Recovery needs help but isn't dead yet

Q3 China Economic Outlook

Some caution over the near-term outlook is clearly warranted. But given the prevailing pessimism, the bar for an upside Chinese economic surprise is low.

This is a sample of our latest quarterly China Economic Outlook, originally published on 28th June, 2023. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium product or to our dedicated China Economics coverage.

China’s reopening recovery is struggling for momentum and quarter-on-quarter growth will be subdued for the rest of the year. But with policymakers likely to step up support soon, the economy should still make some headway.

- The reopening recovery is struggling for momentum and quarter-on-quarter growth will be subdued for the rest of the year. But with policymakers likely to step up support soon, the economy should still make some headway.

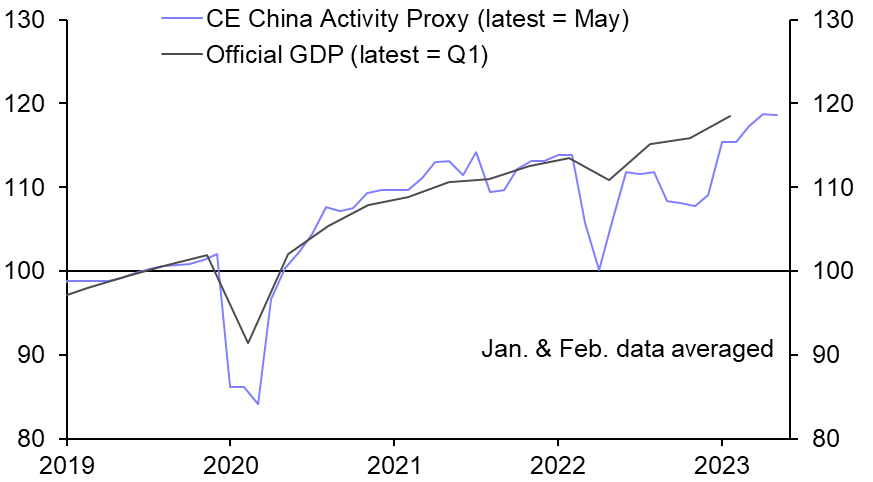

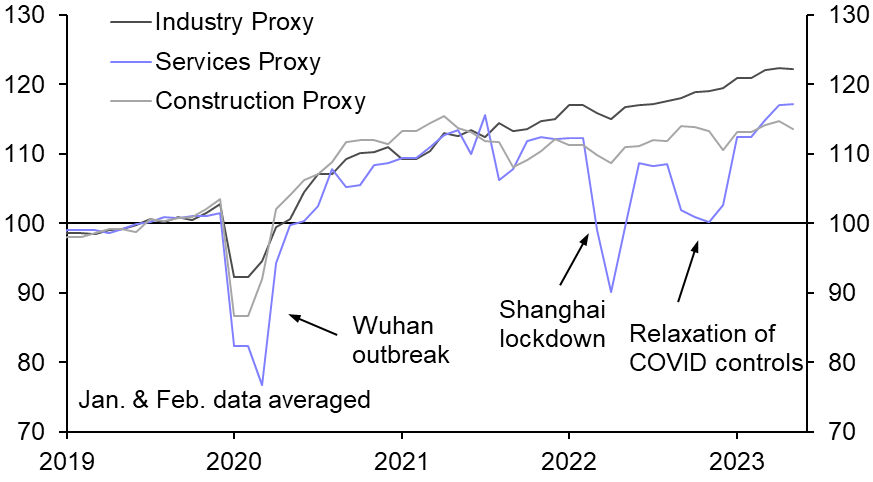

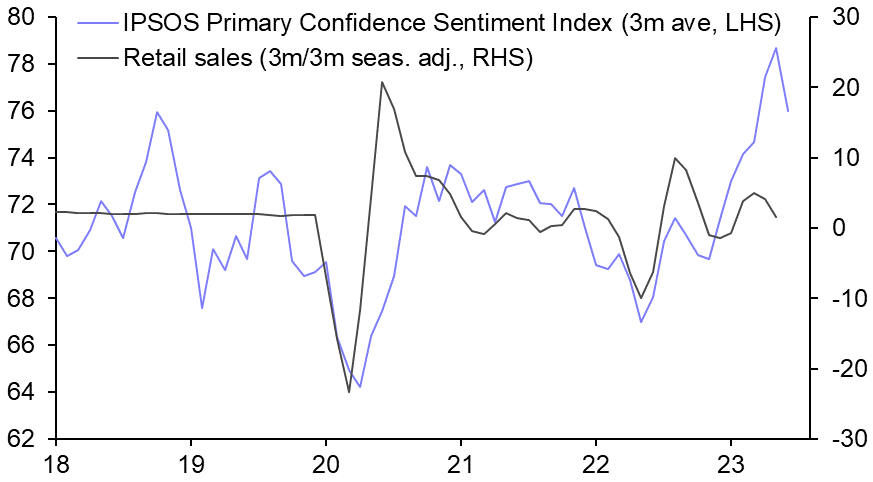

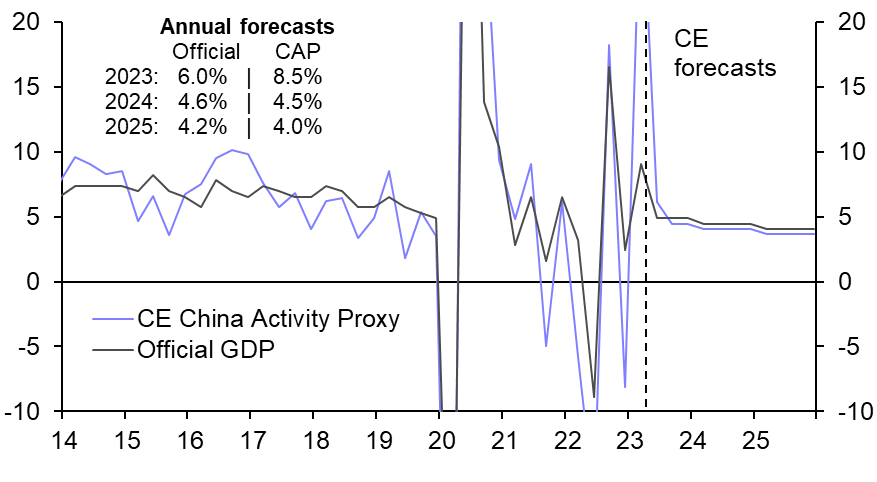

- Output jumped in Q1 as COVID disruptions faded. But the recovery lost momentum in Q2, with our China Activity Proxy (CAP) stagnating in May. (See Chart 1.) The service sector has made further gains this quarter. But cooling foreign demand held back manufacturing, while the property downturn and reduced fiscal support weighed on construction. (See Chart 2.)

Chart 1: Official GDP & CE China Activity Proxy

|

Chart 2: CE China Activity Proxy by Sector

|

|

|

|

- These drags may ease slightly over the coming quarters. A renewed injection of fiscal support should prevent a further slowdown in infrastructure spending. Local governments face worsening fiscal positions, but the central authorities still have room to borrow.

