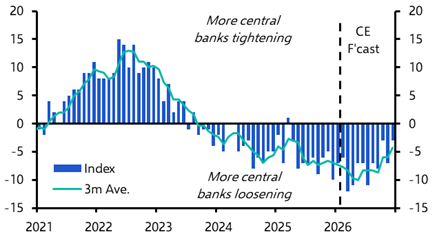

Emerging market economies have so far come through the biggest global tightening cycle in a generation in fairly good shape. But their economies are now slowing and their central banks are turning from rate hikes to policy easing.

As this cycle turns, economists from across our emerging markets teams will explain why they think EM growth will slow faster than the consensus expects, but also highlight which central banks will move most quickly and most aggressively to loosen policy.

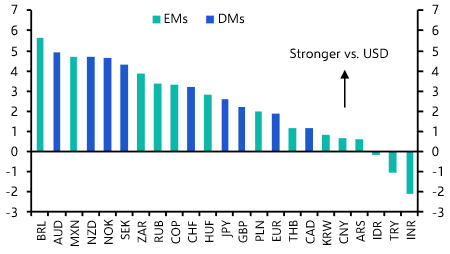

They will be joined by their colleagues from our Financial Markets team, who will explain the impact on EM FX, equities and bonds.

During this special 20-minute session, the team will be answering your questions as they highlight key takeaways from their recently-published Q3 Outlook reports, including:

- Why we’re mostly below consensus on EM GDP growth;

- Why rate cuts in Latin American and Emerging Europe will be constrained by persistent inflation;

- Where FX and sovereign debt risks are greatest.

This content requires an active Capital Economics subscription to view. Please log into your account or contact support@capitaleconomics.com if you are interested in a complimentary access period.