good headway in the near-term. Admittedly, consumers are still holding back. The household savings rate remained elevated in Q1 and there are few signs of any improvement in sentiment since then. (See Chart 3.)

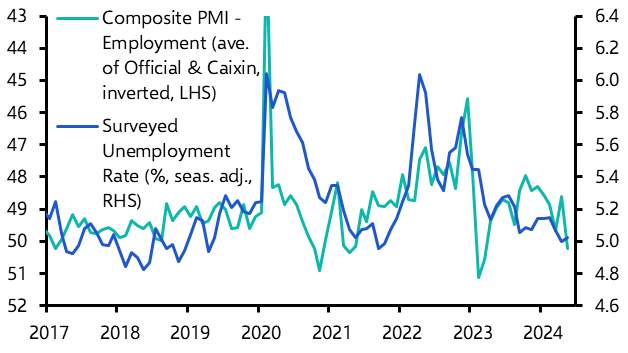

- Confidence may improve somewhat over the coming months given that the labour market is tightening. (See Chart 4.) But negative wealth effects will continue to cast a shadow. The huge backlog of excess housing supply means that property prices look set to fall further even if policy support helps to shore up home sales.

|

Chart 3: Consumer Confidence Indices (2019 = 100) |

Chart 4: Unemployment Rate & Employment PMI |

|

|

|

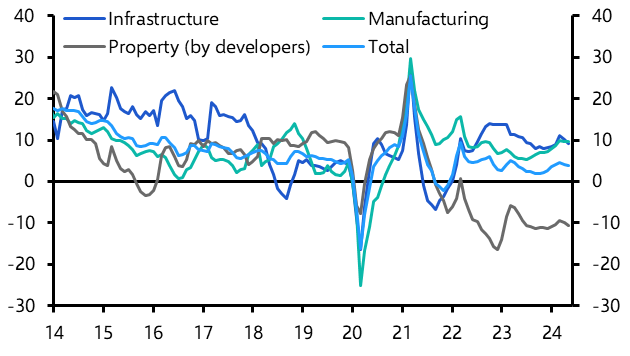

- As such, investment will remain the key engine of domestic demand. Property investment is likely to keep falling. The pace of contraction may ease if policy efforts to channel more credit to developers start to bear fruit by helping them to step up spending on unfinished projects. There is no sign of that so far though.

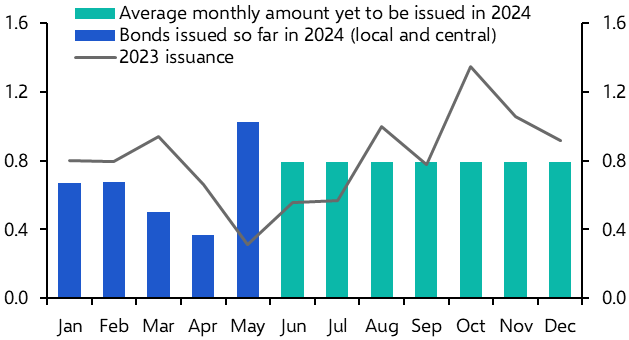

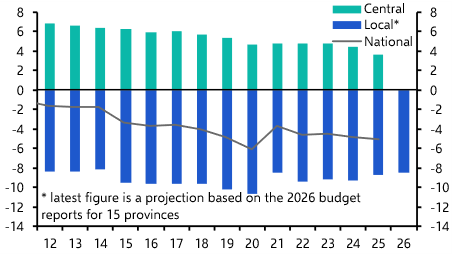

- However, infrastructure investment, which lost some momentum in recent months, should reaccelerate soon thanks to a ramp up in government borrowing. (See Chart 5.)

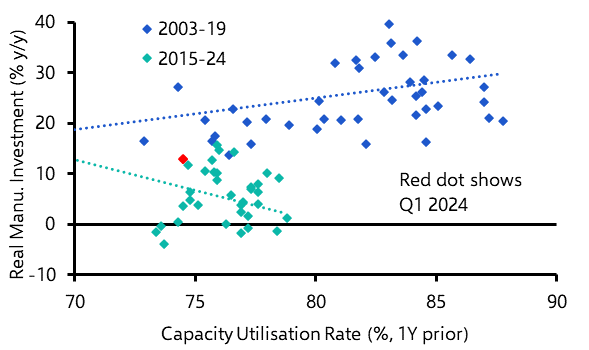

- Manufacturing investment is likely to remain strong. At some point, low capacity utilisation will start to weigh on spending. But this may not happen straight away. Industrial policy has reduced the responsiveness of investment to demand over the past decade. (See Chart 6.) And fiscal incentives are being stepped up to encourage firms to upgrade their equipment.

