Europe Economic Outlook: Zeitenwende!

Q2 2025 Europe Economic Outlook

The euro-zone will get a boost from Germany’s decision to ditch its fiscal rules and ramp up defence spending, as well as the relaxation of the EU’s budget rules.

These are just some of the key takeaways from our latest quarterly Europe Economic Outlook, originally published on 21st March, 2025. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Essential premium platform or to our dedicated Europe Economics coverage.

Germany’s decision to scrap its strict fiscal rules and amp up defence spending, combined with the EU’s relaxed budget framework, will provide fresh momentum for the euro-zone economy. But governments other than Germany won’t loosen policy very much, and the region’s industrial sector will continue to suffer from poor competitiveness and weak global demand, with higher US tariffs acting as an additional headwind. So we think economic growth will accelerate, but not dramatically, over the coming year or two. In the near term we expect the ECB to cut its policy rate two more times as growth remains sluggish and core inflation declines. But next year policymakers will raise interest rates again in the face of a Germany-led recovery. Meanwhile, public finances remain fragile in France and Italy so we expect spreads in those countries to rise even as they fall further in Spain and Portugal.

- Outside the euro-zone, we think monetary loosening cycles are over in Switzerland and Sweden. Norges Bank is likely to cut rates a couple of times but leave interest rates high by European standards.

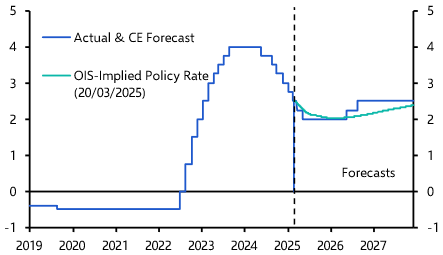

- Looser fiscal policy will provide a small boost to euro-zone GDP growth and core inflation in 2026 and 2027. So after cutting the deposit rate two more times this year, to 2.0%, we think the ECB will raise interest rates again next year.

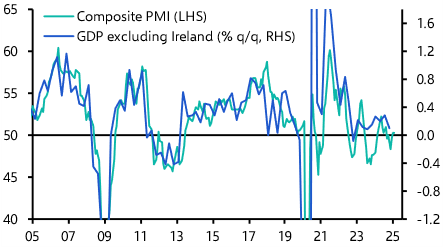

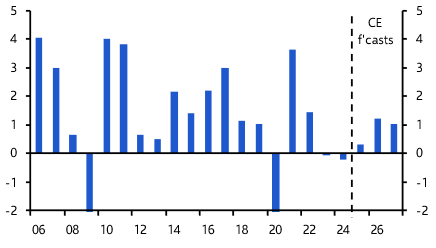

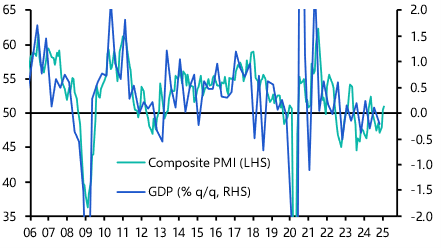

- The business surveys suggest that growth was sluggish in Q1. (See Chart 1.) And we assume that the US will increase tariffs on imports from the EU by 10 percentage points in Q2, which will dent exports further, knocking 0.1-0.2% off euro-zone GDP. The impact would be greater if the US targeted sectors such as autos and pharma with more punitive tariffs.

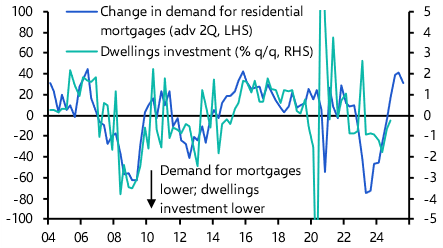

- Uncertainty related to trade policy will also drag on investment, though we suspect that this effect will be smaller than some commentators have suggested. At the same time, lower interest rates should boost construction investment. (See Chart 2.)

|

Chart 1: Euro-zone GDP & Composite PMI |

Chart 2: Euro-zone Mortgage Demand & Dwellings Investment |

|

|

|

- Lower interest rates should also give a boost to consumption as households save a smaller share of their incomes. But that will be offset by slowing growth in aggregate real incomes as employment and wage growth slow.

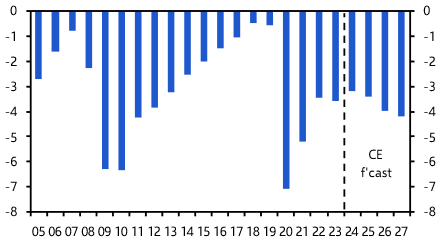

- Next year, looser fiscal policy will give the economy a boost. Our assumption is that there will be a stimulus worth about 0.5% of GDP over the next two years, with most coming in 2026. (See Chart 3.)

