Q2 US Commercial Property Outlook

A tough year in store, but retail returns will be positive

These are just some of the key takeaways from our latest quarterly US Commercial Property Outlook, originally published on 22nd March, 2024. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated US Commercial Property coverage.

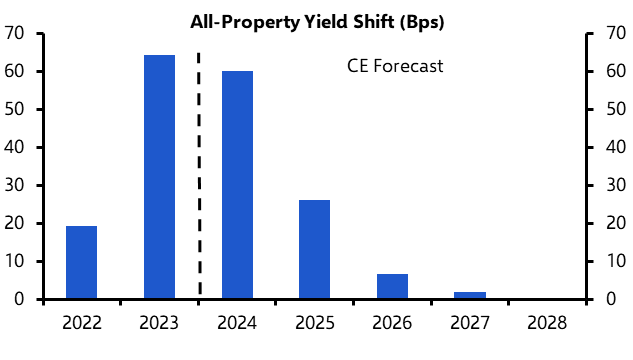

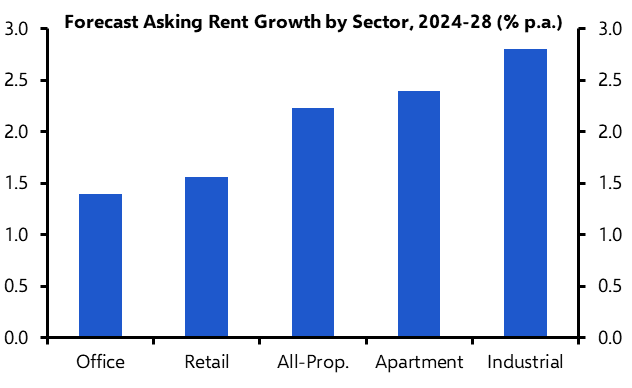

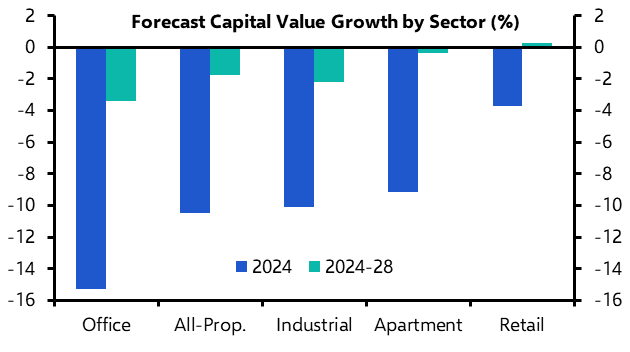

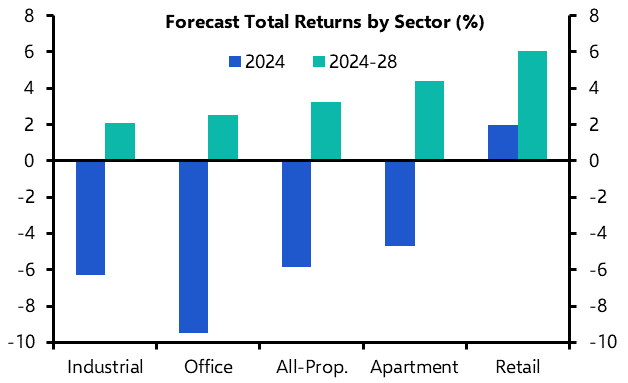

We think activity will gradually pick up in H2, but partly because of the increase in forced sales that we are expecting. That will provide appraisers with greater evidence of value falls and lead to another year of double-digit price falls at the all-property level as cap rates are pushed up by around 60 bps. After this year, improving NOI growth and better relative valuations will see total returns turn positive from 2025. At a sector level though, we think retail will generate positive returns this year, setting it up to be the strongest performer over the 2024-28 period, with a 6% p.a. total return. Conversely, we are forecasting office and industrial returns will be 2%-2.5% p.a. over the forecast, with apartments in-between the two extremes, at around 4.5% p.a.

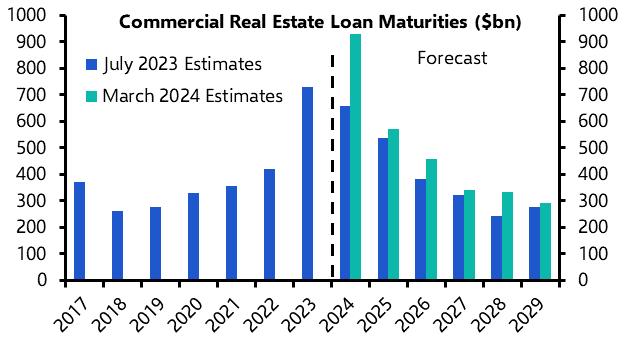

- Investment Market – Transactions activity will stay weak in H1, but we expect a gradual recovery in H2, partially due to more forced sellers bringing distressed assets to market. This should ensure that still-stretched valuations continue to adjust over the next couple of years, with NOI yields rising by around 90-100 bps before reaching a peak. With much of that rise front-loaded to 2024, we expect another 10% fall in values this year and a further few percent in 2025.