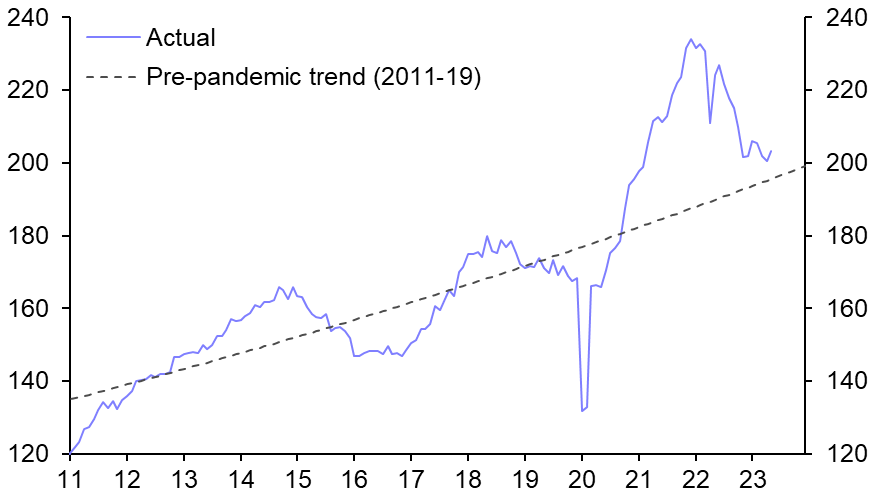

- External headwinds may also moderate. Many developed economies face mild recessions later this year. But the resulting drag is likely to be small compared with the post-pandemic normalisation in foreign goods demand. Much of this has already happened – though export shipments are still elevated, orders have largely returned to their pre-COVID trend. (See Chart 3.) Some support will come from the green transition, which will boost global demand for Chinese-made EVs, batteries and solar panels.

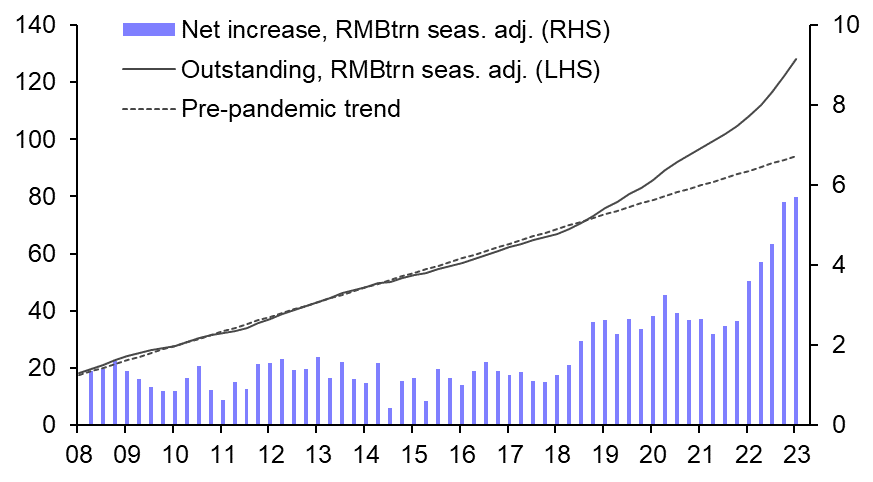

- The property outlook is more uncertain. Given how far sales have fallen, there is scope for a modest cyclical recovery based on genuine housing needs alone. And households are sitting on unusually large deposit balances (see Chart 4), a portion of which could flow into property at some point. But that requires greater confidence in developers and a wider shift in risk appetite among households.

Chart 3: Industrial Export Orders ($bn, seas. adj.) |

Chart 4: Household Deposits |

|

|

|

- Sentiment is also crucial for the consumption outlook. Measures of consumer confidence have been unusually mixed this year. But the most-timely surveys, along with the hard data on spending, suggest that sentiment has softened recently. (See Chart 5.)