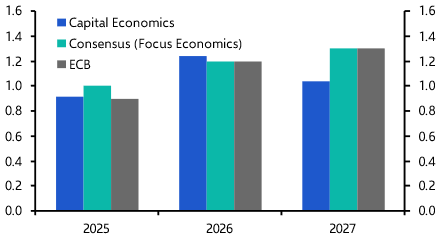

- All told, we think euro-zone GDP will rise by 0.9% this year and 1.2% in 2026. This is higher than we had previously expected. Growth will then slow a touch in 2027 as the fiscal impulse fades and demographic headwinds intensify. (See Chart 4.)

|

Chart 3: Euro-zone Government Budget Balance (% of GDP) |

Chart 4: Euro-zone GDP (% y/y) |

|

|

|

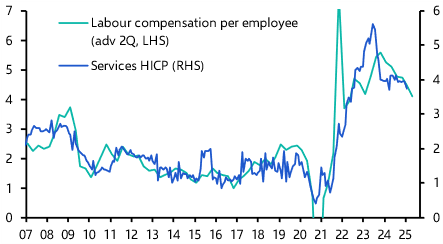

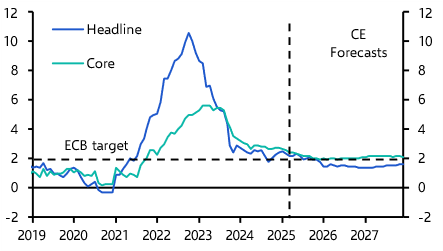

- The labour market will remain tight. Wage growth might be a bit higher than we previously assumed, but it will still slow sharply. (See Chart 5.) That will help to bring services inflation down over the rest of this year. But the impact of looser fiscal policy and faster GDP growth next year will give a small boost to core inflation further ahead. (See Chart 6.)

|

Chart 5: Euro-zone Labour Compensation per Employee & Services HICP (% y/y) |

Chart 6: Euro-zone HICP (% y/y) |

|

|

|

- We suspect that the ECB will cut interest rates in April and June as core inflation declines and higher US tariffs weigh on activity. But we think that it will respond to looser fiscal policy next year by raising interest rates again. (See Chart 7.)

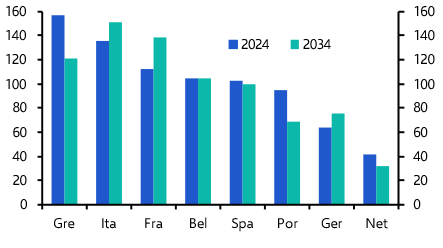

- Overall, recent developments are bad for debt dynamics. Bond yields have risen by a similar amount across the region, but countries outside Germany won’t see as big a boost to nominal GDP growth. This will add to fiscal problems in France and Italy. (See Chart 8.)

|

Chart 7: ECB Deposit Rate (%) |

Chart 8: Gross Government Debt (% of GDP) |

|

|

|

|

Sources: LSEG D&A, Focus Economics, ECB, Capital Economics. |

Germany's turning point

The big fiscal stimulus planned by Germany’s incoming government will return the economy to growth after five years of stagnation. But some of the recent enthusiasm about Germany’s prospects looks overdone particularly as the structural drags on growth are set to intensify.

- The German economy recorded a small contraction for the second year in a row in 2024. (See Chart 9.) However, it looks set to return to decent rates of GDP growth in the coming years.

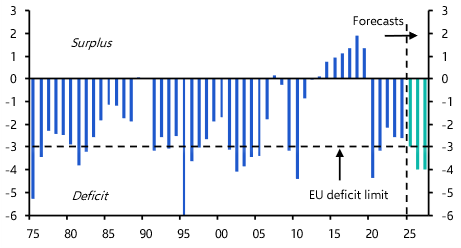

- This is partly because recovering real incomes and the lagged effect of interest rate cuts will support consumption and investment. In addition, a fiscal policy looks set to boost growth significantly. The exact plans of the incoming government are not yet clear. But given the preliminary coalition agreement and the recently approved reform of the national fiscal rule, a widening of the deficit from 2.6% in 2024 to around 4% in 2026 looks plausible to us. (See Chart 10.) This would be one Germany’s biggest deficits other than during a recession in the past forty years.