|

Chart 5: Net Govt Bond Issuance (RMB trn, seas. adj.) |

Chart 6: Manufacturing Investment vs Capacity Utilisation Rate (quarterly data) |

|

|

|

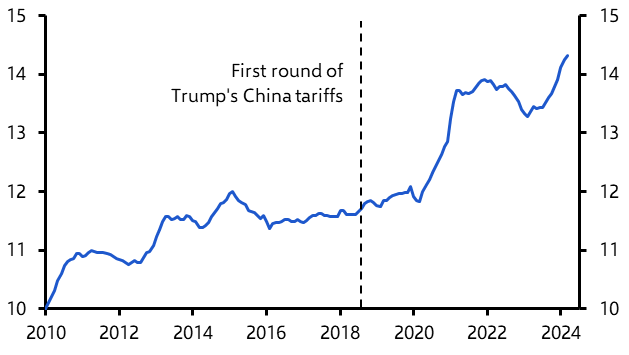

- Exports will remain a near-term source of strength. Rapid expansion of low-cost capacity is allowing Chinese firms to undercut foreign rivals and rapidly gain market share in many sectors. (See Chart 7.) Western governments are hiking tariffs to try to curb the influx. But exporters have become adept at circumventing tariffs by rerouting through third countries.

- Although economic growth is likely to hold up well throughout the rest of this year, there are reasons for caution further ahead. Concerns about government debt risks mean that fiscal policy will be tightened before long. And much of the necessary downward adjustment in construction activity has yet to take place.

- Meanwhile, growth in manufacturing capacity cannot continue to outpace domestic goods demand indefinitely. Imbalances between supply and demand are causing deflationary pressure and financial strains in the corporate sector. And export markets will eventually become a less viable dumping ground as foreign tariffs are made less leaky.

- The leadership is likely to promise wide-ranging reform at the upcoming Third Plenum but, in China’s context, reform can mean more of the same: prioritising manufacturing, innovation and self-sufficiency rather than domestic demand. The constraints that weakened growth over the past decade will sap growth further over the years ahead. (See Chart 8.)

|

Chart 7: China’s Share of Global Goods Exports (%, 12m sum, 2010 prices) |

Chart 8: Official GDP (% y/y) |

|

|

|

Domestic Demand

Rebalancing still needed

- A ramp up in fiscal spending should boost domestic demand in the coming months. But too much focus on investment and persistent weakness in consumer spending will aggravate structural imbalances.

- Consumer spending has cooled recently with retail sales growth slowing to a standstill (See Chart 9), presumably reflecting depressed consumer confidence. In contrast, investment has held up relatively well, though property investment remains a weak link. (See Chart 10).

|

Chart 9: Retail Sales (% 3m/3m, seas. adj.) |

Chart 10: Fixed Investment (3m,%y/y, nominal) |

|

|

|

- Consumer spending should regain momentum in the coming months – its weakness is hard to justify given the tightness of the labour market. The urban unemployment rate has dropped below its pre-pandemic average. (See Chart 11.) But negative wealth effects from property price falls mean that any pick-up will be modest.

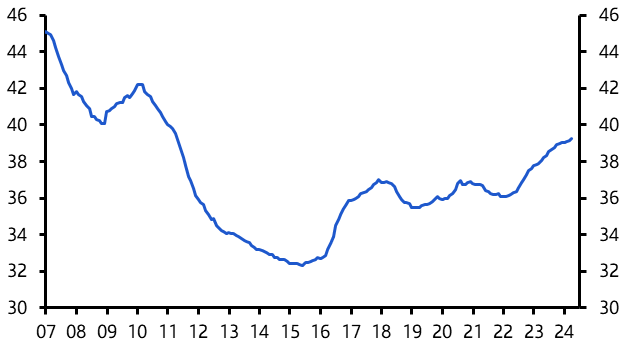

- Instead, investment will remain the key driver of domestic demand. While efforts to support real estate developers are failing to shore up property investment, a ramp-up in fiscal support will continue to boost infrastructure spending and manufacturing capex.

- But the diminishing returns from adding to an already expansive capital stock mean that investment growth will almost certainly slow over the longer-term. Private firms have already pared back their expansion plans. State firms have stepped in to keep spending strong for now. (See Chart 12.) But they can’t do so indefinitely given the mounting pressure on corporate and local government balance sheets.

|

Chart 11: Surveyed Unemployment Rate (%, seas. adj.) |

Chart 12: State Sector Share of Fixed Investment (%) |

|

|

|

- At some point, the composition of domestic demand will need to shift toward consumption. This transition would initially hurt growth but ultimately put it on a more sustainable footing.

