Commodities

Our commodities coverage provides detailed analysis, independent forecasts, and market outlooks for global commodities. We offer rapid responses to new data and developments, along with in-depth coverage of key themes, current trends, and future market dynamics.

Capital Economics named most accurate commodities price forecaster

Our Commodities team earned the highest number of awards and first-place rankings in the FocusEconomics 2024 forecast accuracy awards, including recognition as the most accurate forecaster of WTI crude oil, liquefied natural gas, and US steel.

This service offers high-level coverage of all the most important commodities, with in-depth analysis and independent forecasts for Energy, Metals and Agriculturals, in addition to pan-commodity themes.

The subscription to this service includes 3-5 emailed publications a week, access to our online research archive and our economists, and the opportunity to attend our conferences, forums and webinars.

- Timely insight into the latest market developments.

- Authoritative research by proven experts.

- Rapid responses, concise summations, detailed analysis, & independent forecasts.

Explore our Commodities Data & Insights

Explore Commodities in data

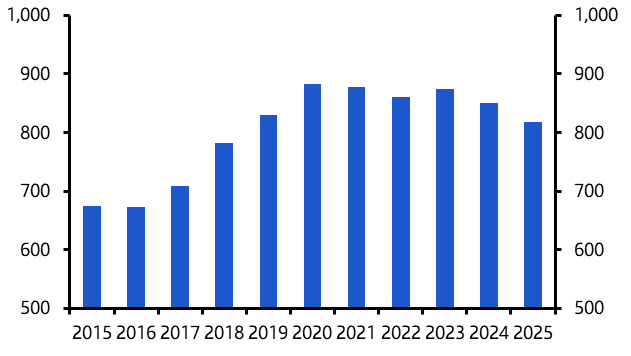

Our interactive Commodities Dashboard gives you the historical data and Capital Economics forecasts you need to track the outlook for key commodities. Available for data subscribers now.

Our Economists Recommend

Our latest timely analysis and in-depth insight

Key Regular Reports

The latest editions of our Weekly Wrap, Outlook & Chart Pack

Try for free

Experience the value that Capital Economics can deliver. With complimentary 2-week access to our subscription services, you can explore comprehensive economic insight, data and charting tools, and attend live virtual events hosted by our economists.