|

Chart 9: Germany GDP (% y/y) |

Chart 10: Germany General Government Balance (% GDP) |

|

|

|

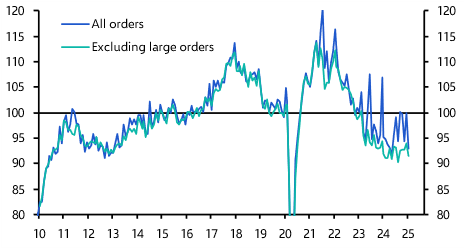

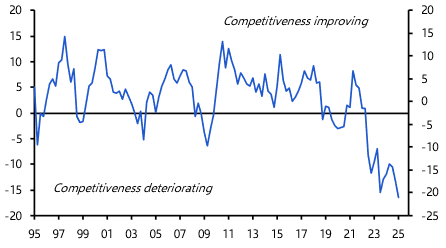

- Growth this year is still likely to be fairly weak as most of the fiscal boost will come in 2026. And most indicators also point to more near-term economic weakness. The Composite PMI is consistent with GDP growth of just 0.1% q/q in Q1. (See Chart 11.) Industrial orders are extremely low and firms are reporting that their competitiveness is still deteriorating, suggesting industrial output and exports will remain subdued. (See Chart 12 & 13.)

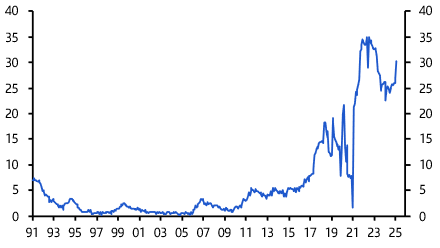

- Growth should accelerate significantly in 2026. But expectations that it will return the pre-pandemic trend of around 2% look too optimistic. The boost to GDP from higher defence spending, which is set to be a key elements of the upcoming fiscal stimulus, will probably be small. And the government may struggle to ramp up infrastructure investment given that construction firms are reporting widespread labour shortages. (See Chart 14.)

|

Chart 11: Germany GDP & Composite PMI |

Chart 12: Germany Industrial Orders (Jan. 2015 = 100) |

|

|

|

|

Chart 13: Germany Industrial Firms’ Self-reported Change in Competitiveness |

Chart 14: Germany Share of Construction Firms Reporting Labour Shortages as Constraint on Production (%) |

|

|

|

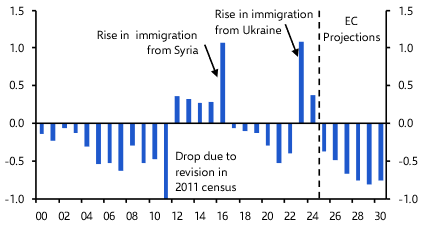

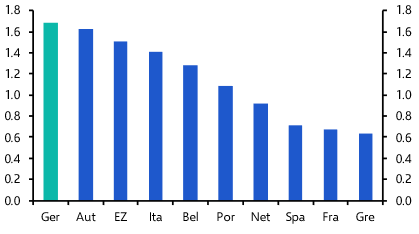

- Moreover, several headwinds will partly offset the fiscal boost. Germany’s working age population will contract at an accelerating rate in the next years. (See Chart 15.) And the structural decline of key industrial sectors, like autos and energy-intensive industry, will continue. Germany would also be hit harder by US tariffs than its euro-zone peers as exports to the US account for a higher share of its value added. (See Chart 16.)

- Overall, yearly growth of around 1% in 2026 and 2027 looks more plausible to us. That would still be a big improvement compared to recent years. (See Chart 9 again.)

|

Chart 15: Germany Working-Age Population (% y/y) |

Chart 16: Share of Domestic Value Added Embodied in US Final Goods Demand (%, 2023) |

|

|

|

|

Sources: LSEG Data & Analytics, Ifo, OECD, Capital Economics. |

More insight and extensive two-year macro forecasts are available in our full Europe Economic Outlook, including:

- Why constraints on increased borrowing for defence and a reduction in its fiscal deficit mean GDP growth in France will stay weak.

- Italian GDP growth will also remain subdued as employment growth slows and the post-pandemic construction boom continues to fade.

- Spain’s economy will continue to outperform in 2025, even as a tight labour market and a strong outlook for demand suggest that it will overheat further ahead.

These are just some of the key takeaways from a 24-page report published for Capital Economics clients on 21st March, 2025 and written by Andrew Kenningham, Jack Allen-Reynolds, Franziska Palmas, Adrian Prettejohn, Ankita Amajuri and Oliver Wilkes.

Get the full report

Trial our services to see this complete 24-page analysis, our complete European macro insight and forecasts and much more