External Demand

Grabbing global market share

- Global demand is giving a bigger boost to China’s economy this year than we had anticipated as price-cutting manufacturers have been able to significantly lift their share of global markets. This is triggering a protectionist pushback, but tariffs won’t make much difference to overall exports in the near term.

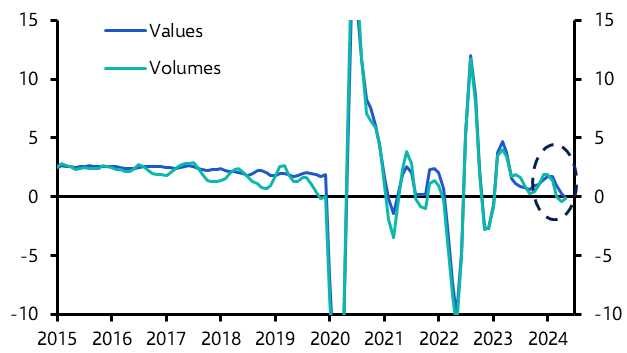

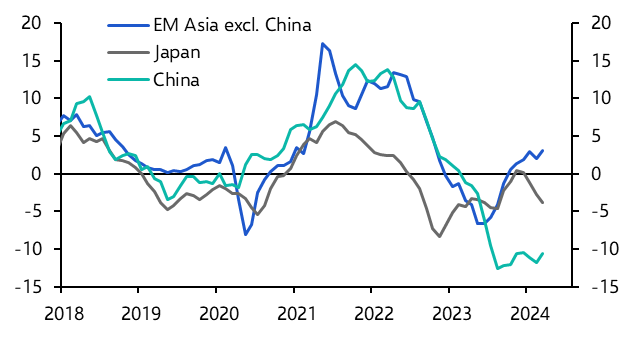

- The unanticipated strength of exports hasn’t been caused by stronger global demand. Global exports have only crept higher recently while China’s have soared. (See Chart 13). Instead, China’s success has come at the expense of other exporters. (See Chart 14.)

|

Chart 13: Export Volumes |

Chart 14: China’s Share of Global Goods Exports (%, 12m sum, 2010 prices) |

|

|

|

- This is the consequence of massive investment in manufacturing. This has, for example, lifted Chinese producers of EVs, batteries and solar panels to the forefront of the global market. But it has also resulted in widespread overcapacity. Chinese firms have slashed prices in competition with each other rather than with foreign firms. (See Chart 15.)

- China’s export success is triggering a protectionist pushback (US, EU). This isn’t a threat in the near-term – indeed, foreign firms may actually be ordering more to front-run possible future tariffs. And previous tariffs didn’t hold back China’s export sector (see Chart 14 again), in part because they were circumvented.

- It does suggest though that China will find it harder in future to use foreign markets to absorb domestic overcapacity, particularly if tariff circumvention is policed more closely. Close to half of China’s manufacturing value-added depends on foreign demand.

- Global concerns would be tempered if China’s demand for imports was rising similarly fast. Instead, they have grown more slowly recently than before the pandemic. (See Chart 16.)

|

Chart 15: Export Prices ($, 3m % y/y) |

Chart 16: Goods Trade |

|

|

|

Sources: CEIC, Refinitiv, Capital Economics

Capital Economics clients get the full analysis, including:

- Monetary Policy – The PBOC doesn’t appear concerned about the continued slide in credit growth and won’t ease policy meaningfully this year.

- Fiscal Policy – A rebound in government borrowing will fuel renewed fiscal expansion over the coming months. But concerns over the growing debt burden will limit how long fiscal policy can remain so loose.

- Inflation – PPI deflation may ease further in the near term but, with overcapacity a structural issue, it won’t go away, while CPI inflation will remain only just clear of zero.

- Property Sector – The latest property rescue package seems to be falling flat. With the right incentive structure, it could be made to work. Success would be measured in much stronger sales. But construction activity would still be set to weaken over the medium-term.

- Hong Kong – While Hong Kong’s economy saw a solid expansion in Q1, this was due to strong export growth. Domestic demand remained weak, and the city still faces serious structural headwinds.

From a report prepared for Capital Economics clients published on 25th June, 2024, written by Julian Evans-Pritchard, Mark Williams, Zichun Huang, Leah Fahy and Gabriel Ng.

Get the full report

Trial our services to see this complete 12-page analysis, our complete China macro insight and forecasts and much more

Make faster informed decisions

CE Advance, our new premium product, equips organisations with actionable macroeconomic data and insight to stay ahead of the curve.