All Commodities Coverage

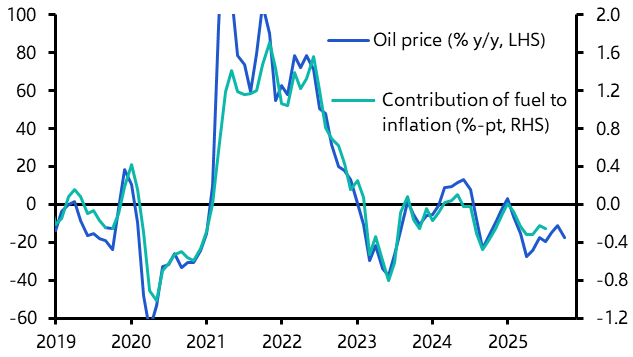

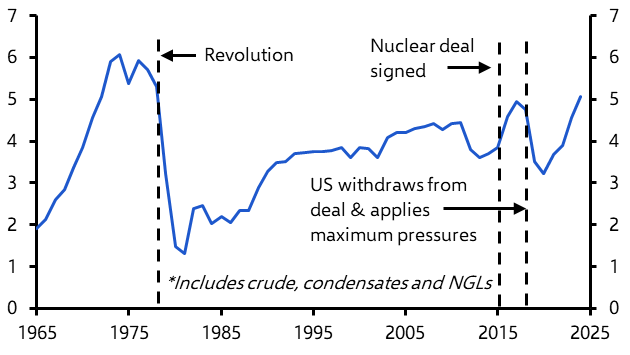

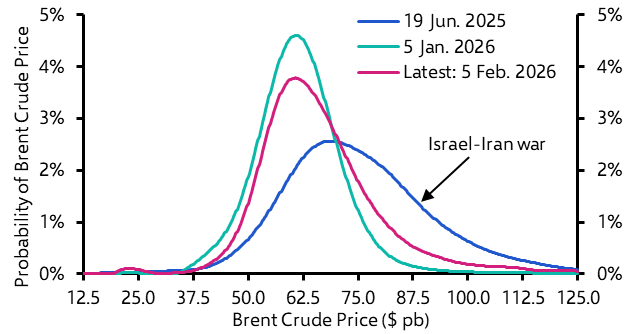

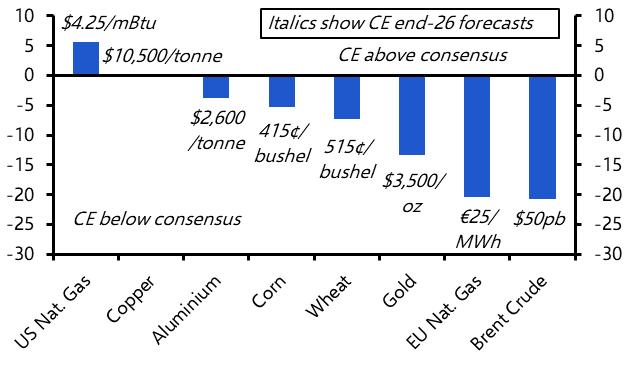

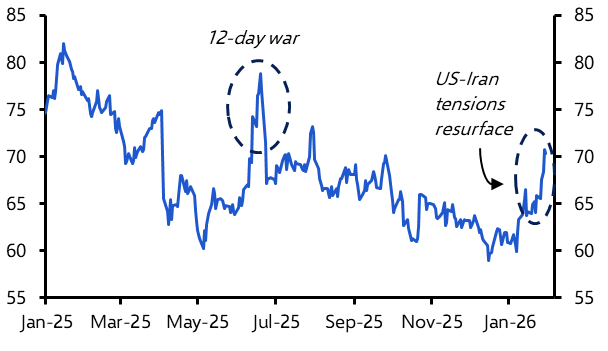

Oil

Our View: We expect the combination of higher OPEC+ supply and subdued global demand growth to push oil prices lower in 2026.

Get ahead of the risks from tariffs

Explore our brand new Oil Tariff Impact Tracker to follow near-term changes in North American oil production, trade flows, and prices. Available for data subscribers now.

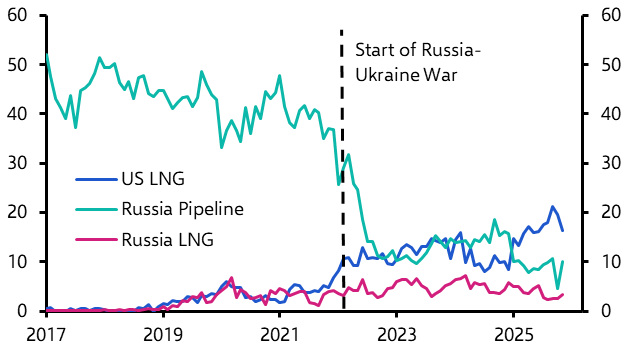

Natural Gas & LNG

Our View: Natural gas prices in Europe and Asia will fall as more LNG supply becomes available. Meanwhile, the rise in AI-related energy demand will support US natural gas prices.