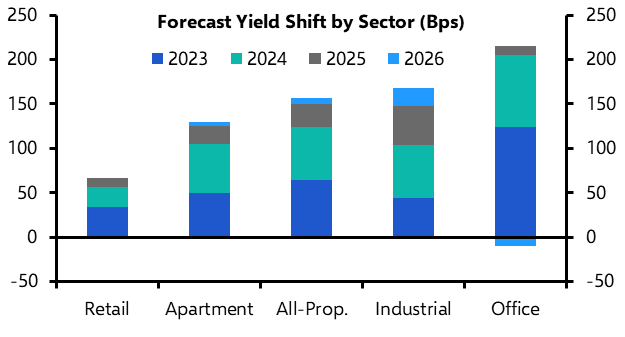

- Office Market – Landlords of all but the newest assets are likely to increasingly feel the pain of reduced occupancy and lower effective rents, which should become more visible this year in the NOI data. With caution still the order of the day, we think NOI yields, which are already 150 bps above their lows, will rise by another 90 bps, mostly in 2024. Together, this will see values drop another 15% in 2024 and 4% in 2025, before very slowly recovering from 2026, meaning total returns reach just 2.5% p.a. in 2024-28.

- Retail Market – We think retail values have seen the majority of their correction. But cyclical weakness in the next year or two and the continued impact of e-commerce will mean the recovery is a relatively weak one. Nevertheless, we think total returns will turn positive this year as cap rates reach a peak and NOIs see steady growth. Over the five-year forecast, we forecast total returns of 6% p.a., making the sector our best performer over the full period.

- Industrial Market – Industrial vacancy should rise a little further this year as new supply remains elevated and demand slows. This will mean rent growth weakens, but as the market stabilises, we expect it to pick up again to 3% p.a. from 2026-28. But with the risk-free rate at or above 4%, this would not be enough to make industrial property look fairly valued at current pricing. We therefore think cap rates will rise by over 100 bps over 2024-26, meaning returns average a little over 2% p.a. in 2024-28.

- Apartment Market – A period of softer demand this year, along with another deluge of new supply, will cause vacancy to climb to 6.4%, its highest level since the end of 2010. Thereafter, vacancy should gradually fall back, supporting an acceleration in rent growth. Nevertheless, we think cap rates need to rise by another 80 bps. That will weigh on capital values, causing them to fall by a further 10% before reaching a floor. Total returns should reach around 4% p.a. over 2024-28.

A chart guide to the USCP outlook

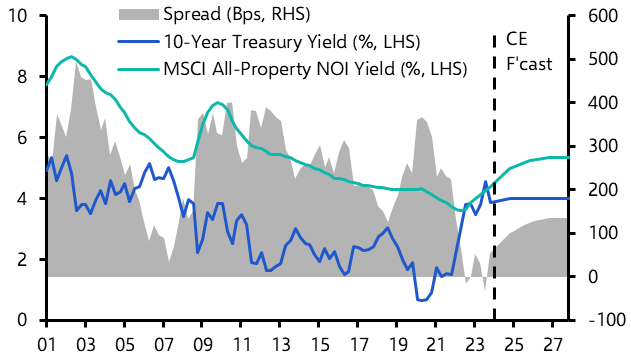

Chart 1: The Fed is set to cut rates this year, but we expect Treasury yields of above 4% over the forecast. |

Chart 2: This means NOI yields need to rise by another 90-100 bps to restore appropriate risk premia. |

|

|

|

Chart 3: The peak in loan maturities this year will bring more distressed assets to market. |

Chart 4: As a result, we expect a large rise in cap rates this year as more sellers become price takers. |

|

|

|

Chart 5: Offices will again see the most pronounced rises in 2024, before giving way to industrial in 2025. |

Chart 6: After a dip this year, apartment rent growth will recover, but industrial will still see the fastest growth. |

|

|

|

Chart 7: A better 2024 means retail will be the only sector that sees a rise in capital values over the forecast. |

Chart 8: That means retail sees the best returns in 2024-28, while industrial suffers from its low income return. |

|

|

|

|

Sources: CBRE, MBA, MSCI, Newmark Research, Refinitiv, CE |

These are just some of the key takeaways from a 13-page report published for Capital Economics clients on 22nd March, 2024. The report was written by Kiran Raichura, Andrew Burrell and Thomas Ryan.

Get the full report

Trial our services to see this complete 13-page analysis, our complete US commercial property insight and forecasts and much more