Q2 2024 Global Economic Outlook

On course for a soft landing

These are the key takeaways from our Q2 Global Economic Outlook, originally published on 28th March, 2024. Some forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated Global Economics coverage.

This year we expect GDP growth to come in below trend, meaningful recessions to be avoided, and the US to continue outperforming its DM peers. As the drag from past monetary tightening fades, growth should pick up towards trend rates going into 2025, although growth in China will succumb to structural headwinds. Inflation should fall further, allowing central banks to cut policy rates back to neutral levels.

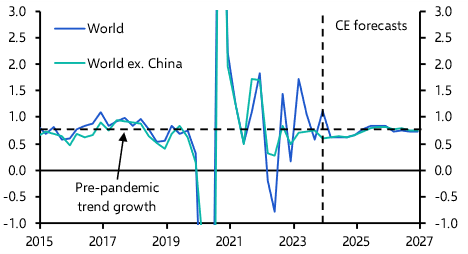

- 2023 was the year when central bank-induced recessions didn’t happen. A variety of factors including strong private sector balance sheets, favourable supply chain conditions, falling commodity prices, and recoveries in labour supply combined to offset much of the headwind from higher interest rates. Some of these tailwinds are fading while tight monetary policy continues to bear down on activity, so we expect global growth to be below trend in the coming quarters (see Chart 1), though meaningful recessions should be avoided.

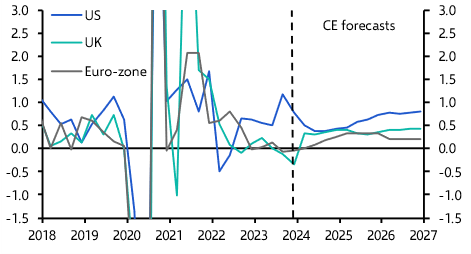

- 2023 was also a year of US macroeconomic outperformance within advanced economies, and we expect this trend to continue. (See Chart 2.)

|

Chart 1: GDP (% q/q) |

Chart 2: GDP (% q/q) |

|

|

|

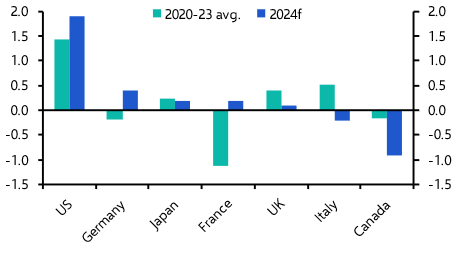

- After all, unlike other DMs, the US is in the midst of a cyclical upturn in productivity which we expect to continue. (See Chart 3.) Stronger productivity will feed into comparatively strong growth in real average incomes, which in turn will sustain a stronger recovery in consumption after a slowdown in the near term.

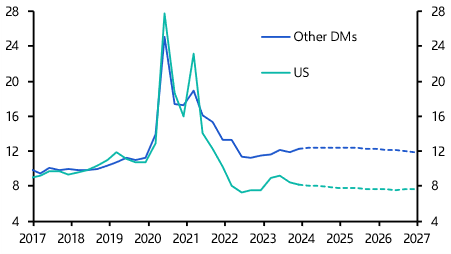

- In addition to enjoying stronger income growth, we suspect that a continued surge in equity prices will boost the net worth of households in the US much more than those in other DMs. The rise in wealth will facilitate households in the US saving a smaller share of their income than before the pandemic, in contrast to those in other advanced economies. (See Chart 4.) On top of relative tailwinds in the US, growth in the euro-zone – and a lesser extent the UK – will be held back by tighter fiscal policy.

|

Chart 3: Productivity (% y/y) |

Chart 4: Household Gross Saving Rates (% of Income) |

|

|

|

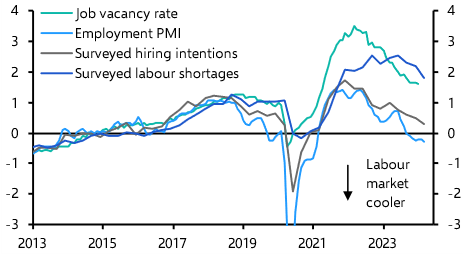

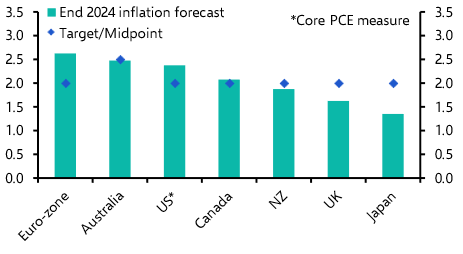

- A mixture of softening demand and improving supply should see labour markets continue to cool across DMs (see Chart 5), even as unemployment rates barely rise. In conjunction with benign supply chain conditions, no big increases in commodity prices and, in the US, collapsing rent inflation, inflation should return to central bank targets in the second half of the year, despite some apparent signs of ‘stickiness’ in several DMs in recent months. (See Chart 6.)