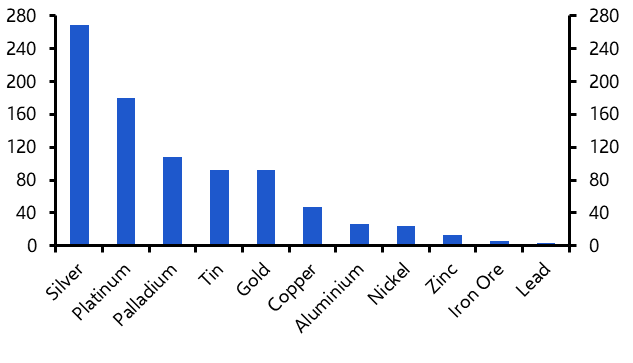

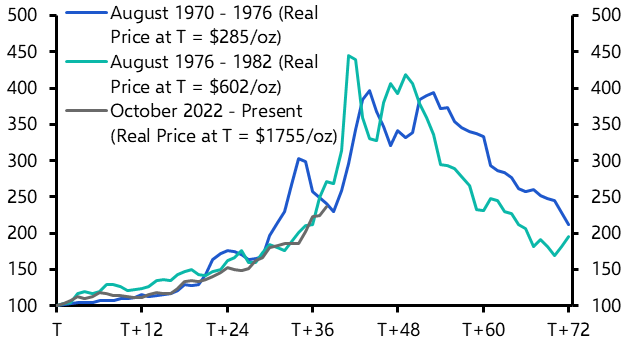

Gold & Silver

Our View: Precious metals prices have risen beyond the levels that we think would be justified by the fundamentals. Accordingly, we forecast prices to fall across the board this year.

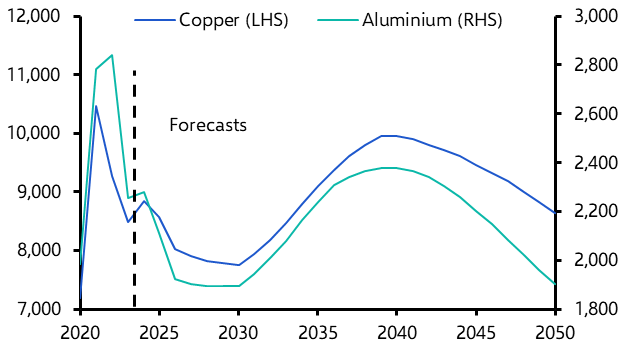

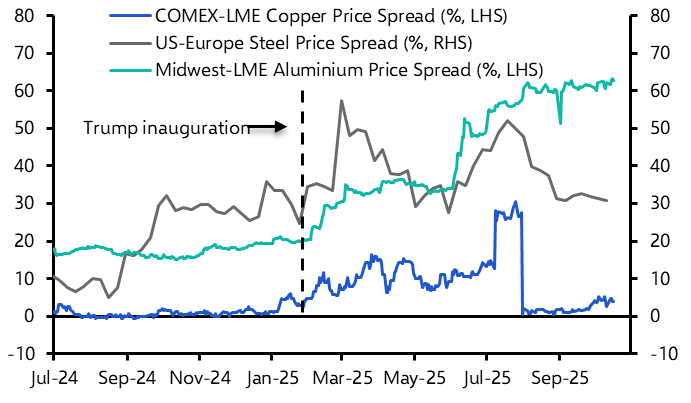

Aluminium & Copper

Our View: While constrained supply of copper and aluminium will keep prices higher than otherwise, we suspect much of the bad news on supply is now priced in. As such, we suspect renewed softness in demand growth will cause prices to come off their recent highs.

Steel & Iron Ore

Our View: Despite the risks posed by tariffs, prices will decline over 2026 against the backdrop of weak demand.

Agriculturals

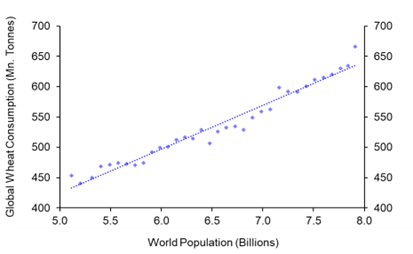

Our View: Grains and soybean prices are likely to fall by end-2026 due to improved supply, an easing in demand growth in China, and lower oil prices.

