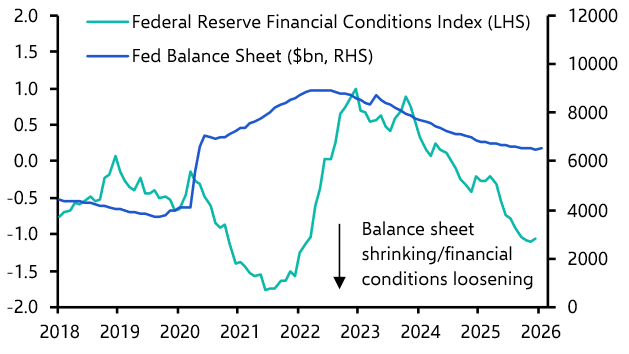

The debate about how quickly and how far central banks should raise interest rates has intensified in recent weeks, but relatively little attention has been paid to the role that quantitative tightening (QT) might play in the overall tightening of monetary policy. With central banks moving aggressively to tackle inflation, this is an idea which deserves more focus, as we explained in a report published last week.

The unconventional policy measures undertaken during the pandemic have super-sized central banks’ balance sheets. In the US, the Fed’s balance sheet is now equivalent to just over 35% of GDP, compared to less than 20% of GDP at the onset of the pandemic. It was around 10% of GDP before successive rounds of quantitative easing (QE) began after the global financial crisis in 2008. Measured as a share of GDP, the balance sheets of the Bank of England, Bank of Japan, and European Central Bank are even larger. (See Chart 1.)

Chart 1: Central Banks' Assets/Liabilities as a % of GDP

Source: Refinitiv

Some of this increase reflects temporary liquidity injections to ease financial markets strains at the beginning of the pandemic. But most reflects longer-term asset purchases intended to support the real economy and made with broader monetary policy goals in mind. The question now is how reversing this process – i.e. reducing central banks’ asset holdings and shrinking their balance sheets – might contribute to monetary tightening.

More than a decade after the world’s major central banks launched large-scale QE programmes, there is still no agreement on how it actually influences conditions in the real economy. Accordingly, it is difficult to judge how unwinding it will affect economic conditions, and therefore what role this should play in policy tightening.

The academic literature identifies many ways in which QE (and QT) can influence the economy, but broadly speaking these fall into one of four categories. The first of these works through the effects on broad money and banks, while the other three work through financial markets.

The first is what we might call the “monetary channel”. QT entails destroying money in the form of commercial bank reserves that was created through QE, which in theory could cause banks to reduce lending to firms and households.

The second is what the Fed has labelled the “duration channel”. QE involved central banks buying long-duration assets, thereby reducing the aggregate duration risk held by private investors and lowering term premia and yields on long-dated assets. It follows that QT should increase term premia and yields on long-dated assets, which in turn should lead to tighter financial conditions.

The third is the so-called “portfolio balance” channel. The idea here is that when a central bank buys an asset (a government bond, for example), investors replace it in their portfolio with an asset of similar characteristics (such as a corporate bond). This has the effect of pushing up all asset prices. Accordingly, QT should push down on asset prices, which will also tighten financial conditions.

Finally, there is the “signalling channel”. This works through influencing the expected future path of interest rates. The argument here is that QE persuaded markets of central banks’ commitment to keep policy supportive and policy rates low well into the future. QT should therefore have the opposite effect – signalling a commitment to tighten conditions and raise policy rates going forward.

It is unlikely that QT will have a big impact through the first channel. All other things being equal, QT will directly reduce the size of the monetary base as commercial bank reserves shrink. But since there is already a large amount of excess reserves in the system this shouldn’t cause a broader monetary contraction by forcing banks to reduce lending.

However, it is possible that QT could contribute to a tightening of financial conditions through the other three channels. What’s more, if QT leads to tightening in financial conditions over and above what would be achieved by just raising policy rates, it could be viewed as a substitute for rate hikes. In this sense, it should be viewed as part of central banks’ toolkit.

The problem for policymakers is that they don’t really know how each of these channels work in practice. It’s therefore impossible to determine how a given amount of QT will affect financial conditions, or how this will influence conditions in the real economy. It may be that a small amount of QT leads to a sharp increase in term premia and a severe tightening of financial conditions, requiring central banks to dial back plans to shrink balance sheets. But it’s equally possible that QT proves to be a damp squib.

It is for this reason that changes to interest rates will remain the primary policy tool for major central banks. They are simpler and quicker to control, and have a more reliable relationship with monetary conditions and inflation. What’s more, because QT is something of an unknown quantity, central banks in economies where financial systems are more fragile will have to tread carefully when deploying it. This is particularly true of the ECB, given the need to contain peripheral bond spreads and limit so-called “fragmentation risk”.

But for other central banks, particularly those such as the Fed that are concerned about the flatness of the yield curve, QT should be part of the policy response. The fact that the linkages between changes in central bank’s balance sheets and financial conditions and the real economy are murky has meant that QT has not received much attention in the current discussion over monetary tightening. But the two are inextricably linked – if QT were to generate an unexpectedly big tightening of financial conditions, then interest rates would presumably peak at a significantly lower level than otherwise be the case.

This is why today’s robust debate about the likely size, scope and impact of central bank policy tightening will remain incomplete without greater consideration of balance sheet policies.

In case you missed it:

- We are covering the many macro and market angles of the Russia-Ukraine crisis in detail. View all our research here.

- Our Chief Asia Economist, Mark Williams, refutes the idea that hostilities between Russia and Ukraine might heighten the risk of a conflict between China and Taiwan.

- Our latest shortages dashboard suggests that, while product and labour shortages remain acute, there is evidence that they are starting to ease in some countries.