A few weeks ago, I argued that the pandemic was a good illustration of Keynes’ principle of “fundamental uncertainty” – an event that radically alters the economic outlook but is impossible to anticipate before it occurs. In such circumstances, it is tempting to reach for the history books to help chart the course ahead.

Economic history often provides a more useful guide to the future than many of the complex economic models that are maintained by central banks, governments, and some in the markets. The key elements of the Global Financial Crisis had played out in prior crises, including the Great Depression. Likewise, a study of economic history would have revealed how the wave of globalisation that turbo-charged the world economy in the 1990s and early 21st Century was more fragile than the optimists believed.

However, the lessons from previous pandemics are more difficult to translate to COVID-19. This is due in part to the fact that previous pandemics have produced a wide variety of economic outcomes. Some have caused significant and lasting falls in output. For example, the Black Death that swept across Europe in the 13th Century caused the UK economy to shrink by 23.5% – and it took 40 years for output to return to its pre-virus level. But others have had a much smaller impact, either causing a brief drop in output that was quickly recovered, or barely denting activity at all. This is true of various outbreaks over the past couple of hundred years, including the Hong Kong Flu of 1967-69 and the 2003 SARS outbreak.

Likewise, some pandemics have had a significant effect on how the proceeds of growth are distributed. In some cases, the return to capital has fallen and the return to labour has increased. This is because the loss of life (and subsequent contraction of the labour force) has increased the amount of capital per worker and therefore lowered investment demand, thus reducing the return to capital. The counterpart has been a rise in labour’s share of GDP. But in other pandemics, the share of income flowing to labour and capital has been unaffected.

The economic consequences of previous pandemics have been heavily influenced by the scale of the loss of life. The deadliest pandemics, including the Black Death and the Spanish Flu, left a considerable mark on economies. But less deadly pandemics, including the Hong Kong Flu of 1967-69 and the 2003 SARS outbreak, have had smaller and shorter-lived effects.

The policy response to COVID-19 adds an additional layer of complexity when looking for historical parallels. While there are examples of individual cities imposing quarantines, COVID-19 is the first pandemic in which governments have taken the decision to shut down entire economies to stem the spread of the virus.

What’s more, COVID-19 is also the first major pandemic to have occurred in the era of modern economic policymaking, in which governments and central banks have been able to draw on fiscal and monetary tools to counter the hit to aggregate demand. In previous pandemics, central banks either did not exist or fixed exchange rates (often tied to gold) imposed a straitjacket on monetary policy. Meanwhile, the idea of counter-cyclical fiscal policy did not enter the mainstream until after the Second World War.

The speed and scale of policy support has been one of the few successes of the past six months. It has helped to cushion the hit to output and facilitate what, for now at least, looks like V-shaped recovery in most countries. It follows that one of the great mistakes of the pandemic would be to withdraw policy support too early.

These differences make it difficult to take the effect of past pandemics on key macro variables like GDP, inflation and wages and project forward to this one. Instead, the most important historical lesson that is likely to apply to the COVID-19 pandemic relates to its effect on economic structures, institutions, and behaviours. Previous pandemics have not typically produced lasting changes that have come “out of the blue”. But they have brought underlying tensions to the surface and accelerated changes that were already underway.

The economic legacy of COVID-19 is therefore likely to form around the fault lines that ran through the global economy prior to the virus. These include the future of globalisation, the role of digital technologies and AI, and the changing role of the state. This will have implications for everything from real yields to property markets. We study these issues and more in our new series “Economies after COVID” – for a complete set of publications, see here.

In case you missed it:

- Our markets team have published their latest Asset Allocation Outlook, in which they argue they despite some bumps in the road “risky” assets should outperform “safe” ones in the years ahead.

- Our Senior Property Economist, Kiran Raichura, takes stock of recent developments in US office markets and argues Boston, DC and Chicago will outperform New York City and San Francisco in the years ahead.

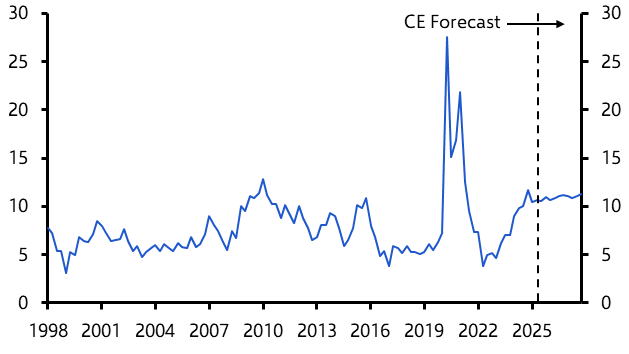

- Finally, our Chief Europe Economist, Andrew Kenningham, argues that low inflation expectations add to the lists of concerns facing the ECB.