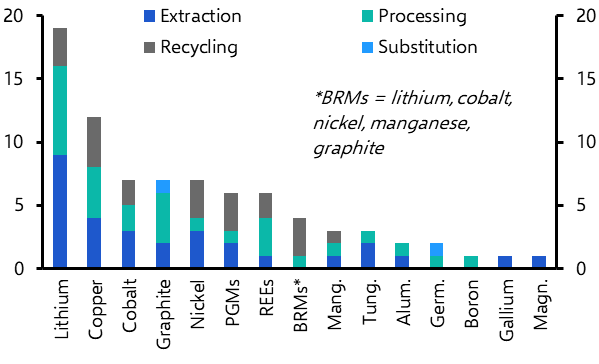

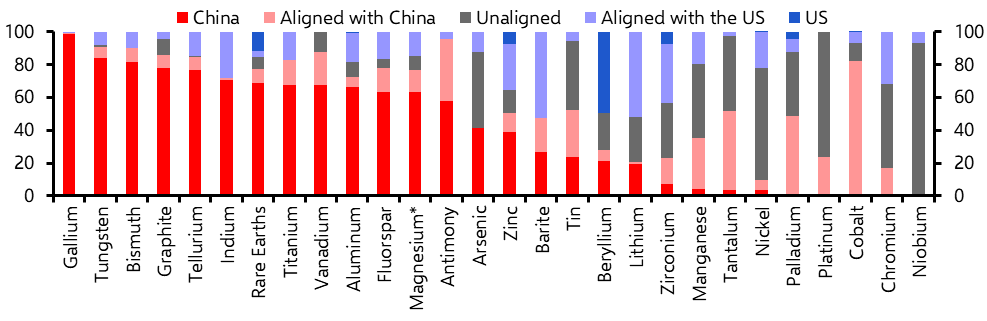

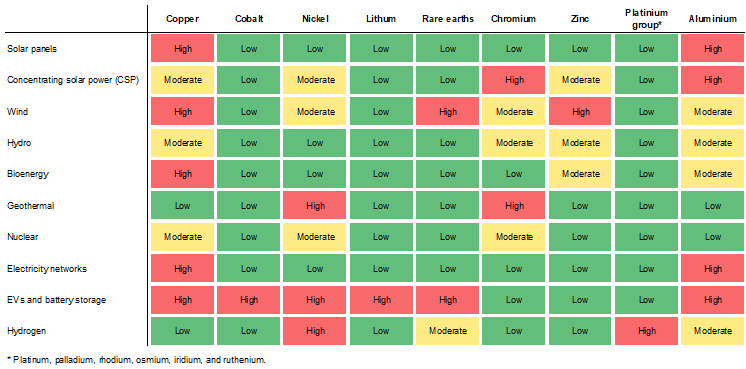

Rare Earths & Critical Minerals

Our View: There is no quick fix to securing access to minerals given the extent of China’s advantage across the value chain. However, while this may be an issue for politicians and some industries, the threat to inflation appears to be limited.

Featured Economists

-

David Oxley

Chief Climate and Commodities Economist

David Oxley joined Capital Economics in 2009 and is Chief Climate and Commodities Economist. Previously, he was in charge of our Swiss & Nordic coverage as well as contributing more generally to the Europe Economics service. David has extensive international experience as a macroeconomist in both the private and public sectors. He has lived and worked in both New Zealand and Switzerland. David has degrees in Economics from University College London and Queen Mary, University of London.

-

Kieran Tompkins

Senior Climate and Commodities Economist

Kieran is a Senior Climate and Commodities Economist and has been with Capital Economics since 2020. He has worked across our Global, UK, and Markets teams and currently sits on our Climate and Commodities desk, primarily contributing to our Energy and Metals coverage. Kieran’s work has been featured in leading media outlets including the BBC, Bloomberg and the Financial Times. He holds a BSc in Economics from the University of Exeter, and an MSc in Economics from City, University of London.

-

Olivia Cross

Climate and Commodities Economist

Olivia Cross is a Climate and Commodities Economist who joined the Capital Economics graduate training scheme in September 2021. She previously spent a year on placement at the company as part of her undergraduate degree. Olivia holds a degree in Economics with Politics from Loughborough University.

-

Hamad Hussain

Climate and Commodities Economist

Hamad is a Climate and Commodities Economist and has been with Capital Economics since 2023. His work focuses on analysing the macro forces driving commodity prices and the key themes at the heart of the green transition. Hamad’s views are regularly quoted by international media outlets such as Bloomberg, the Financial Times and the Wall Street Journal. He holds a degree in Economics from the University of Surrey.

-

Megan Fisher

Assistant Economist

Megan joined Capital Economics in September 2025 as an Assistant Economist, as a part of the graduate scheme. She previously spent a year at the company as a placement student during her undergraduate degree. Prior to joining, she completed an internship in Nomura's Global Markets division. Megan holds a degree in Economics from University College London.