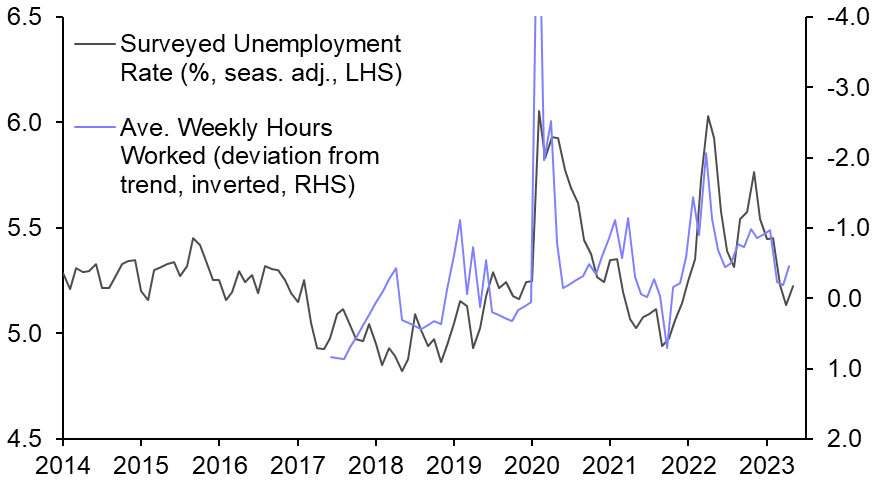

- The good news is that, despite pockets of high unemployment among younger people, the labour market appears relatively healthy overall. (See Chart 6.) As such, it probably wouldn’t take a huge amount of policy support to push unemployment to levels consistent with faster wage growth. That, in turn, would result in positive spillovers to consumer spending and the housing market.

Chart 5: Consumer Confidence & Retail Sales |

Chart 6: Unemployment Rate & Hours Worked |

|

|

|

- Some caution over the near-term outlook is clearly warranted. The monetary easing announced so far won’t be enough, on its own, to shore up investment spending. And hopes that more meaningful fiscal support will follow could still be disappointed.

- But given the prevailing pessimism, the bar for an upside surprise is low. Growth this year still looks set to exceed 8% on the CAP, which we think more accurately captured the true extent of last year’s weakness. (See Chart 7.) Official GDP growth will be lower amid less favourable base effects. But our above-consensus forecast of 6.0% assumes q/q growth of just 4.9% annualised from Q2 onwards, well below the 6% that was achieved across 2019.

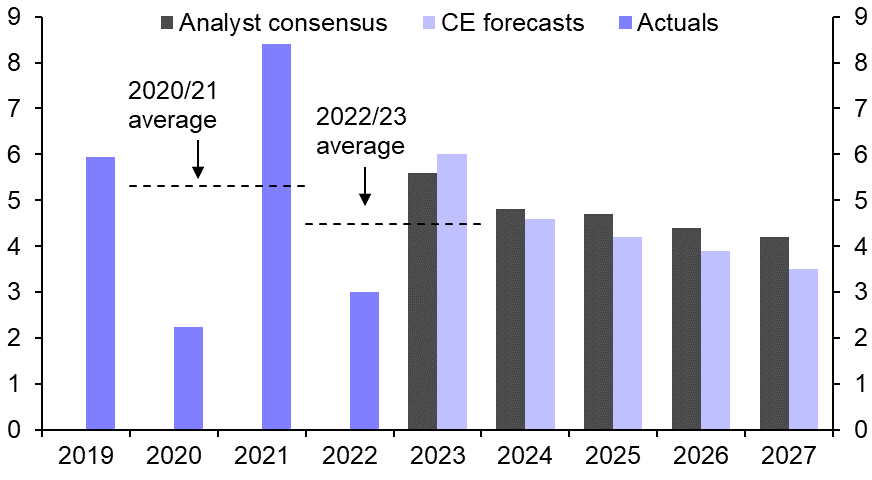

- Regardless of the exact outturn in 2023, it is clear that China’s potential growth rate has declined markedly in recent years in the face of intensifying structural headwinds. That’s a trend we think will continue. And while we are more positive than most on the near-term outlook, we think growth will be weaker than most expect over the medium-term. (See Chart 8.)

Chart 7: Official GDP & CE China Activity Proxy

|

|

|

|

|

Chart sources: CEIC, Refinitiv, WIND, Capital Economics

This is a sample of a 13-page report published for Capital Economics clients on 28th June, 2023. The report was written by Julian Evans-Pritchard, Sheana Yue, Zichun Huang, Gabriel Ng and Mark Williams.