|

Chart 5: G7 Average Labour Indicators (Z-Scores) |

Chart 6: End-24 Inflation vs. Central Bank Targets (%) |

|

|

|

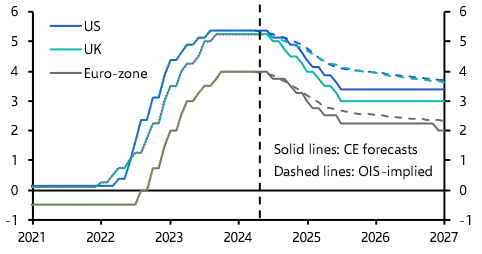

- Soft growth and falling inflation will give major DM central banks what they need to begin cutting interest rates from the middle of this year. Because we think that growth and/or inflation will broadly undershoot consensus expectations beyond 2024, we forecast interest rates to fall a bit further than what is implied by current market pricing. (See Chart 7.) However, if Donald Trump returns to the White House and ushers in significant restrictions on trade and immigration, this would boost inflation and the Fed might have to keep interest rates higher than otherwise in 2025 and beyond.

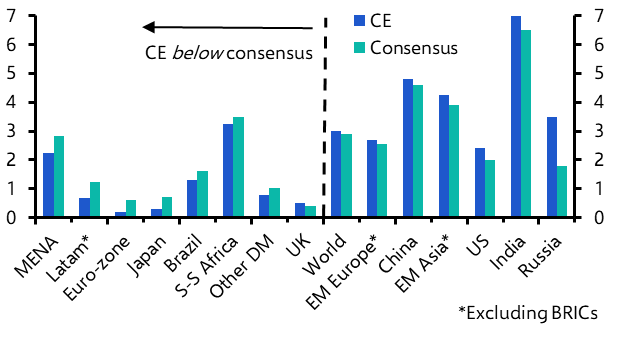

- GDP growth across much of the emerging world will fall short of consensus expectations this year, though Asia will fare better than other EM regions and India will continue to be a particular bright spot. (See Chart 8.) While inflation is likely to fall at a slower pace from here, we expect the EM monetary easing cycle to broaden out. In China, we think that the cyclical recovery underway will continue in the coming months as more stimulus comes through. Before long, though, we expect structural problems – particularly in the property sector – to drag growth down towards 3% on our measure (although official GDP growth will probably come in a bit higher).

|

Chart 7: Policy Interest Rates (%) |

Chart 8: CE vs. Consensus 2024 GDP Forecasts (% y/y) |

|

|

|

|

Sources: Refinitiv, S&P Global, Focus, Capital Economics |

These are takeaways from a 34-page report written for Capital Economics clients by Jennifer McKeown, Simon MacAdam, Ariane Curtis and Lily Milard, originally published on 28th March, 2024. The full report provides extensive near- to long-term economic forecasts as well as country, regional and markets analysis, including:

US – GDP growth will fall below potential in the near term as the effects of past policy tightening feed through. But the US will still outperform its DM peers, and a cyclical recovery will be in motion later this year. Inflation should soon resume its downward trend, albeit with future upside risks from tariffs and immigration limits.

Euro-zone – After GDP stagnating in the first half of this year, we expect the recovery to be slow as fiscal policy tightens. Inflation will be back at the 2% target by mid-year, allowing the ECB to start cutting rates in June.

Japan – As the peak squeeze on real incomes comes to an end, GDP growth should settle back to its potential pace of about 0.5% this year. Price pressures are not strong enough to justify further rate hikes from the BoJ.

UK – We think that inflation in the UK will undershoot that in the US and euro-zone, falling below 2% this year and staying there. This will give the BoE scope to cut interest rates by more than most expect.

Canada – A reduction in temporary resident numbers will weigh on price pressures, prompting more rate cuts.

Australia & New Zealand – Below-trend growth will allow both the RBA and RBNZ to cut rates in H2 2024.

China – Looser fiscal and credit policies will continue to prop up investment in the near term and the property downturn may alleviate somewhat too. But the cyclical upturn will fade before the year is out. China’s export boom is unsustainable, and the downward adjustment in construction activity is only in its early stages.

India – Growth will be strong enough to allow India to become the world’s third largest economy by 2027.

Other Emerging Asia – Soft domestic demand, easing inflation and stronger currencies will soon enable rate cuts.

Emerging Europe – Recoveries will strengthen, but so too will inflation, so policy will remain restrictive.

Latin America – Even though growth will remain tepid, resilient price pressures will limit the scale of rate cuts.

Middle East & North Africa – Unwinding OPEC output cuts should lead to a pick-up in growth in the Gulf.

Sub-Saharan Africa – While the external environment should improve, tight policy will constrain recoveries.

Commodities – A relaxation of production restraint by OPEC+ should offset a modest recovery in oil demand to pull the Brent crude price down to US$60pb by end-26. In the near term, industrial metals prices will benefit from policy stimulus in China, but China’s construction downturn will drag prices down again further ahead.

Get the full report

Trial our services to see this complete 34-page analysis, our complete Global Economics insight and forecasts and much more